Trend Equity – NewFound Primer

Today’s post is about Trend Equity, and looks at a paper from NewFound Research.

Contents

Trend Equity

Trend equity is another name for a concept that we’ve come across several times already.

- The basic idea is that the addition of trend following / momentum strategies to a diversified portfolio can increase returns and / or reduce risk (volatility), depending on your goals.

Trend is a useful diversifier to traditional stock / bond portfolios (and even to more sophisticated allocations).

A few weeks ago, we looked at Meb Faber’s Trinity Portfolio, but we’ve examined similar concepts on a couple of other occasions:

- Meb’s VAMO Hedge strategy, and

- Gary Antonacci’s Dual Momentum.

Andrew Craig’s Own the World Fund and The Idle Investor also covered similar subject matter.

NewFound Research

NewFound Research are a firm whose articles I retweet and link to a lot.

- They tweet under the “sexier” name Flirting With Models.

They describe themselves as follows:

While other asset managers focus on alpha, our first focus is on managing risk. We believe in systematic, disciplined, and repeatable decision-making powered by the evidence-based insights of consistent, thoughtful research.

We focus on the high conviction application of the major quantitative investment “styles” – i.e. value, momentum, carry, defensive, and trend – within tactical asset allocation.

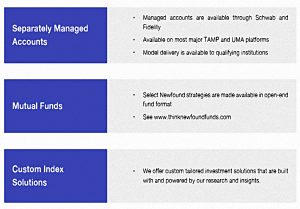

Here’s chart of their services:

When I was looking at the Trinity Portfolio I came across NewFound’s Trend Equity Primer.

- It was only published a few months ago, so I thought that I would take a look.

Two risks

In the paper, NewFound talk about two risks:

- failing slow, and

- failing fast

These seem to correspond to low returns and sudden sharp drawdowns respectively.

- The latter is especially dangerous just before and just after moving into decumulation (retirement / drawdown).

NewFound believe that Trend Equity can address both risks.

Concave and convex

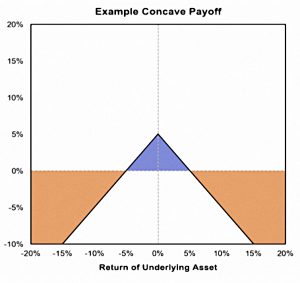

The historical premiums associated with many active investment strategies are assumed to be risk-based in nature. An investor bearing risk can be thought of as an insurer, expecting to collect a premium over time for their willingness to carry risk that other investors are looking to offload.

The payoff profile for premiums generated from bearing risk, however, is concave in nature: the investor expects to collect a small premium over time but is exposed to potentially large losses.

This approach is often called being “short volatility,” as the manifestation of risk often coincides with large (primarily negative) swings in asset values.

I’m not a fan of the diagram that NewFound use to illustrate this distribution of returns.

- It looks like an option payoff chart to me. (( There’s a more traditional bell-curve like chart later in the paper,which we’ll come to below ))

This property of returns – normally discussed in the context of equities, but also with FX carry – is usually known as negative skew.

- Strategies with negative skew are sometimes referred to as “picking up pennies in font of a steamroller”.

Strategically allocated portfolios – even those with exposure to alternative risk premia – tend to combine a series of concave payoff structures.

But things are a little more complicated:

- Equities have positive expected returns (they go up more than they go down), despite their negative skew, so it still makes sense to hold them.

- Adding negative and positive skew strategies together can improve your overall portfolio – it’s another form of diversification.

In fact, this underpins the Trend Equity approach:

- Trend Equity has neutral to positive skew, whereas carry and long-only strategies have negative skew.

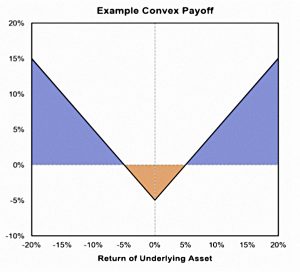

Trend-following strategies “cut their losers short and let their winners run” , creating a convex payoff structure. A convex payoff can be thought of as expecting to pay an insurance premium in order to hedge risk.

Convex payoffs benefit from instability, potentially helping hedge portfolios against large losses at the cost of smaller negative returns during normal market environments.

Effect of trend equity

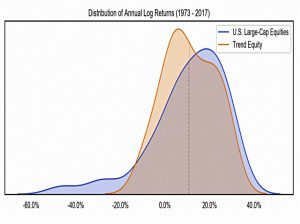

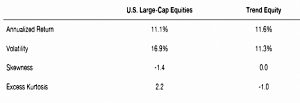

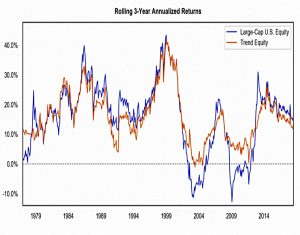

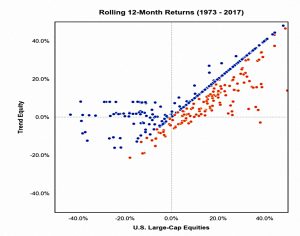

This chart compares Trend Equity returns to the S&P 500.

- The “fat tail” to the left is not present in Trend Equity.

The cost of this is that the positive (right-hand) side of the distribution shifts down (to the left) a little.

The annualised return of Trend is slightly higher but the key points are that volatility, and kurtosis are lower, and skew is more positive.

Implementation

Trend equity can be implemented in two ways:

- To hedge risk, by producing the same returns with lower volatility

- This is a hedging strategy, where Trend forms part of the target equity allocation.

- When the Trend portion is in cash, the overall equity exposure will be lower.

- To increase returns for the same level of risk, buy adding trend on the side of the static portfolio.

- This core / satellite approach is the one that I use.

- When Trend is in equities, you are over-allocated and when Trend is in cash you are under allocated.

Glide paths

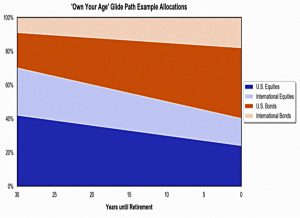

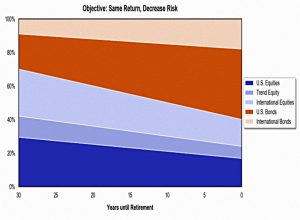

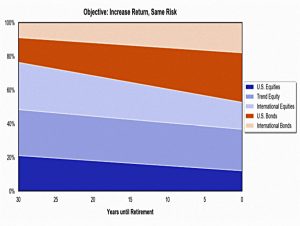

To look at Trend in more detail, NewFound use glide paths, specifically the “own-your-age” (in bonds) allocation.

- They assume a 60/40 domestic / international split for stocks, and 70/30 for bonds, in order to match the Vanguard Target Retirement Funds.

I’m not a fan of glide paths (also known as “lifestyleing”).

- They made sense when everybody retired at the same age (say 60) and bought an annuity with their pension.

- Such a strategy made it important to reduce volatility as you approached the annuity purchase.

Now that the majority of retirees use drawdown, and retirement can last for 30 years or more, it’s important to maintain a high allocation to equities.

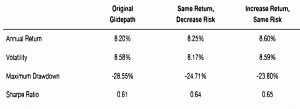

The hedger would take 30% of their US equity allocation (at each life stage) and convert it to Trend.

- This would produce the same returns with lower volatility and lower maximum drawdowns.

To increase returns, you replace 50% of US equity exposure and 20% of US bond exposure with Trend.

- This gives the same volatility profile but with higher returns.

Trade offs

The final section of the report reminds us that the trade-off of removing the left-hand tail (sharp drawdowns) is underperformance during calm market conditions.

NewFound also warn about whipsaws:

A trend equity strategy may go several years without experiencing whipsaw, seemingly avoiding paying any premium, then suddenly experience multiple back-to-back whipsaw events at once.

Investors who allocate immediately before a series of whipsaw events may be dismayed.

Conclusions

We haven’t learned anything new today, but it’s a nice (and fairly short) paper.

I am increasingly convinced of the benefits of adding trend / momentum to a static, globally-diversified multi-asset portfolio (with tilts).

- As such, I’m keen to see how different investment houses approach implementation.

Many practitioners see Trend as the only strategy you need, whereas the Trinity Portfolios we looked at last time average around 45% Trend exposure.

- The glide paths we’ve looked at today would (after correction to a max return base asset allocation – ie. 80/20) involve somewhere between a 15% and a 30% allocation to Trend.

This seems a much more achievable target from where I sit now.

Until next time.