ESG Portfolio 3 – Morningstar

Today’s post is the third about an ESG Portfolio that I will be putting together during 2020.

Contents

ESG Portfolio

My core portfolio is a modified risk parity portfolio based around a large number of asset classes.

The requirements for a new asset class are:

- I can access it through UK-listed products and

- I have a reasonable belief that it will not be too closely correlated to the developed equity markets which form the core of the portfolio

Both of those requirements now appear to have been met for ESG, so I will get started in 2020 in a small way, with just a 1% or 2% allocation (of total net worth).

- This small initial size means that I can incorporate the ESG funds within the core passive portfolio.

I have a 5.6% allocation of the passive portfolio to non-country aligned assets.

- This was split 2.8% to global funds and 2.8% to Theme funds.

- The new allocation will be 1.2% Global, 2.2% ESG and 2.2% Other Themes (largely Biotech and IT).

DIY Investor UK

In our first post we looked at the work of DIY Investor UK and ended up with 18 trusts and stocks on our list:

- seven generalist investment trusts

- six specialist investment trusts

- three ETFs, and

- two AIM stocks

Exposure stocks

We also looked at our existing list of Exposure Stocks here on 7 Circles.

Six of the DIY Investor funds were on there, but we added:

- SDCL Energy Efficiency (SEIT), and

- Greecoat Renewables (GRP)

- Carbon Credits ETF (CARP)

- Shares Global Water ETF (IH20)

- Lxyor World Water ETF (WATL), and

- WATR

- BATG – L&G ETFS Battery Value Chain

- ECAR – iShares Electric Driving Tech ETF

And we also found the BNP Paribas Easy Low Carbon Europe 100 ETF (0E5F).

- That took us to 27 stocks.

Bestinvest

From the Bestinvest Clean 15 portfolio we added Civitas Social Housing (CSH).

Interactive investor

The Interactive Investor Ethical Growth portfolio has just ten holdings.

We added:

- Syncona (SYNC), and

- Impact Healthcare REIT (IHR).

The ii Ethical Growth portfolio had three new ETFs:

- UBS MSCI World Socially Responsible (UC44)

- UBS MSCI PaCIFIC Socially Responsible (UB45)

- iShares MSCI Europe SRI (IESG)

And one new IT:

- Pacific Assets (PAC)

That brought us to a total of 34 stocks and funds.

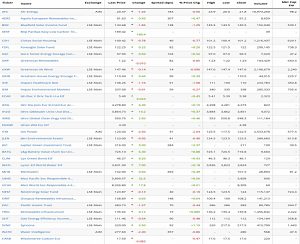

Morningstar

No sooner had I written part two than I came across a Morningstar article on climate-friendly ETF investing (hosted on Money Observer).

There were three sections:

Unfortunately, the article didn’t include tickers, so I had to look up each of the funds individually.

The first section included five funds:

- Xtrackers ESG MSCI World ETF (XZW0)

- iShares MSCI Japan ESG Enhanced ETF (EEJD)

- BNPP E Low Carbon Europe 100 ETF (0E5F – already on our list)

- Ossiam US ESG Low Carbon Equity Factors ETF (OUFU)

- Ossiam ESG Low Carbon Shiller Barclay CAPE US ETF (5HED)

So now we have 38 funds and stocks.

All of the ex-fossil fuel ETFs are from iShares.

Here are the tickers:

- SUSM (Emerging markets)

- IESG (Europe, already on our list)

- SUJP (Japan)

- SUAS (US)

- SUSW (World)

Now we have 42 funds and stocks.

Lyxor Green Bond (CLIM) is already on our list.

- As far as I can tell, the BNP fund (REUSE) is not available in the UK.

The Franklin fund (FLRG) has been added to the portfolio.

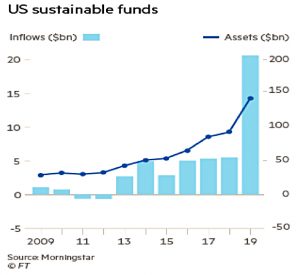

Fund flows

The FT reported that net inflows to sustainable funds in the US almost quadrupled during 2019, rising to $20.6 bn from $5.5 bn, according to Morningstar.

- Assets in the 300 funds concerned were up 54% to $137 bn.

Cannibalisation threat

Meanwhile, Citywire reported JP Morgan’s warning that renewable energy ITs could plunge by up to 43% (albeit over the very long term).

- The six wind and solar ITs currently trade at an average premium of 16%.

JMP think that the cost of electricity will fall over the next 30 years, leading to NAV falls of up to a third, and hence price falls of 43%.

Analyst Christopher Brown said:

Essentially renewables become a victim of their own success by “cannibalising” their own revenue base.

The six funds concerned are:

- Bluefield Solar Income (BSIF)

- Foresight Solar (FSFL)

- Greencoat UK Wind (UKW)

- JLEN Environmental Assets (JLEN)

- NextEnergy Solar (NESF) and

- Renewables Infrastructure Group (TRIG).

A few days later, JLEN reduced its stated NAV to reflect lower power price forecasts.

- NAV went down from 104.7p in October to 101.8p in January.

The impact of renewable power prices was actually 4.3p per share, but lower discount rates on anaerobic digestion biogas plants offset this somewhat.

The following day, UKW and GRP also cut their 4Q NAVs – UKW by 1.5p to 121.4p and GRP by €0.4 cents to €103.1.

Stifel analyst Iain Scouller said the impact on UKW would have been greater had the company not lowered the discount rate on the returns it expects from its assets. He said UKW had at least incorporated a 19% corporation tax rate in its figures, whilst JLEN was still using the abandoned 17% rate.

UKW shares are still on a 15% premium, with a 7.1p dividend target this year.

Dividend cover

The day after JP Morgan’s note, Matthew Hose of Jeffries warned that falling power prices would also hit the dividend cover on these funds.

We see the cover of certain funds as relatively thin and, in some cases, as being supported by fixing/hedging that could eventually roll off into lower realised power prices.

He also thinks that NAV premiums could turn to small discounts.

Using a 5% fall in power prices, he predicts the following impacts:

- NextEnergy Solar (NESF), 9.8% share price premium, -5.3% hit to NAV

- Foresight Solar (FSFL), 10.8% premium, -4.4% hit

- Bluefield Solar (BSIF), 20% premium, -3.7% hit

- Greencoat UK Wind (UKW), 14.4% premium, -3.7% hit

- Renewables Infrastructure Group (TRIG), 13.7% premium, -3.5% hit

- JLEN Environmental Assets (JLEN), 15% premium, -2.9% hit

Greencoat UK Wind has the best dividend cover (1.7), compared to 1.1 at Bluefield, 1.2 at

Foresight and JLEN and 1.3 at NextEnergy and Renewables Infrastructure.

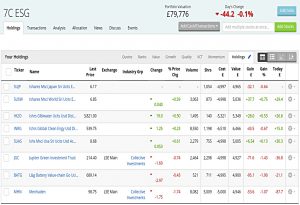

Implementation

So now we have 43 funds and stocks.

- Our initial target is to choose 16 or so.

Let’s start prioritising.

- Implementation will be split into two phases, as I only have half of the cash to hand right now.

- I’ll need to sell off and transfer an ISA before phase 2 can begin.

- So we’re looking for 8 funds to get started.

- The funds on our list are split roughly 2:1 between ETFs and ITs, and I’d like to follow that allocation.

- I also don’t want to double up on sectors too much, as I only have 16 slots to play with.

- I’ll use a momentum filter to focus on funds that have been doing well over the past 10 months or so.

As it happens, I already own two of the funds on the list (INRG and IH2O), so we’re only looking for six funds today.

- In the end, I bought three of the iShares SRI ETFs (US, Japan and Global), two ITs (JGC and MHN) and the battery chain ETF (BATG).

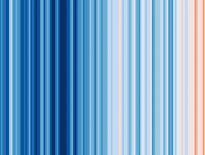

Here’s how the portfolio looks today:

We have six ETFs and two ITs, which is something like the ratio that I expect.

I began the portfolio with £80K of nominal capital, but I’ve been buying through the coronavirus scare, so we’re about 3% down at the moment.

- Hopefully, that will improve.

We’ve half-filled the portfolio, but the other half is waiting on the transfer of an ISA that I’ve just converted to cash.

- So I might not be back with the next update for a few weeks.

Until next time.