Irregular Roundup, 12th February 2024

We begin today’s Weekly Roundup with the behaviour gap.

The Behaviour Gap

Joachim Klement looked at the behaviour gap:

The difference between a fund’s performance if an investor had bought the fund and held on to it for the long run, vs. the performance the average investor experienced because of buying and selling the fund in the interim.

This is a variation on the performance-chasing tax suffered by private investors in general, but more often with stocks. As Joachim puts it:

ETF picking is the new stock picking.

New research from Morningstar shows that it’s worse for thematic funds, in particular for thematic ETFs.

The average loss in performance for open-end thematic funds is large at 2.7% per year. But for thematic ETFs, this loss of performance is an astonishing 6.7% per year!

That’s an extraordinarily large behaviour gap.

This is a real problem, not least because ETFs are so easy to trade – and one that I’ve faced myself.

- It’s very easy to become interested in a new sector when the financial media are discussing it, and fund houses have new launches.

This is usually the worst time to buy in, and a few years later the funds will have lost money and you’ll be tempted to sell.

I have become a lot more disciplined with thematics in recent years:

- You might not be able to easily invest until a theme is fashionable and the funds are available, but you can at least stick with it once you are in.

- Allocate a fixed proportion of your portfolio to thematics (my current allocation is 6%, reviewed annually)

- Limit the number of themes you target – I have five, listed in order of decreasing conviction:

- Tech, including AI, robotics and fintech

- Biotech and healthcare

- ESG, including solar and wind energy generation and batteries

- Nuclear and uranium (quite close to ESG these days)

- Blockchain and crypto

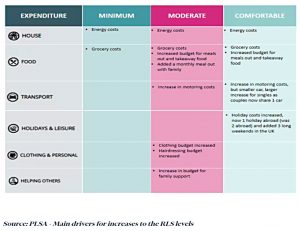

Retirement living standards

The academics behind the Pensions and Lifetime Savings Association’s (PLSA’s) target income levels in retirement have announced some significant increases.

- The Centre for Research in Social Policy at Loughborough University (probably not a right-leaning think tank) said that the rising cost of living and “an expectation to offer financial support to grandchildren” had pushed up the numbers.

The PLSA publishes three target levels of after-tax income, aimed at supporting minimum, moderate and comfortable lifestyles respectively (outside of London) and based on focus group research.

- For a single person, these targets used to be £13K, £23K and £37K pa.

- For a couple, the numbers were £20K, 34K and £55K pa.

The new numbers are £14K, £31K and £43K for a single person.

- For a couple, they are now £22K, £43K and £59K.

The moderate levels in particular seem to have shot up. PLSA policy director Nigel Peaple said:

The cost of living has put enormous pressure on household finances over the last year and, as the research shows, this is no different for retirees.

Loughborough Professor Matt Padley said the research highlighted the increasing importance people placed on spending time with family and friends outside the home:

Priorities have changed following the pandemic. Discussion groups considered that at the moderate level, people should be able to have a monthly meal out with their loved ones and help their family members financially with a budget of £1,000 (such as helping with grandchildren’s activities).

Sounds like aspirational thinking to me, but it’s worth pointing out that the single state pension is now almost £3K pa below the minimum target – though two pensions would be just enough for a couple. Steve Webb of LCP agrees:

Despite a significant increase in the state pension last April, the state pension rate is actually further away from providing a decent minimum standard of living now than it was a year ago.

Mastering Emotion

For the FT, Moira O’Neill looked at mastering emotions when investing.

- The article focused on lower-income types drawn into day trading and crypto during the Covid lockdowns.

Research from City Index found more than a third of traders admitted emotions influenced their trading decisions. People aged 41-60 were most likely to have their trading decisions consistently influenced by emotions.

Moira says that the problem dates back to our time as hunter-gatherers:

Stone Age hunters had to exert more effort to avoid pain (broken leg = inability to defend or feed family for two months) than to make a gain (kill gazelle). But it also paid to take big risks — one big mammoth kill could mean a month’s protein.

So we have the two traits of greed and fear (fight and flight), alongside Kahneman’s two systems for thinking (fast and slow).

- Losing hurts more than winning feels good

- And we deceive ourselves that we can defeat our emotions and beat the market

Yet when things are risky (after market crashes) we run to cash.

It’s a confusing message so far, but Moira has some tips to help:

The conventional advice is to drip money into investments and add on the big corrections. Keeping emotions in check may be as simple as making your password forgettable so you leave your investments alone. Or use a rules-based percentage approach, allocating a certain percentage for each theme, topping up if it gets too low and reducing if it gets too high.

I do recommend sticking to your asset allocation, but I can’t back throwing away your password.

- Pound cost averaging works well in accumulation (when you are working) but it’s mirror (constant withdrawals) can actually be a drag during decumulation (retirement).

And Moira’s tip to restrict your high-risk bets to a small portion of your portfolio is a very good one.

Crypto

Buttonwood noted that bitcoin ETFs have got off to a bad start, and wondered whether they might follow the path of gold ETFs.

- The first application for a bitcoin ETF was in 2013 when the BTX price was $100 – so it’s only taken 11 years to become reality.

Devotees had hoped that such funds would attract strait-laced institutional investors, increase liquidity, and demonstrate the credibility and professionalism of crypto. They had also hoped that their approval might buttress demand for bitcoin.

Something similar happened when the first gold ETF was launched.

In 2004, the metal fetched less than $500 per ounce, below its price in the early 1980s. Over the years that followed, it soared in value, reaching almost $1,900 per ounce in 2011.

So far, the Bitcoin price is down significantly since the approval and the inflows to the new ETFs have been matched by outflows from the pre-existing (and more expensive) Grayscale Bitcoin Trust.

There were specific factors that helped the gold price rise:

- The prohibition on ownership in China was lifted

- Interest rates were falling, making an asset with no yield more attractive

- Gold had a life as a physical asset (mostly in jewellery) and its conversion to a liquid financial asset was a novelty.

None of this applies to BTC, though the ETFs are much easier to access (for US investors) than the pre-existing methods.

Less encouraging data for BTC comes from thematic ETFs (see above) which tend to underperform after launch.

When thematic ETFs get going, the buzz around the investment is already extensive and the underlying assets are already pricey.

We’ll have to see which of the precedents Bitcoin follows.

For the FT, Steve Johnson noted that the UK is increasingly isolated by being anti-bitcoin ETFs.

- The government claims to be blockchain- and fintech-friendly, but the FCA has different ideas.

Continental Europe has them, as do Australia, Brazil and Canada. The US has followed suit most recently with spot bitcoin ETFs, prompting Hong Kong to say it will also jump on board.

FCA hostility dates back to 2021 when access to crypto derivatives (eg. spread bets) was removed for UK retail investors.

- We’ve missed out on two bull runs (and a crash) since then.

Bizarrely, trading minor “shitcoins” directly on crypto exchanges was not banned.

- Leverage seems to be the thing that frightens the FCA, specifically when applied to already volatile assets.

Fair enough, but there should be a waiver for sophisticated investors or a process for setting a maximum pot size/stake level.

Bradley Duke of ETC Group said:

A UK retail investor can’t invest in a product like ours [an ETC] , a Mifid II instrument, listed on a regulated exchange and sold through a regulated broker, who would screen you for applicability, depending on your investment objectives and profile.

But they can go to a crypto exchange and buy bitcoin without going through any checks and balances, and to me that doesn’t really make sense.

Hector McNeil of HANetf said:

I think the FCA will have to reassess their position. I don’t agree with general access. If it’s somebody like me putting 3 per cent of their portfolio in, that should be fine. If it’s my mother wanting to put 100 per cent in because her friend down the social club told her she made loads of money, then I don’t think that’s right

Which is roughly my take.

LTA watch

Labour has announced a review of pensions and retirement savings (including the potential simplification of the ISA regime), assuming they get elected later this year.

- There’s no mention of the LTA in the paper, but there were rumours in the press this week that not only would doctors be exempt from any new cap, but so would teachers.

No doubt by the time we get the regulation, the whole of the public sector will be safe.

- I obviously have a dog in this fight, but not only is this outrageously unfair, but it’s also stupid.

The idea that public sector workers contribute more to the success of the nation than the private sector is complete nonsense.

- It sounds like something that Corbyn would have come up with.

Quick Links

I have just four for you this week:

- The FT said that Big tech will either be fine or probably mostly fine

- Morningstar told us that Bonds Are Still Too Expensive

- Albert Bridge Capital wrote about Pods, Passive Flows, and Punters

- And MoonTower had some Lessons From Ed Thorp.

Until next time.

Re: PLSA’s retirement living standards:

Just in case you missed this detail, the report is based on interviews with a sample of 135 people many of whom, to my eyes, appear to have totally unrealistic expectations! Enough said. See: https://www.retirementlivingstandards.org.uk/2023_research_report.pdf