Factor Investing 4 – RA Symposium

Today’s post is the fourth in a series on factor investing, otherwise known as smart beta. We’re going to look at a symposium hosted by Research Associates in California.

RA symposium

I am grateful to John Authers for tipping me off about the Research Affiliates annual advisor symposium in his regular Bloomberg newsletter Points of Return (well worth signing up for).

John was lucky enough to attend:

I spent the first part of this week in sunny Newport Beach in southern California.

In fact, he was one of the speakers.

Research Affiliates is run by Rob Arnott, as is described by John as:

The home of fundamental indexing.

We first met Rob when he appeared in John Mauldin’s book Just One Thing.

- His chapter described the benefits of alternative indices.

We’ve also built stock screens from his work.

Fortunately for us, most of the slides from the symposium are available.

- Twelve presentations are listed, and nine sets of slides can be downloaded.

Three of these are out of scope for us, but there are six presentations that look interesting.

- So we have a lot to get through.

Robust strategy

First up is – what makes for a robust strategy?

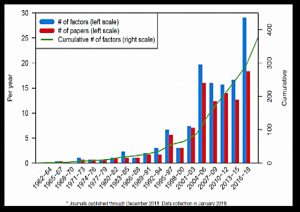

The presentation begins with the rapid growth in factors – close to 400 have now been “discovered”.

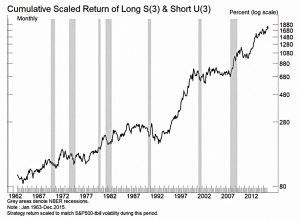

The ease with which data mining can be presented as back-testing is illustrated using the S3U3 long-short strategy from a paper authored by Arnott and Markowitz (inventor of Modern Portfolio Theory).

- This was an arbitrary strategy chosen from the many possible variations of buying and selling stocks based on the letters in their ticker codes.

It was found by brute force, and persisted for more than 50 years, allowing “discovery” after 25 years and “cross-validation” through out of sample testing with the following 25 years.

- But it’s fake, and has no economic foundation.

We really need factors to be:

- understandable / explicable

- robust across time, geography and definitions

- RA stressed the significance of periods with different valuation regimes

- and of the persistence of factors even when changes of valuation have been taken in to account

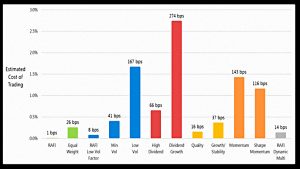

- persistent even after trading costs

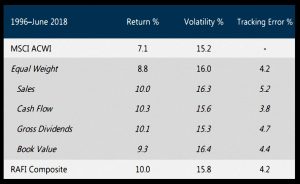

RA’s non-market cap indexing (what they call non-price weighting) outperforms across 22 countries.

- RAFI stands for Research Affiliates Fundamental Index.

RAFI is also cheap to implement.

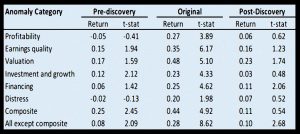

But annoyingly, factors seem to work less well once they have been discovered.

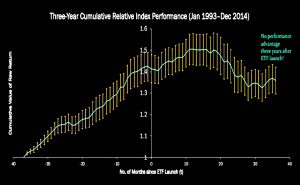

RA’s research shows that the typical factor ETF will use a strategy that has shown good outperformance in the three years before its launch, but will show no further outperformance in the following three years.

- Note that this doesn’t mean that the factor will never work again in the future.

- All factors are cyclical, and a multi-factor approach is recommended.

It’s as much a warning not to buy into fund launches as anything else.

Valuations

The second presentation comes from Rob Arnott himself.

- It’s not strictly about factor investing, but it has some interesting stuff.

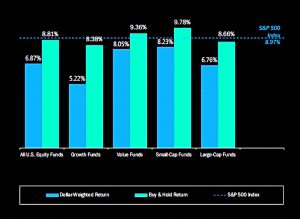

Rob points out that most investors are trend chasers.

- They underperform the funds they are in through buying high and selling low.

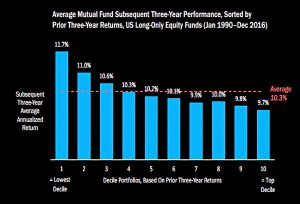

A simple contrarian strategy of buying funds from the lowest performance decile over the previous three years would outperform.

- Rob speculates that this is because of the industry “rule” of “three bad years and I’m out”.

Today, investors are chasing growth, since that is what has outperformed over the past ten years.

- But of course, expected returns are now higher for value approaches.

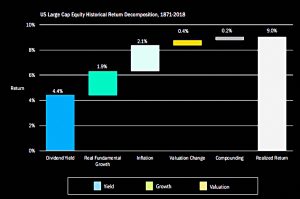

US historical stock returns of 9.0% pa are made up of:

- 4.4% dividends

- 1.9% underlying growth

- 2.1% inflation

- 0.4% increased valuations (PE multiple)

- 0.2% compounding

Forecast returns (no period specified) of 2.8% pa (much lower) have the same structure:

- 2.1% dividends

- 1.3% growth

- 2.1% inflation

- minus 2.6% valuation change

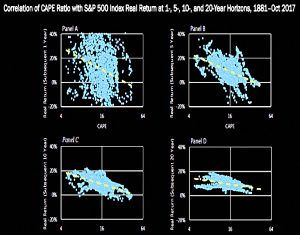

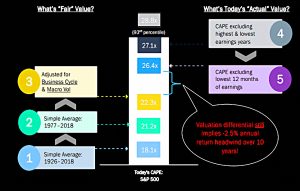

Rob notes that CAPE (the 10-year valuation) is useless for market timing (1-year forecasts) but becomes much better as the time period increases.

- This link between starting valuations and future (long-term) returns is robust across equity markets.

- Which implies that highly valued US stocks are due for poor 10-year returns.

Rob notes that macro volatility affects the equilibrium CAPE level.

- The equilibrium level for 2017 was 23, almost 30% below the prevailing level of 32.

Rob looks at some plausible adjustments to CAPE (some might call them excuses for today’s high level) but still concludes that valuations will shrink by 2.5% pa over the next ten years.

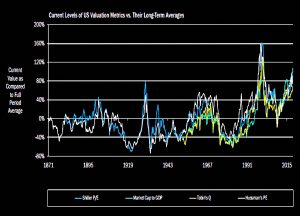

Other useful metrics (all sending the same signal at the moment) include:

- market cap to GDP (one of Buffett’s favourites)

- Tobin’s Q, and

- Hussman’s PE

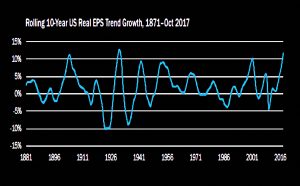

EPS growth is cyclical, with high growth leading to low growth.

- So high earnings alone are not enough to justify a high CAPE, and the high historical earnings growth points to disappointment ahead.

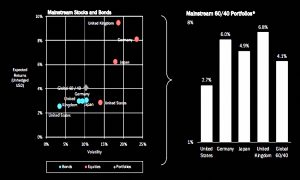

Rob concludes that the expected returns for a US 60/40 portfolio are just 2.7% pa.

- In contrast, UK expected returns are 6.8% pa.

Of course, the prospects for the tech stocks, which are even more highly rated than the US market in general, are even worse.

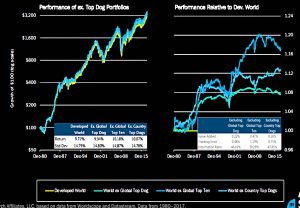

Rob notes that the ten biggest firms globally (what he calls the Top Dogs) are remarkably inconsistent from year to year.

- Previous Top Dogs vanish from the list because they underperform.

The largest firm has grown faster than the global market (price-weighted) in only 5% of the last 30 years.

- They had a 95% chance of underperforming over 10 years.

The average annual shortfall was 10.5%, leading to a two-thirds erosion of value over 30 years.

- So of course, you don’t want these stocks in your portfolios, and certainly not at their market cap weights.

That’s it for today.

- I’ll be back in a couple of weeks with a look at some more of the presentations.

Until next time.