Factor Investing 3 – Funds

Today’s post is the third in a series on factor investing, otherwise known as smart beta.

Contents

The story so far

So far we’ve written two articles about Factor Investing, each based around index firm MSCI’s classifications.

- Factor investing is the use of a rule other than market-cap weighting to allocate money within a pooled investment fund.

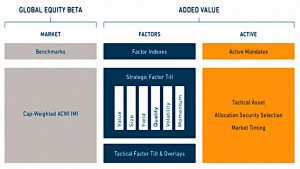

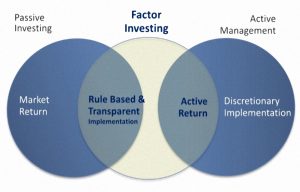

Different observers would place factor investing at different points along the passive / active spectrum.

- They deviate from market-cap weighted indexes, which now monopolise the term “passive”.

- But factor funds require no active management from the private investor.

MSCI have six basic factors:

- Value

- Small Size

- Momentum

- Low Volatility

- High Yield / Dividend, and

- Quality

Their FaCS classification (aimed at industry professionals) adds two more:

- Growth, and

- Liquidity

MSCI have found that factors are responsible for around 55% of mutual funds active returns. Within this:

- style factors contribute 35%

- country and industry factors contribute 25% each

- currency factors contribute 15%.

All of the factors have been supported by academic research over varying look-backs of financial history, and across a variety of asset classes.

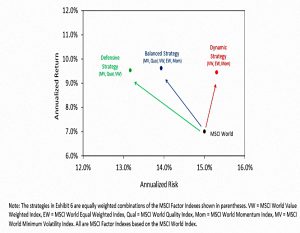

- But no factor works all of the time so diversification across factors is a good idea.

- A long time horizon and some kind of timing mechanism (momentum / trend following) for entry are also good ideas.

There are three explanations on why they work – exposure to systematic risk, behavioural biases and (institutional) investor constraints.

- Recent very long-term studies have tended to support the behavioural explanation.

Factor funds

Today we’ll be looking for some factor funds that we can invest in.

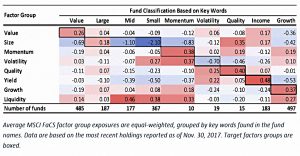

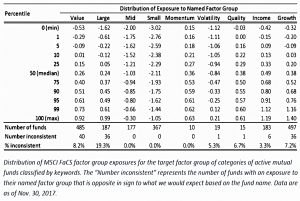

MSCI’s paper on the FaCS classification found some shortfalls in the way that active funds are exposed to the factors they should be tracking.

Some funds (particularly large cap) had inconsistent exposures (ie. in the wrong direction).

- MSCI also found overlaps / confusions between (quality & dividends) and (growth & quality).

- And even where there was no inconsistency, there was wide variation in exposure to the desired factor.

These issues should be limited to active funds.

- Smart beta funds which track a factor index should have a high factor exposure and no inconsistency.

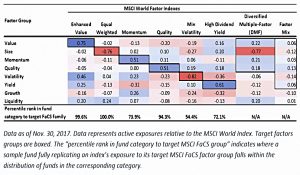

Happily, factor index funds do have much better exposure.

- The worst performing category was Min Vol, where the index fund would have ranked only in the 55% percentile amongst active funds.

- In contrast, the Value and Equal Weight index funds rank in the 100th percentile.

Momentum, Quality and Yield index funds all did acceptably well (73rd to 95th percentile).

Momentum

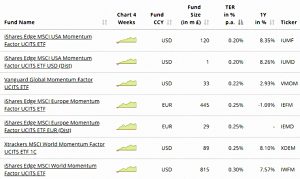

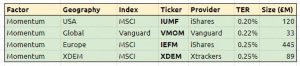

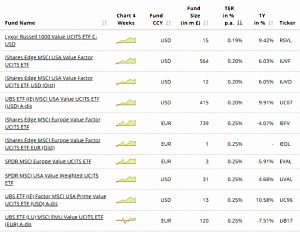

There are seven momentum funds available, but they only track four indices:

I will exclude the distribution funds, and IWFM because it is more expensive than XDEM.

So now we have four funds:

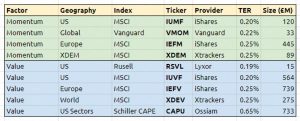

Value

There are twenty value funds available, so they have been split across two tables:

As before, I’ve removed distribution funds, plus currency hedged funds, and then chosen the cheapest / largest funds that track each available index.

That takes us down to just five value funds:

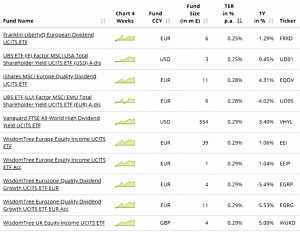

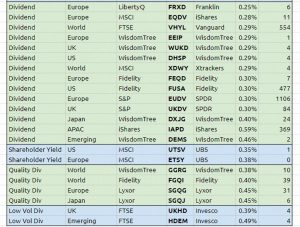

Dividend

There are 77 dividend funds available, so I won’t bore you with them all.

Here are the cheapest ten:

This is a much more complicated section to filter, and I’ve ended up adding 22 of them to our table.

As well as straight dividend funds, we also have:

- Shareholder yields funds (there are also buyback-specific funds that I’ve ignored)

- Hybrid quality and dividend funds

- Hybrid Low Vol and dividend funds

Equal weight

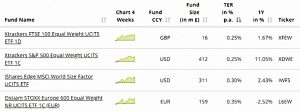

The next section is equal-weighted funds.

There are only four of these, each tracking a different index.

- So we can take them all.

Quality

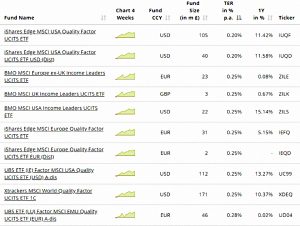

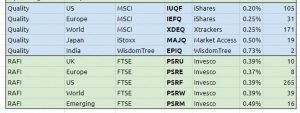

There are 27 quality funds, so here are the cheapest ten:

We ended up with ten funds here – five pure quality funds and five from the RAFI (formerly Powershares) stable.

- RAFI funds use four fundamental measures – dividends, cash flows, sales and book value.

Growth

There are only two growth funds available, so we can add both of them:

Low Vol

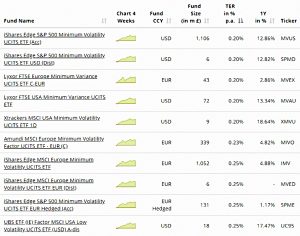

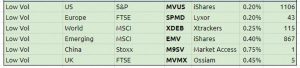

There are 27 Low Vol funds, so here are the cheapest ten:

I’ve added six Low Vol funds to the list:

Exclusions

I have excluded the following categories of funds:

- Market cap strategies

- Small cap / mid cap etc.

- These are included in our baseline / core / passive portfolio.

- Multi-factor strategies

- Where more than two factors are involved

- We will be building a multi-factor portfolio from the remaining funds.

- Private Equity

- This is included in our baseline / core / passive portfolio.

- Long Volatility

- This is included in our baseline / core / passive portfolio.

- ESG funds and Islamic funds

- These restrictions are outside the scope of the present portfolio.

Weightings

We now have a list of 50 factor funds from which to build a portfolio.

- I will use the usual hand-crafting method to allocate cash between and within groups.

Top level groups are:

- Momentum

- Value

- Dividend

- Low Vol

- Quality

- Growth, and

- Equal Weight

I see Value and Dividend as related, so will slightly underweight these groups.

- The hybrid groups (Shareholder Yield, Quality Div, Low Vol Div and RAFI) will also be under-weighted.

- Equal Weight is also slightly under-weighted, to simplify the allocations.

I will use a maximum allocation to a single fund of 5%, and a minimum allocation of 1%.

The final portfolio can be found here.

- It has a weighted average ongoing charge of 0.30%, which seems pretty good to me.

In the next article we’ll get back to the theory, and see if we can find any reasons to deviate from this baseline allocation.

Until next time.

The portfolio has around 40-50 holdings – what do you think of a smaller portfolio approach with one holding in each factor category using one of the world level funds for that factor.

I think that would be much better than nothing, but I like to get to 30 stocks/funds in a portfolio if I can. It depends on portfolio size, too, of course.

I actually had problems buying a lot of these funds in tax-sheltered accounts and I currently hold only 20 factor funds.