ESG Portfolio 4 – Phase 1 Complete

Today’s post is the fourth about an ESG Portfolio that have put together for 2020.

Contents

ESG Portfolio

My core portfolio is a modified risk parity portfolio based around a large number of asset classes.

My requirements for adding a new asset class are:

- I can access it through UK-listed products

- I have a reasonable belief that it will not be perfectly correlated to the developed equity markets (principally the UK and US) which drive the core portfolio, and

- The expected returns will not be significantly lower than my SWR / those from the core portfolio (3% pa plus inflation)

Essentially this is a trade-off between the effort required to construct and maintain a new allocation, and the rewards this might bring.

- Over the Xmas break, I came to the conclusion that ESG now clears this hurdle.

My plan for 2020 is just a starter portfolio – a 1% or 2% allocation (of total net worth).

- This small initial size means that I can incorporate the ESG funds within the core passive portfolio, but I will still get to learn more about ESG investment.

I have a 5.6% allocation within the passive portfolio to non-country aligned assets.

- This was split 2.8% to global funds and 2.8% to Theme funds.

- The new allocation will be 1.2% Global, 2.2% ESG and 2.2% Other Themes (largely Biotech and IT).

DIY Investor UK

In our first post we looked at the work of DIY Investor UK and ended up with 18 trusts and stocks on our list:

- seven generalist investment trusts

- six specialist investment trusts

- three ETFs, and

- two AIM stocks

Exposure stocks

We also looked at our existing list of Exposure Stocks here on 7 Circles – six of the DIY Investor funds were on there, but we added:

- SDCL Energy Efficiency (SEIT), and

- Greecoat Renewables (GRP)

- Carbon Credits ETF (CARP)

- Shares Global Water ETF (IH20)

- Lxyor World Water ETF (WATL), and

- WATR

- BATG – L&G ETFS Battery Value Chain

- ECAR – iShares Electric Driving Tech ETF

And we also found the BNP Paribas Easy Low Carbon Europe 100 ETF (0E5F).

- That took us to 27 stocks.

Bestinvest

From the Bestinvest Clean 15 portfolio we added Civitas Social Housing (CSH).

Interactive investor

The Interactive Investor Ethical Growth portfolio has just ten holdings. We added:

- Syncona (SYNC), and

- Impact Healthcare REIT (IHR).

The ii Ethical Growth portfolio had three new ETFs:

- UBS MSCI World Socially Responsible (UC44)

- UBS MSCI PaCIFIC Socially Responsible (UB45)

- iShares MSCI Europe SRI (IESG)

And one new IT:

- Pacific Assets (PAC)

That brought us to a total of 34 stocks and funds.

Morningstar

Morningstar’s recent article on climate-friendly ETF investing had three sections:

Unfortunately, the article didn’t include tickers, so I had to look up each of the funds individually.

The first section included five funds:

- Xtrackers ESG MSCI World ETF (XZW0)

- iShares MSCI Japan ESG Enhanced ETF (EEJD)

- BNPP E Low Carbon Europe 100 ETF (0E5F – already on our list)

- Ossiam US ESG Low Carbon Equity Factors ETF (OUFU)

- Ossiam ESG Low Carbon Shiller Barclay CAPE US ETF (5HED)

So now we have 38 funds and stocks.

All of the ex-fossil fuel ETFs are from iShares.

Here are the tickers:

- SUSM (Emerging markets)

- IESG (Europe, already on our list)

- SUJP (Japan)

- SUAS (US)

- SUSW (World)

Now we have 42 funds and stocks.

Lyxor Green Bond (CLIM) is already on our list.

- As far as I can tell, the BNP fund (REUSE) is not available in the UK.

The Franklin fund (FLRG) has been added to the long list.

ESG news

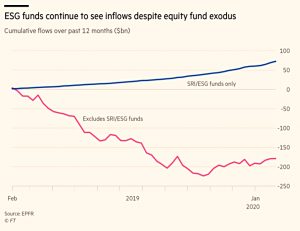

In the FT, Robin Wigglesworth reported that flows into ESG funds are hurting value investors.

ESG-focused equity funds have taken in nearly $70bn of assets just over the past year,

while traditional equity funds have suffered almost $200bn of outflows.

Since ESG funds are heavy in tech and consumer products, these flows support growth and quality stocks at the expense of value stocks (such as the energy sector).

In FT Adviser, David Thorpe reported that a Schroders fund manager has warned that ESG funds are in a bubble. James Sym said:

The valuations have gone beyond the reality. A company we know in Spain is able to build solar plants with borrowed money for basically zero interest. They are borrowing more than the full cost of building them, and that is a classic characteristic of a bubble.

Moira O’Neill of interactive investor noted that of 140 funds on the company’s ethical long list, only 17 (12%) were investment trusts.

- There were also four VCTs on the list.

My experience has been better than this since I exclude the many OEICs.

- I’m comfortable with the 2:1 ratio between ETFs and ITs that I have observed, but I might run into problems as the portfolio grows towards 30 positions.

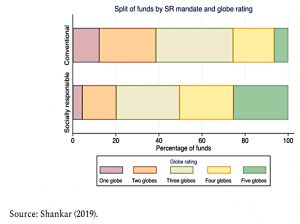

Joachim Klement pointed out that plenty of conventional funds are green.

- He was looking at a paper by Harshini Shanker, who analysed the Morningstar database of 5,161 equity funds available in the US.

Joachim was particularly worried about active funds since ETFs have to track a clearly defined index.

Harshini compared the ESG rating (measured in “globes”) of socially responsible funds with that of conventional funds.

- Socially responsible funds were on average rated 0.7 globes higher.

But around half of the SRI funds were rated at three globes or less – Joachim thinks that these could be accused of greenwashing.

- And close a quarter of conventional funds had ratings of four or five globes – twice the number of all SRI funds, and managing 3.5 times the assets.

Joachim concludes:

What I want to get with a socially responsible investing is protection from risks that are not priced in markets, such as environmental or governance risks. And if I can get that from a conventional fund, I don’t care about the label – and neither should you.

Implementation

Our initial target was to choose 16 or so funds and stocks from our list of 43.

- Implementation would be split into two phases, as I only had half of the necessary cash to hand (I needed to sell off and transfer an ISA before the second phase, but this has now happened).

- The funds on our list are split roughly 2:1 between ETFs and ITs, and I’d like to follow that allocation.

- I also don’t want to double up on sectors too much, as I only have 16 slots to play with.

- I’ll use a momentum filter to focus on funds that have been doing well over the past 10 months or so.

As it happened, I already owned two of the funds on the list (INRG and IH2O), so we were only looking for fourteen funds.

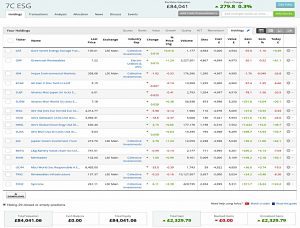

Here’s how the portfolio looks today:

We have nine ETFs and seven ITs, which is something like the ratio that I expect.

- I was aiming for a 10:6 or 11:5 split, but several ETFs were unavailable on the platform I was using.

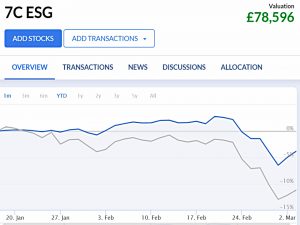

I began the portfolio with £81.7K of nominal capital (the odd number is from the starting valuations of the two inherited positions), and we’re up around £2.3K (3%) in these early weeks.

- The next update on this portfolio will probably be in six months or so, but definitely after a year, at which point I will decide whether to increase its size.

Stop press

Since I drafted this article a couple of weeks ago, we’ve had the coronavirus market crash, and the portfolio is now down by close to 4%.

- But it’s held up much better than the index (the FTSE All-Share).

Until next time.