Weekly Roundup, 13th December 2021

We begin today’s Weekly Roundup with big government.

Big government

The Economist said that the world is entering a new era of big government.

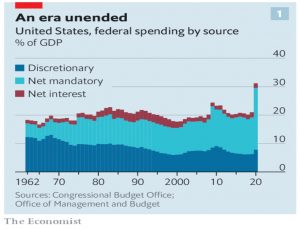

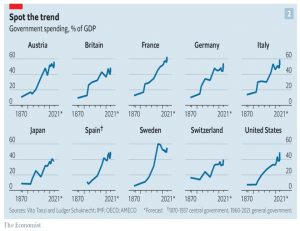

Governments have spent $17trn on the pandemic, including loans and guarantees, for a combined total of 16% of global gdp. On current forecasts, government spending will be greater as a share of gdp in 2026 than it was in 2006 in every major advanced economy.

Net-zero targets will only make things worse, adding 21% to the debt-to-GDP ratio in Britain by 2050.

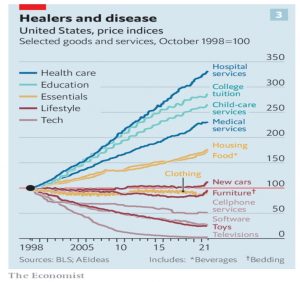

- And ageing populations will mean more spending on health care and potentially on pensions.

The long-term threat of a big state is that bureaucracy, institutional failure and corruption become routine and widespread, making people poorer and limiting individual freedom.

From 1274 to 1691 the English government raised less than 2% of GDP in tax. Over the 18th and 19th centuries that changed, with the tax-raising and spending capacities of the government massively expanding, especially at times of war. In the 1870s the governments of rich countries were spending about 10% of GDP. In 1920 it was nearer 20%. It has been growing ever since.

The newspaper thinks that state growth is almost inevitable, for three reasons:

- Intertia, mission creep, lobbying and empire-building make it hard to get rid of spending that already exists.

- Healthcare and education grow faster than the economy because of labour intensity and low (service) productivity increases.

- Richer and more diverse voters – and those mobilised to war – demand more services over time (initially health and education, most recently action against climate change).

But there are still roles for markets and individual choice:

Climate change should be fought with a price for carbon, research-and-development subsidies and highly scrutinised public investments, not by rationing flights. The welfare state should focus on redistributing cash and letting those in need choose what to do with it, not setting up new bureaucracies. Taxes should be broad-based and friendly to investment.

Good luck with that.

Health

Joachim Klement looked at a new paper on the impact of health on savings and wealth.

There are two related issues with retirement savings:

First, most people tend to save too little for their retirement and old age and

consume too much. Second, most people tend to live longer than they think

they will.

This means that a lot of people run out of money in retirement.

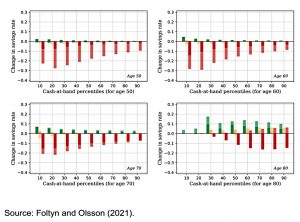

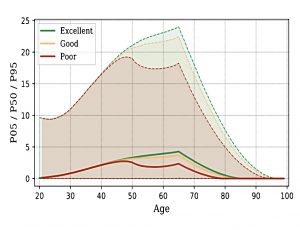

One problem is that younger people (aged 50, on the left side of the charts above) underestimate their chances of living to 75, 80 or 85.

- In contrast, people aged 75, 80 and 85 overestimate their chances of living for another fifteen years (right side).

This helps to explain why younger people don’t save enough (they don’t expect to be around) and older people don’t spend their money (they expect to live for a long time).

The second factor is health, or at least peoples’ perception of their health.

In the charts above the green bars are those in good health, yellow is moderate health and red is poor health.

- The bars show the variance from the optimal level of saving at ages 50 to 90, split by deciles of cash-at-hand.

People in poor health save less.

Which of course translates into poorer outcomes.

People with poor health accumulate less wealth and run out of money sooner than people in good health.

Housing

The Economist reported on the hostility towards the push by private equity into property.

Private-equity firms, insurance companies, pension funds and other institutional investors that have snapped up residential property during the pandemic are becoming the butt of resentment.

In some countries, this has led to restrictions:

- The White House wants to restrict the types of properties that large investors are allowed to buy.

- New Zealand has scrapped tax breaks for property investors

- Ireland has slapped a 10% tax on the bulk-buying of houses.

- Canada’s central bank says the role that big investors play in housing requires more

scrutiny. - Berlin’s residents voted to force their city’s biggest landlords to sell more than 200,000 flats to the state, though the constitutional court is expected to overturn the result if it becomes law.

- Spain’s left-wing government is the latest to unleash measures to deal with big landlords.

They will face rent controls, higher taxes on empty property and a ban on buying social housing.

This is despite institutional ownership of only between 1% and 5% of rental stock per country.

The Economist thinks that with demand high, institutional capital should be welcomed.

- So do I.

Default funds

In FT Adviser, Amy Austin wrote about FCA plans for personal pension providers (ie. pensions other than auto-enrolment workplace plans) to offer a default investment option (fund).

- The non-workplace market comprises 13M accounts and £470 bn in assets.

The default fund would be required to offer a “diversified basket of investments” and “take account of climate change and other ESG risks”.

- The fund would also move towards “less risky” assets and the investor approaches retirement.

Although it would be a default fund, it would be opt-in (rather than opt-out, as with workplace pensions).

- But providers will be required to nudge savers who are holding too much cash in their pension pots.

Investors who use an IFA can sidestep the default option and accept the advisor’s recommendation instead.

Sarah Pritchard, FCA executive director for markets, said:

People spend decades working hard to build up a pension to support them in retirement, and we want their savings to work just as hard for them.

These proposals will ensure that customers who don’t take financial advice can benefit from a professionally designed investment strategy, and reduce the risk of their retirement income being eroded by inflation.

At the moment this is just a consultation (which closes in February 2022) – the final proposals will be issued later in 2022.

- It’s a reasonable idea, but the devil will be in the detail (“diversified”, “less risky” etc).

I’ll take another look next year.

Constitution DAO

The potentially funny crypto story of recent weeks, depending on your view of all things blockchain, was the attempt by the Constitution DAO to win an auction at Sotheby’s.

- A DAO (decentralized autonomous organisation) is a club on the blockchain designed to achieve a specific purpose.

This DAO wanted to buy one of the last two privately-owned copies of the US Consitution, and it raised (crowdfunded, effectively) $49M from more than 17,000 investors to do that.

- Which sounded promising, given that the sales estimate was $15-20M.

But DAO’s are transparent, and so everyone else involved in the auction knew that $40M was their max bid.

- So they were outbid by billionaire Ken Griffin of Citadel, beneficiaries of payment for order flow one of the firms blamed by the Reddit gang for the way that the GameStop squeeze panned out earlier in the year.

So now the DAO is being wound up, and because of the high gas fees on the relevant crypto networks (estimated at $1.7M for the round trip), some smaller contributors won’t get any money back.

- Clutching at straws, you might say that they forced their enemy to pay more than he would have liked for his latest treasure.

The whole episode is like a microcosm of 2021 finance – people love to pay to join online clubs even if there is no direct financial benefit to themselves and despite the fiendishly clever technology involved having some glaring holes in it.

- Particularly if there is some claim (however spurious) of “sticking it to the man” attached to the club.

In this case, the holes are transparency and ludicrous transaction fees but you can lob similar grenades at Tesla and climate change/ESG plays.

Quick links

I have five for you this week, the first three from The Economist:

- The Economist looked at the shortcuts to Theranos

- And at the liberalisation of the rules of the London Stock Exchange

- And at whether a lack of chargers might stall the electric vehicle revolution.

- Alpha Architect examined whether the market prices the value of brands efficiently

- And looked at the “music” factor.

Until next time.