ESG Portfolio 2 – ii and Bestinvest

Today’s post is the second about an ESG Portfolio that I will be putting together during 2020.

ESG Portfolio

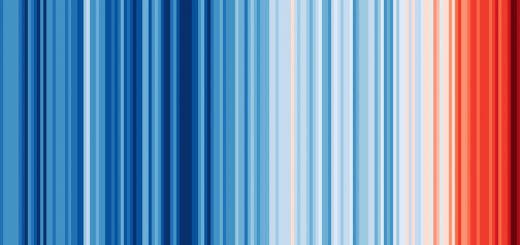

After Brexit, climate change was probably the biggest item on the mainstream media’s agenda during 2019.

- Later in this series, I’ll dig into the science and politics surrounding the issue but my priority is to build a portfolio and get some skin in the game.

My core portfolio is a modified risk parity portfolio based around a large number of asset classes.

The requirements for a new asset class are:

- I can access it through UK-listed products and

- I have a reasonable belief that it will not be too closely correlated to the developed equity markets which form the core of the portfolio

Both of those requirements now appear to have been met, so I will get started.

I will start small this year, with just a 1% or 2% allocation (of total net worth).

- This small initial size means that I can incorporate the ESG funds within the core passive portfolio.

I have a 5.6% allocation of the passive portfolio to non-country aligned assets.

- This was split 2.8% to global funds and 2.8% to Theme funds.

- The new allocation will be 1.2% Global, 2.2% ESG and 2.2% Other Themes (largely Biotech and IT).

DIY Investor UK

Last time out we looked at the work of DIY Investor UK, the pioneer of ESG investing within the UK blog community.

- He’s written around 35 posts and a book on the topic since October 2018.

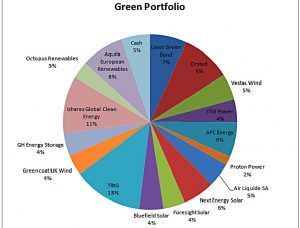

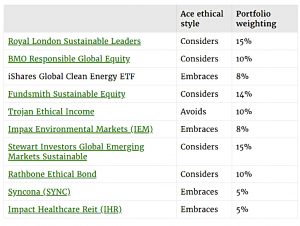

Here’s how his portfolio looked at the end of 2019:

Quite a few of the funds and stocks he identified are foreign-listed, or not listed at all (OEICs).

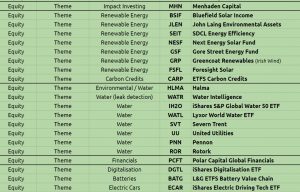

So we ended up with 18 trusts and stocks on our list:

- seven generalist investment trusts

- six specialist investment trusts

- three ETFs, and

- two AIM stocks

Exposure stocks

We also looked at our existing list of Exposure Stocks here on 7 Circles.

Six of the DIY Investor funds are on there, but there are a couple of others that I would have expected to see:

- SDCL Energy Efficiency (SEIT), and

- Greecoat Renewables (GRP)

The Carbon Credits ETF (CARP) should also be there – it’s recently been renamed from ETFS to WisdomTree.

- Searching for that one also threw up the BNP Paribas Easy Low Carbon Europe 100 ETF (0E5F).

DIY Investor doesn’t seem to include Water under ESG, but I will, so we can add the following:

- iShares Global Water ETF (IH20)

- Lxyor World Water ETF (WATL), and

- WATR, as a potential spread bet position.

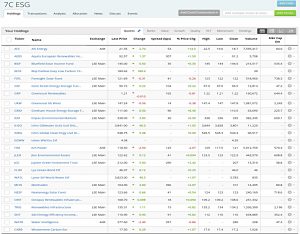

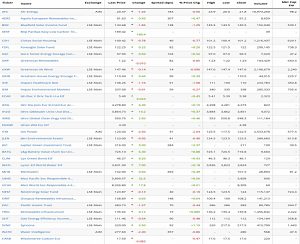

Here’s the list as it stood last week (no purchases yet):

Twenty-five stocks, of which we might buy up to eighteen.

I’ve since decided to add the battery and electric car ETFs to the portfolio:

Bestinvest

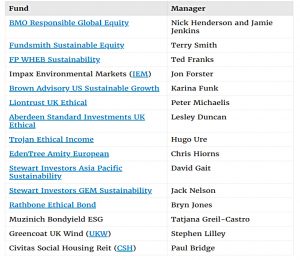

The Bestinvest Clean 15 portfolio is made up of:

- one foreign fund

- eleven OEICs,

- three UK investment trusts.

Two of the ITs (IEM and UKW) are already on our list.

- The remaining IT is Civitas Social Housing (CSH).

I’m overweight property as it is, so I’ll have to think carefully about taking this on.

- But some investors may welcome this as diversification.

Interactive investor

Interactive investor classifies ESG activity into three forms:

- avoids: funds that focus on excluding companies, sectors, or business practices

due to ethical reasons - considers: funds that consider a range of ethical, or environmental, social, and

governance (ESG) criteria and themes when investing - embraces: funds that only invest in companies delivering a positive social or

environmental outcome

Their acronym for this system is ACE, of which more later.

The Interactive Investor Ethical Growth portfolio has just ten holdings:

- six OEICs

- three ITs, and

- one ETF.

The ETF (INRG) and one of the ITs (IEM) are already on our list.

The new additions are:

- Syncona (SYNC), and

- Impact Healthcare REIT (IHR).

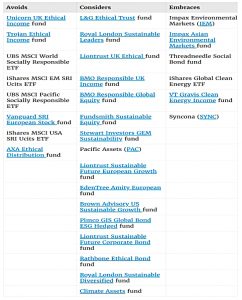

Nine of the funds and trusts from the Ethical Growth portfolio are included in the Ace 30 list, also from ii.

The Ace 30 is made up of:

- twenty-three OEICs,

- four ETFs, and

- three investment trusts.

Some of the ETFs are new:

- UBS MSCI World Socially Responsible (UC44)

- UBS MSCI PaCIFIC Socially Responsible (UB45)

- iShares MSCI Europe SRI (IESG)

And there is one new IT:

- Pacific Assets (PAC)

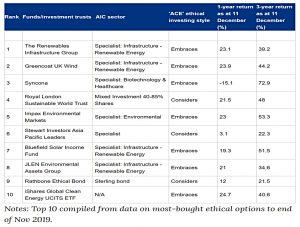

Money Observer reported on ii’s list of the most bought ethical funds of 2019.

- Despite the preponderance of OEICs on the lists we’ve reviewed to date, seven of the top ten funds were ITs or ETFs.

All seven were already on our list.

So we’ve added nine new funds today, to bring us up to a total of 34:

The next step will be to apply a momentum filter and start buying some of them.

- Until next time.