The Equity Edge 5 – Selling, Portfolios & Routines

Today’s post is our fifth visit to a new book – The Equity Edge by Mark Jeavons.

Contents

Selling

Stop losses

Chapter 14 of Mark’s book looks at when to sell shares.

The first idea is a stop loss.

Most falling stocks keep falling, and your money is better invested somewhere else.

The trick is working out what is a real fall and what is just noise.

- I used to trade with 10% stop losses, but in recent years these have become too tight, particularly for smaller stocks (eg. AIM stocks).

I moved on to 15% stops and now usually choose a 20% stop for UK stocks.

- I use tighter stops on spread bets.

Mark also recommends a 20% stop loss.

I also sell if a stock loses 20% relative to the index (1-month RS) and if the price falls to 20% below the 200-day moving average.

- And I use trailing stops, so I will sell if the price falls by 20% within a month, even if I am still in profit.

Those with concentrated portfolios (less than 20 positions) might consider tighter stops, though 20% of a 5% position is still only 1% of the overall portfolio.

- Mark also recommends tighter stops (10% to 15%) for growth stocks.

Time stop-loss

Mark’s investment horizon is three years upwards, and he recommends a time-driven review at this point.

- Growth stocks should at least be in positive territory by this stage, and incomes shares should have lost no more than 5% (which will have been recovered via the dividend).

Value shares can be kept for up to five years, so long as they satisfy the buy-list criteria.

Investment thesis

Which brings us neatly to the next point, that shares should be sold when the original investment thesis no longer holds.

- Mark recommends reviewing the investment case at least annually.

I review most of my portfolios every two to three months, but I don’t look at the investment thesis.

I would sell on a profit warning, but otherwise, I would wait for the stop loss to take out shares where the situation has changed.

- So long as the price is still going up, I would remain invested.

Take your profits

In the next section, Mark introduces trailing stop losses.

When the current share price has risen above the breakeven purchase price by 11%, the stop loss should be moved to 2% above the breakeven share price.

When the share price has risen above the breakeven price by 15%, the stop loss should be moved to 5% above the breakeven share price.

These rules seem a little arbitrary to me.

- I just wait for a 20% fall in the price.

Mark recommends placing stop losses below horizontal support for more volatile stocks (tech, biotech, smaller companies).

Sell expensive

When shares are identified as being very expensive, it is time to sell them and move the money into new investments which offer greater potential for large returns.

For growth stocks, the simplest version of this rule is a PEG of more than 3, but Mark also sells when the dividend is cut.

- For income stocks, Mark recommends selling when the dividend yield is below 2%, or the PE is over 20, or the dividend is cut by 50% pre more.

For value shares, three out of five traffic lights need to flash red:

- the PE ratio is greater than 20,

- the PTBV ratio is greater than 5,

- the PSR is greater than 5,

- the PCF ratio is greater than 20 or

- the EV/EBITDA ratio is greater than 12.

Buying back in

Mark will buy back into a stock he has sold provided that:

- it meets the buy-list criteria

- the price is at its high for the last three weeks and the daily price trend is upwards.

Portfolio allocation

Managing investment allocation helps produce a well-balanced portfolio that is structured to limit potential losses at any point in time. It achieves this by specifying rules on the maximum amount that can be invested in a company, sector or region.

So Chapter 15 is about diversification.

- But also about making the most of tax allowances.

Investing too large a proportion of your overall portfolio in a single company is the most frequent reason for portfolio values being severely damaged.

Mark quotes the table showing that various percentage losses require larger percentage gains to reach break-even again.

- For example, a 25% fall is cancelled out only by a 33% gain.

He adds an extra column showing how many years you would need to recover, based on an annual return of 7%.

- Since I think that the real return from the UK stock market is likely to be of the order of 3% to 4% (and I further believe that no-one should have a large allocation to a single market), I haven’t reproduced the table here.

Mark has allocation rules for portfolios of different sizes:

- at less than £500K, the max position should be 5% (£25K)

- this means you need at least 20 stocks in your portfolio

- there’s a lower limit of £1K since trading costs are prohibitive below that (( Note that the new “free” trading apps have changed the lower limit for investing down to a few pounds ))

- between £500K and £1M, the cap stays at £25K

- this means that position size shrinks towards 2.5%

- and the number of stocks increases towards 40

- above £1M, the limit sticks at 2.5% (40 stocks)

Sector risk

No more than 20% of the portfolio value can be invested in any one sector.

So with 20% stop losses, the risk on a single sector is around 4%.

Position risk

Since position sizes range from 5% down to 2.5%, with a 20% stop loss the position risk is from 1% to 0.5%.

- This compares favourably with the typical position risk in a trading system of 1% to 2%.

Portfolio risk

Portfolio risk is the sum of all the position risks.

- With 20% stop losses, this will always be 20% for a fully invested portfolio.

Mark suggests a portfolio risk of 15%, which would limit the number of open positions to 7 initially, and to 30 for portfolios over £1M.

- You could, of course, use smaller positions in order to have more open.

I use a 20% portfolio risk limit, though in practice my asset allocation means that my realistic portfolio risk is around 15% (14.3% at the time of writing).

Regional risk

Regional risk is the risk that companies located in a geographical region will fall in price at the same time because of a negative regional event or shock.

For me, this is relatively easy to track since I use regional ETFs in my core portfolio.

- Satellite portfolios are deliberately targeted at specific risks.

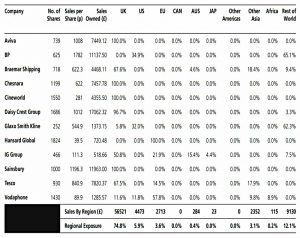

Mark suggests that UK investors use Morningstar data to break down the earnings of the stocks they hold by region.

This is what the finished table looks like, but it’s a step too for fore me, I’m afraid.

Rebalancing

As some stocks grow more than others and some fall in price, position sizes will drift apart.

- Mark doesn’t go into too much detail on his rebalancing approach, but in any case, rebalancing at the asset class and geography level is much more important than trying to keep all your stock positions the same size.

Tax efficiency

Mark plugs the ISA over the superior (more tax-efficient) SIPP.

- You should fill your SIPP first, and then your ISA (unless you are likely to need the capital before you reach retirement age).

In Mark’s opinion:

ISAs have four advantages that make them preferable when investing for general purposes:

1. ISAs have lower running costs compared with SIPPs.

2. ISAs allow you to access your money at all times, with no restrictions on what you can do with the money; this means a tax-free income can be drawn at any time.

3. The income generated by an ISA does not need to be entered on a tax return, and therefore does not count towards income calculations for tax purposes.

4. ISAs are simpler and currently less affected by government meddling.

All these points are true, but they don’t compensate for 40% tax-relief upfront, and the gains on that extra money over 20 to 40 years.

Mark also mentions the annual capital gains allowance (currently £12.3K) which applied to taxable brokerage accounts.

- More annoying is the £2K dividend limit.

Between them, they limit the efficient size of a taxable account to somewhere between £50K and £100K.

- Mark recommends buying income shares in an ISA and growth and value shares in a taxable account, which will help a little.

It makes sense to strip out gains from within your annual capital gains allowance as the end of the tax year approaches, rather than letting large gains accumulate over a number of years and eventually result in a large tax bill.

Married couples have further advantages when it comes to capital gains since they can share assets.

Routines

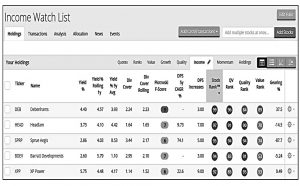

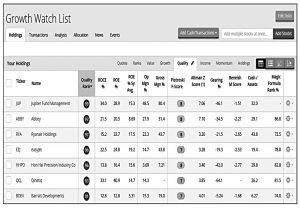

Chapter 16 looks at Mark’s regular routines.

Saturday:

- review current holdings against stop losses (20 mins)

- check market and sector direction (20 mins)

- screen for new stocks for the buy list (30 mins)

Sunday

- reading financial news and research (2 hours)

- Mark reads the FT, Times, Telegraph and Economist

- Identify shares to buy (30 minutes)

- Company research (3 hours)

Monday to Friday

- Check stop losses (30 mins)

- Financial news and magazines (30 mins)

- End-of-day review (1 hour)

I make that around 17 hours per week.

In addition, Mark has some less frequent actions:

- End-of-quarter – portfolio valuation

- End-of-tax year – portfolio valuation and individual company reviews.

Conclusions

That’s it – we’ve made it through the book.

I didn’t get much out of today :

- I won’t be adopting Mark’s selling rules – a stop loss is all I need – and his portfolio management stuff is fine but much simpler than my own rules.

I was also surprised to find that Mark spends seventeen hours per week on his active UK stock portfolio.

- My similar portfolio accounts for just 4% to 5% of my net worth, and I only spend three or four hours a week on it.

For me, the meat of the book was in the early sections on stock screening and fundamental checks.

- I’ll be back in a few weeks with an attempt to distil those sections into a small number of my own screens.

Until next time.