Digital Wealth – State of the Market 2020

Today’s post looks at a report from AltFi on the state of the Digital Wealth Market.

Contents

Digital Wealth

This is AltFi’s first annual report on Digital Wealth, focusing on what I call robo-advisors.

- I should start by recording my disappointment with this sector (which parallels my disillusion with P2P lending and equity crowdfunding).

I was very excited when robo-advisors launched, and wrote a series of articles about the main platforms, even going so far as to interview several of them.

- I spend a lot of time managing my money, and I was hoping to be able to outsource some of the work.

But so far, robos are too expensive and/or too boring in what they offer.

I have 2.6% of my assets in robos, via PensionBee. (( I also have another 1.2% with digital stockbrokers Trading 212 and Freetrade, but I use them in an execution-only capacity ))

- Their service and interface are pretty good, though they have struggled to add one of our smaller pensions to their platform.

But 2020 has reminded me of what a blunt instrument their portfolios are.

- They have lagged the money I manage myself by around 8%, largely because of an over-allocation to the UK, but also because of their bond allocation.

As things stand, I don’t plan to add any more money to robo, and I will run down the PensionBee allocation at some point over the next decade.

Financial products

The first section of the report looks at a survey that AltFi commissioned to assess the state of the nation’s finances.

- Opinium interviewed 2,000 UK adults between 16th and 20th October 2020.

I’m not sure how useful this is, given the impact of the Covid pandemic (and the announcement of a vaccine less than three weeks later).

- But a few of the answers should still be relevant.

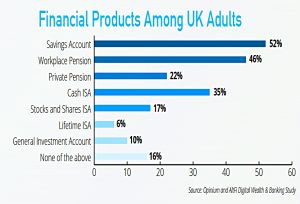

First up was the use of financial products:

- 22% have a private (non-workplace) pension

- 17% have a stocks ISA

- 10% have a taxable investment account

In contrast, 52% have a savings account and 35% have a cash ISA.

Barriers to investing

Not surprisingly, this biggest barrier to investing more is a lack of funds (cited by 56% of respondents).

- This is why my advice to young would-be investors is always to focus on your earning potential.

Investing becomes a lot easier when you earn more than the average salary.

The other two barriers were mentioned by far fewer people:

- 9% have a lack of knowledge, which is fixable (over time)

- 8% don’t have the time – which really means that they are prioritising other things (in the same way as the people who have no time to exercise).

Two- thirds of our overall panel ranked themselves as having either no investment knowledge or only rudimentary understanding, while just a third (31 per cent of people

or 623) ranking their knowledge as either intermediate or advanced.

Sources of advice were family (26%), or nobody (46%).

People were also split on whether more financial advice would actually help their situation, with 65 per cent saying they didn’t see the benefit or weren’t sure what the benefits would be.

Of those that did think it would help, 58% said they would be happy to pay.

- There are no details of how much they would be willing to pay, and I suspect only a small minority would stretch to traditional IFA fees in the thousands of pounds.

Brand awareness

Brand awareness of robos was quite high (from my perspective):

- 80% had heard of Paypal

- Around a third were familiar with Hargreaves Lansdown

- And around 30% had heard of Nutmeg, the leading UK robo

- Freetrade was the leading fintech broker, on around 10% awareness

However, awareness does not translate into usage.

- The most used robo was Moneybox with just 3% penetration (compared to 49% for Paypal).

Social issues

The survey also asked about social issues, and not surprisingly, climate change came top.

International

The report has several sections comparing the UK robo scene to those abroad,

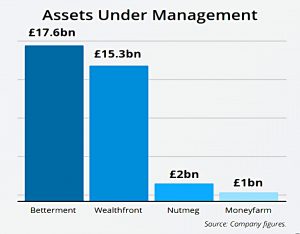

The US is the global leader in robo-advice, with assets under management more than an order of magnitude greater.

- In other areas of fintech, like Open Banking and cross-border payments, Europe is ahead.

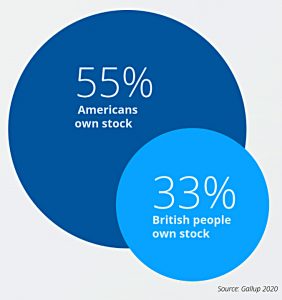

It should be noted that Americans have a much greater tendency to invest in stocks in the first place.

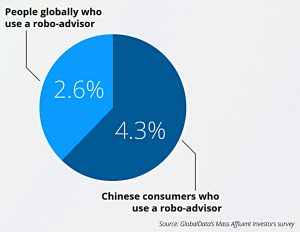

In second place behind the US, perhaps surprisingly, comes China.

4.3 per cent of Chinese consumers use a roboadvisor as their primary investment provider, nearly double the global average of 2.3 per cent.

They are using local brands rather than US or European ones:

Fintechs fight for market share against the big tech giants who have entered the world of financial services, like Ant Group and Lufax, while China’s major banks—including China Merchants Bank—have led the charge with their own digital wealth propositions.

On the other hand, these firms are also unlikely to compete successfully in the US or Europe.

Conclusions

From a Private Investor’s point of view, this is a disappointing report, with too much space devoted to open banking and international markets.

- I would have liked to have seen more coverage of the current robo-advice offers, including costs and investment options, and a roadmap of their future plans.

I remain unconvinced that robo-advice will ever reach critical mass in the UK, other than as a default pathway for cash savers looking for the next step.

- Customer acquisition costs seem too high, which means that robos are likely to be absorbed by platforms that already have a lot of customers (ie. banks, perhaps including digital banks).

Until next time.