Factor Portfolio Review, March 2020

Today’s post is the first review of a factor portfolio (smart beta portfolio) that we put together a year ago.

Factors

This is the fourth article in our series on factor investing, but it also stands alone as the first review of a factor portfolio that we put together in 1Q19.

Factor investing is the use of a rule other than market-cap weighting to allocate money within a pooled investment fund.

- But in one sense it’s still a passive strategy since factor funds require no active management from the private investor.

There are lots of potential factors – the classics from academic research are:

- Value

- Small Size

- Momentum

- Low Volatility

Some investors also support:

- High Yield / Dividend (I see this as part of the Value factor)

- Quality – which has many definitions

- Growth (which I see as a “pass the parcel”/greater fool approach)

- and Liquidity (illiquid investments like PE and VC should outperform)

No factor works all of the time so diversification across factors is a good idea.

- A long time horizon and some kind of timing mechanism (momentum/trend following) for entry are also good ideas.

UK factor funds

In January 2020, we looked at the available factor funds in the UK.

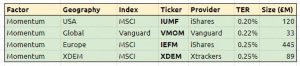

I chose four momentum funds:

And five value funds:

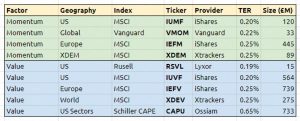

And 22 dividend funds.

As well as straight dividend funds, we also have:

- Shareholder yields funds (there are also buyback-specific funds that I’ve ignored)

- Hybrid quality and dividend funds

- Hybrid Low Vol and dividend funds

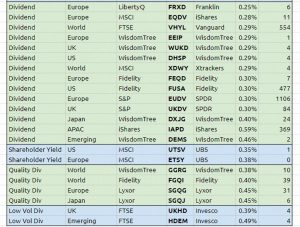

I also added four equal-weighted funds.

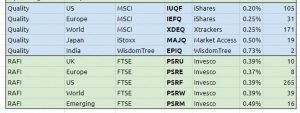

And ten quality funds – five pure quality funds and five from the RAFI (formerly Powershares) stable.

- RAFI funds use four fundamental measures – dividends, cash flows, sales and book value.

And two growth funds:

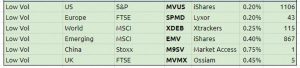

Finally, I added six Low Vol funds to the list:

I excluded the following categories of funds:

- Private Equity and Long Volatility

- These are included in our baseline/core passive portfolio.

- ESG funds and Islamic funds

-

- These restrictions are outside the scope of the present portfolio, though we have since constructed a separate ESG portfolio.

-

I also intended to exclude market-cap strategies (small-cap/mid-cap etc, which are already in the core passive portfolio).

- And multi-factor strategies (where more than one factor is involved), since we are building a multi-factor portfolio from the single-factor funds.

But it turned out that I was holding some of these funds already, and I decided not to sell them.

Model portfolio

We now have a list of 50+ factor funds from which to build a portfolio.

I used the usual hand-crafting method to allocate cash between and within groups. The top-level groups were:

- Momentum

- Value

- Dividend

- Low Vol

- Quality

- Growth, and

- Equal Weight

I see Value and Dividend as related, so will slightly underweight these groups.

- The hybrid groups (Shareholder Yield, Quality Div, Low Vol Div and RAFI) will also be under-weighted.

- Equal Weight is also slightly under-weighted, to simplify the allocations.

I will use a maximum allocation to a single fund of 5%, and a minimum allocation of 1%.

The final model portfolio can be found here.

- It has a weighted average ongoing charge of 0.30%, which seems pretty good to me.

Implementation

I started constructing this portfolio back in March 2019 – the anniversary is the reason for this initial review.

- In practice, many of the funds were unavailable on the platforms I was using (probably in part because they are tax-sheltered SIPP and ISA accounts) and I was only able to buy 20 funds for the portfolio.

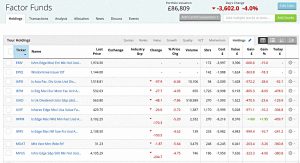

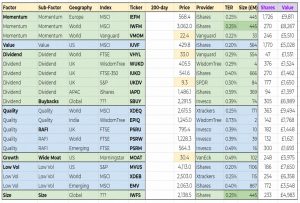

Here’s how it looks today (in the midst of the coronavirus crash):

Performance

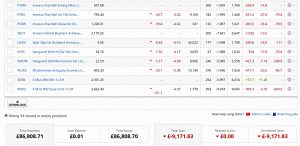

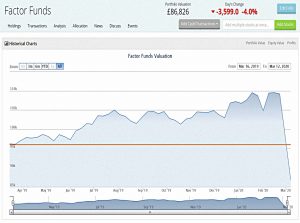

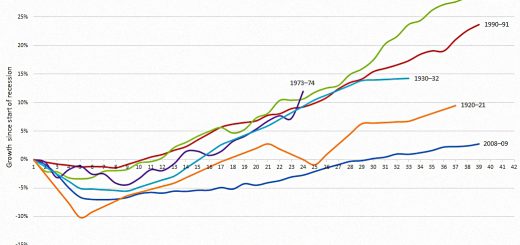

The performance was pretty good for most of the year but like everything else, it has fallen off a cliff over the last month or so:

Things look a lot better against the FTSE All-Share index:

We’ve outperformed by 13% in a year (albeit at minus 9% rather than minus 22%).

- I’m pretty happy with this and plan to add to the portfolio.

Analytics

Because the portfolio is made up of ETFs, the regular Stockopedia analytics aren’t available.

- And since I’m adding over the next few months, the priority for me is to look at the existing allocations to the various factors, so that I can work out where I am under- and overweight.

That, in turn, will tell me what to buy next.

Here are the holdings again, arranged by factor and sub-factor.

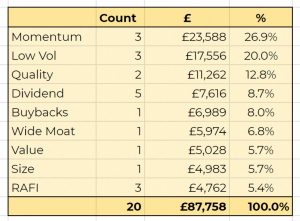

Here’s the level 2 analysis, which looks somewhat bitty.

- But Quality and RAFI are very similar, and so are Dividends and Buybacks.

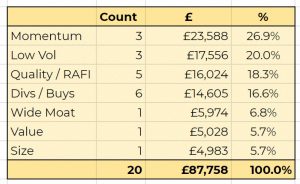

Which means that we can group them together.

The level 1 analysis looks a lot better.

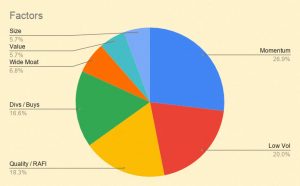

As we can see from this pie chart.

When the market carnage settles down (which I accept might be quite a few months yet), I plan to add to the portfolio.

- Priorities will be value and wide moat (a proxy for both growth and quality), which are both underweight.

I’ll also try to add more geographical diversification within the factors, where possible.

- Until next time.