Weekly Roundup, 27th January 2020

We begin today’s Weekly Roundup with the biggest story in a thin week – the coronavirus scare.

The Economist focused on the medical side of the story, noting that the world is better prepared than ever to stop contagion.

- As I write there have been 830 confirmed cases, and 26 deaths.

We don’t know yet how easily the virus spreads between humans, but the current mortality rate of 3% is pretty high.

- There are no cases to date in the UK.

The virus is similar to SARS (severe acute respiratory syndrome) which also came from China, back in 2002.

- That epidemic lasted for 6 months, infecting 8,000 and killing 800.

It also caused $30bn to $100 bn of economic damage.

- The Chinese hushed up the SARS outbreak, but this time they have been swift to act, even though travel bans are unpopular at the time of the Chinese New Year.

The World Health Organisation has said that it’s too early to classify the coronavirus as an international public health emergency.

Joachim Klement wondered how bad things could get.

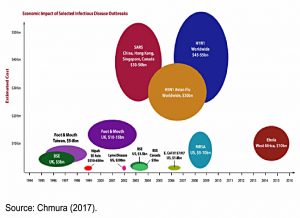

- He had a handy chart of the economic impact of recent pandemics.

Joachim felt that SARS was the best comparator – the coronavirus spreads faster but is apparently less deadly.

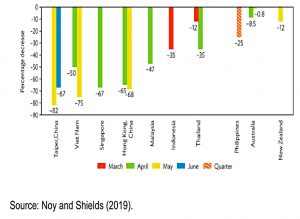

Travel will be badly affected:

John Authers also looked at the potential impact in his Bloomberg email newsletter.

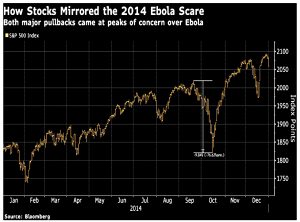

He agreed that SARS was the closest medical analogy, but felt that the Ebola epidemic of 2014 might be a closer match for the economic impact.

- After a few Ebola patients arrived in the US, the issue went political, stirred up by Trump during the mid-term elections.

Here is the chart for the S&P 500 for that year:

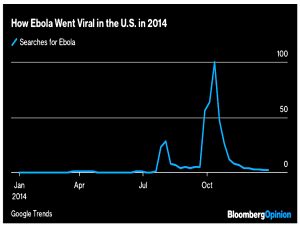

And here is the chart for Google searches for Ebola:

Quite a neat (inverse) match.

- The biggest pullback was close to 10%.

There were only ever 11 confirmed cases of Ebola in the U.S., all but two of which were contracted outside the country.

The two nurses who contracted the virus on American soil both recovered; only two people died of it in the U.S., both of whom had fallen victim to the disease in West Africa.

All deaths are regrettable, but a 10% market correction over a disease which only killed two people in the US is remarkable.

- If a coronavirus panic takes hold, it might lead to a great buying opportunity.

Betting against the noise

On the Bloomberg website, John wrote that betting against the noise is a consistently successful strategy.

- Joseph Mezrich of Instinet LLC began with a simple reversal strategy of shorting the best-performing stocks at the end of each month and buying the worst-performing.

This is only mildly positive – you also need to control for how a stocks underlying sectors and factors performed that month.

- That leaves idiosyncratic relative performance, which you can profitably bet with/against.

The third step is to focus on stocks where there is a close consensus amongst analyst forecasts.

If you avoid stocks that are moving in line with their sector or factor, or in response to news about their fundamentals, the chances are that what is left is pure “noise.”

Betting on these stocks to reverse at the end of each month makes money very consistently.

Private equity

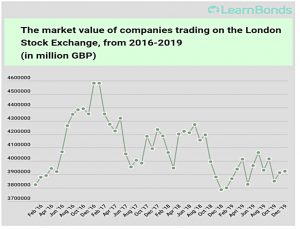

In a second newsletter, John reported that Private Equity is eating the UK stock market.

- The chart shows the value of UK stocks (in £) since the start of 2016.

The All-Share index is up 23% over the period, but the value of its shares is up only 2.7%.

Companies aren’t bothering to issue new shares, but instead going to private equity companies; buying back their own stock; or selling out altogether to nonpublic investors.

All these measures affect the size of the market, but don’t hurt the value of individual shares within it, which is what drives indexes.

In fact, buybacks and buyouts tend to increase share prices.

High fees

In the Economist, Buttonwood made a case for paying more to asset managers – if they really diversify your portfolio.

- This runs against the recent trend away from high-fee active management and towards low-fee passive funds.

But at the same time:

Capital has also poured into “alternative” assets, including private-equity, venture-capital and hedge funds, which levy the sort of fees that incite a taste for yacht-racing and caviar.

VC and PE can have high returns, and offer true diversification.

- Sometimes, it can be worth it to stump up for access to a tricky asset.

You just have to make sure that you are getting value for money.

Quick Links

I have seven for you this week, the first three from The Economist:

- The newspaper reported that Airbus will help airlines to hedge ticket prices

- And that a clan of activist investors is taking on Japan Inc

- And that it has never been easier to launch a new brand

- Jason Collins provided a primer in ergodicity economics

- UK Value Investor wrote that Ted Baker’s collapse is a lesson in the dangers of too much growth

- Flirting with Models asked “Should I Stay or Should I Growth now?”

- And the Times reported that big investors are cashing in their profits in star fund bosses.

Until next time.