Factor Investing 1 – Introduction

Today’s post is the first in a series on factor investing, otherwise known as smart beta.

Contents

MSCI

We have to start somewhere, and I’ve chosen to start with MSCI (the index firm), for two reasons:

- They make dozens (though not all) of their papers on factor investing available to the public.

- I attended a webinar on factor investing last week, and someone from MSCI was on the panel.

What is factor investing?

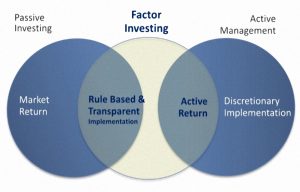

Factor investing, in practical terms, is the use of a rule other than market-cap weighting (as used by normal index funds) to allocate money within a pooled investment fund.

Factor premia represent exposure to systematic sources of risk that have historically earned a long-term premium.

The big debate is whether factor investing is an active or a passive strategy.

- The alternative name of smart beta (which seems to have picked up negative connotations over the years since it was introduced) doesn’t really help us much here.

Factors are also sometimes known as tilts.

My personal opinion is that there’s no such thing as a truly passive investor.

- We’re all making choices about where to park our money that deviate from the “universe of money” (some of which is likely to be unavailable to us in any case).

Market-cap weighted index investing, which seems to have swallowed the term “passive investing”, is just one way amongst many of approaching this.

- And although it has advantages in terms of cheapness, simplicity and transparency, it’s definitely not the best approach in terms of maximising returns.

For example, equally-weighted (EW) indexes usually outperform market-cap weighted ones.

- EQ is a form of Small Cap investing since their will be a greater allocation to smaller firms than in a market-cap weighted index.

Of course, passive has another sense, that of the amount of effort required from the investor.

- On those terms, factor funds are passive, unlike a small cap stock portfolio.

What are the factors?

A factor can be thought of as any characteristic relating a group of securities that is important in explaining their returns and risk.

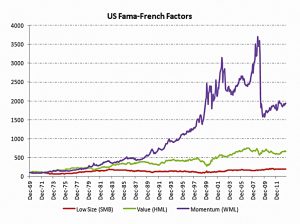

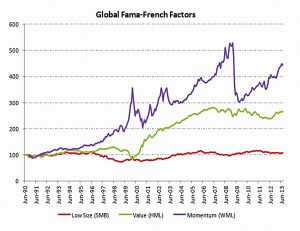

Factor investing comes out of CAPM and the various Fama and French (FF) factor models.

FF identified three factors back in the 1990s:

- the market (beta)

- size (small cap), and

- value (low price to book).

Later on they added momentum.

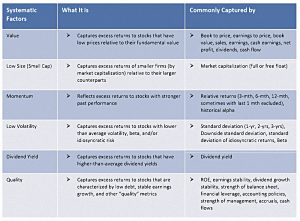

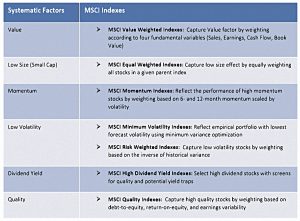

MSCI currently have six factors:

- Value

- Small Size

- Momentum

- Low Volatility

- High Yield / Dividend, and

- Quality

These are all “fundamental” factors – based on stock characteristics – as opposed to macro-economic and statistical factors.

I tend to class High Yield as an easily observable version of the Value factor.

- I struggle the most with Quality, which seems very open to interpretation and revision.

Growth isn’t on MSCI’s list, though it resurfaces from time to time.

- This is another one that I struggle with: Growth seems to work for a while, until somebody overpays for it – it’s a “pass the parcel” factor.

MSCI provide indices against each of their factors for funds to track.

Do they work?

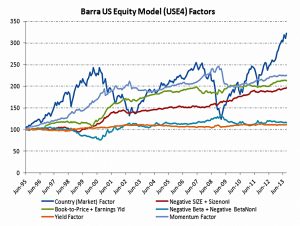

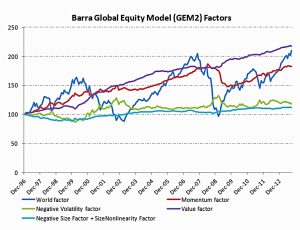

All of the factors have been supported by academic research over varying look-backs of financial history, and across a variety of asset classes.

- Some – particularly momentum and value – work better than others, and more consistently across time, geography and asset classes.

But it’s important to remember that no factor works all of the time and that factor returns are very cyclical.

Given strong anecdotal evidence that the majority of investors have relatively shorter horizons, their cyclicality may in fact be one of the reasons [factors] have not been arbitraged away.

Cyclicality means that diversification across factors is usually a good idea, since the periods of underperformance from different factors tend not to coincide.

- And so is a long time horizon (15 years or more).

As an alternative to a long horizon, it might also be advisable to use some kind of timing mechanism (momentum / trend following) for the initial purchase.

Style box investing

Two of the systematic factors, Value and Size, form the basis of what has become a fund categorization standard – “style box investing.”

Style box / style investing, was first popularized by Morningstar in 1992. It’s a framework in which institutions allocate to managers within style segments (large/mid/small and value/growth).

We’ve all seen those grids on the Morningstar X-Ray reports (and indeed, on the Stockopedia analysis pages).

Why do they work?

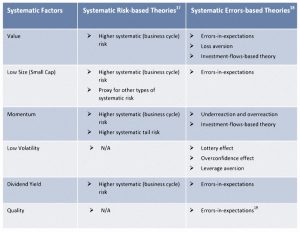

There are two camps on this one:

- That factors reflect some source of systematic risk, which allows for outperformance and efficient markets at the same time.

- Low Vol is particularly difficult to explain in this way, since according to CAPM, low beta should mean low returns.

- That behavioural and emotional weakness / cognitive bias from investors is to blame.

- A variation on this explanation is that investor constraints are responsible.

For example, investors with short time horizons might explain a long-term premium for illiquid stocks.

-

- Similarly, institutional benchmarks and the targeting of relative returns could explain the low volatility premium.

- And herding / reputational risk might explain momentum.

Recent very long-term studies have tended to support the behavioural explanation.

Both theories allow for continued factor outperformance, but investors should beware any of the factors becoming much more popular than at present.

- Though this might initially mean that the factor does even better than usual, in the long-term, performance could be impacted.

Factors as bets

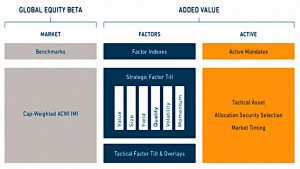

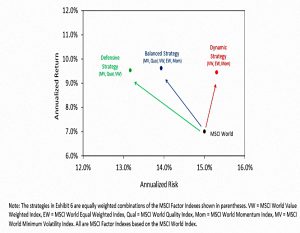

MSCI classify factors into groups that form “bets” away from the world (market-cap) portfolio:

- Defensive = Low Vol, Value and Quality

- Balanced = Low Vol, Value, Equal Weight and Momentum

- Dynamic (aggressive) = Value, Equal Weight and Momentum.

Confusingly, Value appears in all of the bets.

Note that all of the strategies improve returns, but the Defensive and Balanced strategies also reduce volatility.

Factor indexes

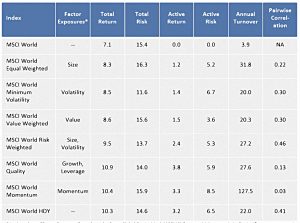

The original studies on factors were not concerned with whether those factors were actually investable.The factors they described did not, nor were they meant to, take into account features key to implementation: transaction costs, liquidity, investability, and capacity.

There is a tradeoff between the exposure to the factor (and potential returns) and the investability of a factor index. One can generally only achieve purer factor exposure by sacrificing investability and being willing to take on greater amounts of active risk.

Obviously, MSCI have fixed all this with their factor indexes.

Conclusions

Investing in factors represents active views away from the market portfolio and investors must form their own belief about what explains the premium and whether it is likely to persist.

Factor strategies should be assessed in the long run against a market capitalization weighted benchmark.

I believe in factors.

- I believe in the behavioural and the constraint explanations for their outperformance, and I expect them to continue to work over the long term.

In the next post in this series we’ll look at some more papers from MSCI.

- But soon we’ll take a look at the factor funds available to UK investors.

Until next time.