Dual Momentum Systems

Today’s post takes a look at the Dual Momentum Systems website.

Dual Momentum

We’ve come across Dual Momentum before when we looked at Gary Antonacci’s book and website.

- The Dual Momentum Systems (DMS) website is not affiliated with Gary but has been inspired by his work.

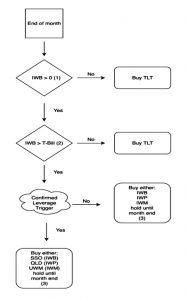

Dual Momentum has two parts:

- Absolute momentum – is the price up over the lookback period?

- Relative momentum – which of our investment options has the highest return?

If we fail the first test, we invest in government bonds and/or cash.

- Here’s the decision tree for one of the DM strategies (the Russell):

The goal of Dual Momentum is not massive outperformance year after year, but rather a performance that is comparable to or better than a benchmark, but with lower volatility and smaller drawdowns.

The major source of outperformance is avoiding the bad years for the market.

- Leveraged portfolios (DMS has both types) should also outperform during bull runs but will be more volatile.

The strategies

DMS provides a monthly reporting pack on seven strategies:

- Triad

- May invest one third into each of Russell 1000 & Russell MidCap Value, and one-sixth into Gold.

- The remainder goes into the best of Short Term Investment Grade Corporate Bonds, Short Term Treasuries, or Intermediate-Term Treasuries.

- Global Navigator

- Invests in US or Foreign stocks and in Long Term Treasuries when markets are going down

- The Russell OG

- Goes into either Russell 1000, MidCap Growth, or Russell MidCap Value and into Long Term Treasuries when markets are going down

- The Russell

- Global Navigator XL

- The Russell XXL

- Max Pain

- Invests in 3X leveraged versions of Russell 2000, S&P MidCap 400, or S&P 500 and 3X Intermediate Treasuries when markets are going down

DMS provides ETF tickers for all these strategies, but they are US ETFS, so we’ll need to work out our own UK equivalents.

UK interpretation

Looking across the seven portfolios, we have the following dimensions on which to make decisions:

- Equities by geography

- UK, US, Europe, Japan, APAC, EM makes sense to me

- Growth and Value twists

- We’ll have a more limited range of options here than in the US

- Treasuries by duration, and corporate bonds

- I see this element as protection only, and to me, that means US and UK government bonds

- Leverage

- I’m interested in trying out the leveraged ETFs where they are available

Performance

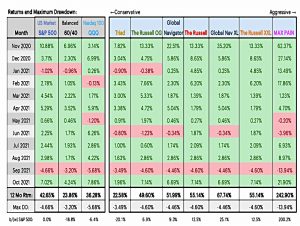

First up is the one year returns table.

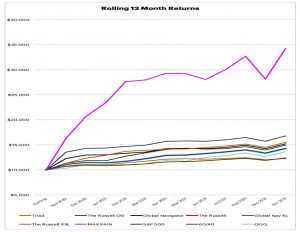

Here’s the same data in chart form.

- The leveraged portfolio has done far better than the others.

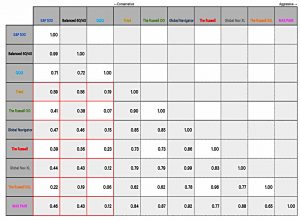

The next table shows three-year correlations between the seven portfolios, and against three benchmarks:

The correlations with the benchmarks are low enough, but some of the strategies have quite high correlations with each other.

- This makes me more inclined to use a top-down approach (using the instruments from all of the strategies) rather than a bottom-up combination of individual strategies.

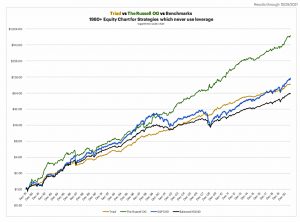

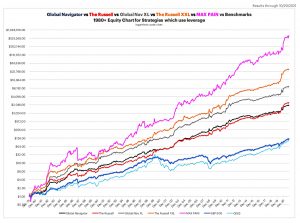

Now onto long-term performance (since 1980).

- The first chart shows the two strategies that never use leverage.

The Triad has matched the benchmarks, but the Russel OG has beaten them comfortably.

The leveraged portfolios do much better than the benchmarks, particularly the Max Pain strategy.

- It’s also interesting to note that the S&P 500 remains ahead of the Nasdaq (QQQ) even after the recent tech boom – the fall from 2000 to 2003 has yet to be completely erased.

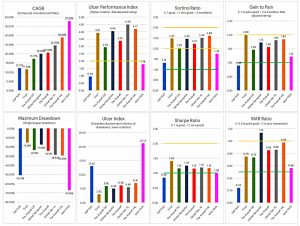

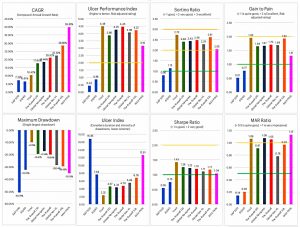

Metrics

DMS uses a range of metrics to assess the strategies:

- CAGR

- Compound Annual Growth Rate

- Ulcer Performance Index

- A risk-adjusted performance ratio that uses the Ulcer Index

- The Ulcer Index measures downside risk in terms of both the depth and duration of price declines

- Sortino Ratio

- A risk-adjusted performance ratio that is like the Sharpe ratio but ignores upside volatility

- Gain to Pain

- Made famous by Jack Schwager, the total net gain divided by net losses

- Max Drawdown

- Calculated on a month-end basis

- Ulcer Index

- Defined above

- Sharpe Ratio

- A commonly used risk-adjusted performance measure which unfortunately penalizes for upside volatility

- MAR Ratio

- A risk-adjusted performance ratio using max drawdown

The first chart shows the metrics since 1980.

The second chart shows the metrics since 2000.

That’s it for today.

- DMS is a useful website and the sign-up for the monthly reporting on the seven strategies is free.

I’ll cobble together my own UK approach to leveraged dual momentum in the coming weeks and report back in the new year.

- Until next time.

Hi Mike

Fascinating article! Is there a way to implement this system easily? Also, do figures include comission and other fees?

Thanks

I don’t think you can’t buy an ETF if that’s what you mean.

You should check the DMS website for the details you are after. Transaction costs are less of an issue for momentum systems these days, since they are so much lower than they used to be.