ESG Portfolio 1 – DIY Investor UK

Today’s post is the first about a new ESG Portfolio that I will be putting together during 2020.

Contents

ESG

You would have to be pretty slow on the uptake not to notice that climate change became one of the biggest items on the mainstream media’s agenda during 2019.

Today’s post is about portfolio construction rather than science and politics, but even portfolio construction doesn’t operate in a vacuum.

So here are some relevant things that I believe, to be explored more fully in subsequent posts:

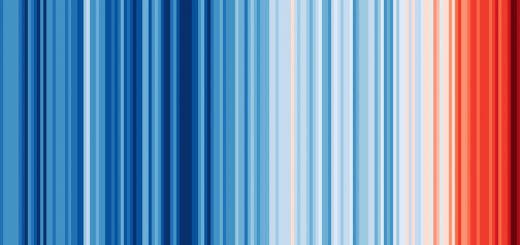

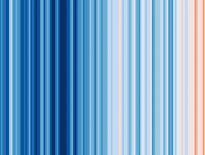

- The world is getting hotter (see the featured image).

- And there is more CO2 in the atmosphere since the industrial revolution.

- But the world has been hotter than this before and had more CO2 before, so it might not be a man-made phenomenon.

- Here in the UK, we are fortunate that the effects of this warming are as much beneficial as problematic (other parts of the world are obviously not so lucky).

- The industrial revolution was a good thing and has improved people’s lives immeasurably.

- If climate change is man-made, we can’t fix it from the UK because our share of global emissions is tiny.

- The same argument applies to plastic pollution.

- Persuading the growing middle classes in the emerging economies not to adopt a western lifestyle is going to take some doing.

- We are a long way from being able to switch over to renewable energy sources.

- The climate change agenda has been hijacked by hair-shirt anti-capitalists.

- Which is ironic, because if a solution is to be developed / discovered, capitalism is our best shot at finding it.

- Personal freedom is paramount

- I don’t want to be told by Swampy or by school children that I can’t eat beef, drive a Jag or fly to the Med.

- Economically speaking, spending a lot of money now to fix the problem might not be the best idea.

- Our descendants will be much richer and will have access to much better relevant technology.

- Of course, this approach requires us to turn a deaf ear to the perennial claim that we have only x years left to save the glaciers/ice cap/planet.

- G is by far the most important letter in ESG.

- ESG investing should underperform in the long run, since it uses a restricted investment universe.

- But the markets are pretty good at pricing things to equalise long-term returns.

- And a rush of money to the ESG investment style might lead to short-term outperformance (that certainly seems to have been the case over the last 18 months).

- The elephant in the room is that there are too many people on the planet

- The population has increased by 160% since I was born.

- With fewer people, we wouldn’t have this big a problem – but I don’t see anyone arguing for that as a solution.

ESG Portfolio

Why start an ESG portfolio, if not on moral grounds?

My core portfolio is a modified risk parity portfolio based around a large number of asset classes.

- The requirements for an asset class are that I can access it through listed products and that I have a reasonable belief that it will not be closely correlated to the developed equity markets which form the core of the portfolio.

Both of those requirements now appear to have been met.

I will start small this year, with just a 1% or 2% allocation (of total net worth).

- If all goes well, I can increase my allocation later.

This small initial size means that I can incorporate the ESG funds within the core passive portfolio.

- I have a 5.6% allocation to non-country aligned assets.

This was split 2.8% to global funds and 2.8% to Theme funds.

- The new allocation will be 1.2% Global, 2.2% ESG and 2.2% Other Themes (largely Biotech and IT).

DIY Investor UK

The pioneer of ESG investing within the UK blog community has been DIY Investor UK.

- He’s written around 35 posts on the topic since October 2018 and has now written a book on the climate “emergency”.

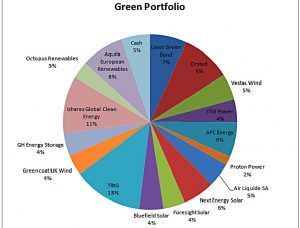

Here’s how his portfolio looked at the end of 2019:

I’m only planning to invest in UK-listed funds, so my portfolio will look different.

Let’s break down the DIY portfolio a little – there are six main groups:

- UK-listed generalist investment trusts

- UK-listed specialist investment trusts

- UK-listed ETFs

- UK-listed stocks

- UK OEICS (unit trusts)

- Foreign-listed stocks (mostly from Denmark).

I’m only interested in the first four categories, and particularly the first three.

- Within which there are 18 stocks and funds in total.

Generalist Investment trusts

There are seven of these:

- Aquila European Renewables Income Fund (AERS)

- Impax Environmental Markets (IEM)

- JLEN Environmental Assets (JLEN)

- Jupiter Green Investment Trust (JGC)

- Menhaden (MHN)

- Octopus Renewables Infrastructure (ORIT)

- Renewable Infrastructure (TRIG)

We might buy all of these.

Specialist Investment trusts

There are six of these:

- Bluefield Solar Income Fund (BSIF)

- Foresight Solar Fund (FSFL)

- Gore Street Energy Storage Fund (GSF)

- Greencoat UK Wind (UKW)

- Gresham House Energy Storage Fund (GRID)

- Next Energy Solar Fund (NESF)

We could focus on a single fund for solar, and batteries, to give us three funds from this section.

ETFs

There are three of these:

We could buy all of these.

Stocks

There are just two of these:

- AFC Energy (AFC)

- ITM Power (ITM)

These are both hydrogen power stocks, and both on AIM.

- They look pretty volatile, and I think that I might take positions on them via spread bets, rather than as part of a largely buy-and-hold portfolio.

So that gives us a plan to buy around 13 funds from DIY Investor UK’s list.

Exposure stocks

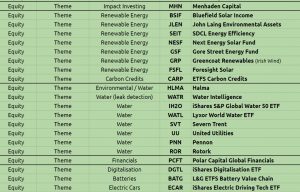

We also have a list of Exposure Stocks here on 7 Circles.

This is what the relevant section of the Themes category looks like:

Six of the DIY Investor funds are on there.

There are a couple that I would have expected to see, however:

- SDCL Energy Efficiency (SEIT), and

- Greecoat Renewables (GRP)

The Carbon Credits ETF (CARP) should also be there – it’s recently been renamed from ETFS to WisdomTree.

- Searching for that one also threw up the BNP Paribas Easy Low Carbon Europe 100 ETF (0E5F).

DIY Investor doesn’t seem to include Water under ESG, but I will.

So we can add the following:

- iShares Global Water ETF (IH20)

- Lxyor World Water ETF (WATL), and

- WATR, as a potential spread bet position.

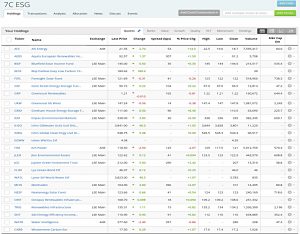

Here’s the list as it stands (no purchases yet):

Twenty-five stocks, of which we might buy up to eighteen.

- In the next article, we’ll look at suggestions from Interactive Investor and Bestinvest.

Until next time.