Forestry

Today’s post looks at UK Forestry as an asset class.

Why Forestry?

I don’t know too much about forestry, but I’ve been meaning to find out more – and to write about it – since I started this blog back in 2014.

From my limited knowledge, there are three (investing) reasons to invest in forestry:

- There are tax breaks

- It’s a real asset, which might be expected to offer protection against inflation.

- Subject to suitable levels of transaction and holding costs, it might be a good diversifier against the stock market.

You might also like the idea of preserving some trees, or of enjoying a camping/glamping holiday on your own land, but these are lifestyle rather than financial considerations.

Timber prices have a low correlation with stocks, which mean that forestry should be defensive against a downturn in the wider economy.

- This is somewhat surprising, given that construction is the main demand driver, but the growth in population is the underlying driver.

Timber is being used more in houses and increasingly in taller buildings of up to six stories.

Inflation

The threat of inflation is what brings me to write about it today.

- Biden (eventually) sweeping the board in the US elections means that for the first time since I started investing, I have a non-trivial fear than inflation will increase in the medium term.

We have the prospect of suppressed demand from Covid turning into a mini roaring twenties at the same time that more dollars will be created than ever before.

- 4% pa inflation looks pretty likely in the next few years

And governments have a pretty bad track record in preventing 4% pa inflation from turning into 10% pa inflation.

- At that point, I don’t want to be holding cash or bonds, but I also don’t want to increase my stock exposure (since stocks will also do badly in the short run).

So throughout 2021, I’ll be looking for alternatives in the commodities and real assets space.

Growth and Income

Forestry is a two-pronged investment:

- You get income from selling any timber that you cut down each year

- And you get capital growth from the rise in the value of the land itself (which is in part driven by the yield as the price of timber rises over time.

Tax

There are three taxes to consider:

- Woodland qualifies for Business Property Relief (PBR) after being owned for two years.

- This is the same tax-break that AIM shares qualify for, and provides an exemption from IHT.

- There is no CGT on growing trees/wood in a forest.

- Owning the land can complicate this, as land is subject to CGT (though most of the gain perhaps 85% to 90% – will be from the timber).

- Entrepreneur’s relief can reduce the CGT on the land.

- There is also roll-over relief for the CGT, and hold-over relief when making a lifetime gift.

- Leasing the land and growing trees on it means no CGT.

- You don’t pay income tax (or corporation tax) on profits from forestry.

- Income from property revenue (country sports, lettings, renewable energy) is taxable.

I would describe these tax breaks as reasonably good, particularly if you have an aversion to AIM stocks.

Performance

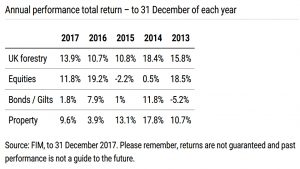

Intelligent Partnership (who used to produce reports on forestry – see below for some data from the most recent one) says that forestry returned 14% pa from 1987 to 2008, and 11% pa since 1972.

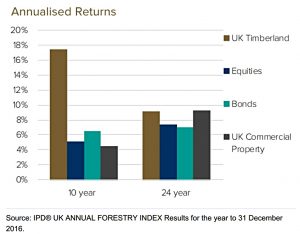

Dave Prosser wrote in MoneyWeek that the Investment Property Databank (IPD) UK Forestry index show returns of 11.6% pa over ten years and 9.2% pa over 25 years.

Wealth Club used data from the Investment Property Databank (IPD):

Regulation

Specialist forestry funds operate like private-equity (usually as limited partnerships).

- They are unregulated investments, which means that the FCA only allow their promotion to “high-net-worth” and sophisticated investors.

There’s also no ombudsman scheme or FSCS protection.

Fees

As with other specialist investments, fees are much higher than in the mainstream.

- A fund might have an initial fee of 2%, an annual fee (say 1%), an admin fee (another 1%) and a performance fee (say 20% above 5% pa).

Downsides

The main downside of forestry is illiquidity.

- As well as the normal transactional illiquidity of any property-style investment, you have the issue that trees only grow at one speed.

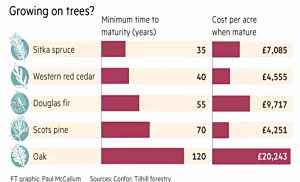

It takes at least 10 to 15 years for a crop of trees to mature, and sometimes 35 to 50 years.

- And if the timber price is depressed at the end of this cycle, the harvest might be deferred until better times.

Which makes forestry an investment better suited to (inter-generation) wealth preservation rather than growth or short-term safety.

- And limits a sensible allocation to perhaps 5% of net worth.

There’s also the problem of trade size.

- Most stocks and ETFs start at less than £10, and trades of £2K to £10K are common.

Most forests – even small ones and via pooled investments – will cost a lot more than that.

- Which means in turn that diversification – in this case, time diversification, via several investments at differing stages of maturity – is expensive to achieve.

A commercially viable forest is likely to cost at least £1M.

- This might get you 350 acres of 20-year-old Sitka spruce in Scotland or Wales, which would take another 20 years to mature.

Hobby/conservation plots are available for much less.

Each timber fund will set its own entry-level, often around £50K to £100K.

- There are also ETFs like WOOD (iShares Global Timber and Forestry) if you just want access to the asset class without any of the tax-breaks.

Risk mitigation

Here are a few things to look out for:

- Insurance against dead/damaged trees, which is difficult to come by.

- A clear chain of title to the land/lease ownership

- This will be easier to establish in the UK (many forestry investments are abroad)

- Forestry Stewardship Council (FSC) certification – green certification

- Carbon credit qualification – another green certificate (and potential revenue stream)

- An independent agent to protect investors’ interest (if buying from a product provider)

That’s it for today.

- I’ll be back with another article looking at the data from the publicly-available industry reports.

After that, we’ll look at how you might get invested.

- Until next time.