Weekly Roundup, 7th June 2021

We begin today’s Weekly Roundup with another look at crypto.

Contents

Crypto

The Economist argues that the boundary between crypto and fiat money is becoming permeable.

- And that crypto should probably no longer be considered a self-contained system.

Crypto, like gold, is built on a collective belief about its value. But so to an extent are all asset prices.

The newspaper refers to the work of Nobel-prizewinning economist/game theorist Thomas Schelling, who says that people can act tacitly in concert if situations throw up a “focal point”.

if asked to pick a positive number, people will offer a variety of responses—one, seven, 100 and so on; but if asked to choose a number that others will also select, there is a preponderant choice: the number one.

Similarly, the value of gold and bitcoin depends on enough people tacitly agreeing with that value.

Back to the link between crypto and everything else:

There is already a pathway linking crypto prices with gold. Flows into ETFs that invest in gold started to revive just as money was flowing out of bitcoin futures and ETFs. Viewed this way, the fall of bitcoin and the revival of gold are a relative-value trade within the broader set of inflation hedges.

There’s also the fact that as the size of the crypto market increases (it was $2.5 trn in mid-May), the crashes have more impact.

- We are down $1 trn from the peak.

The other crypto story was the banning of Luno’s ” If you’re seeing Bitcoin on the underground, it’s time to buy” ad by the Advertising Standards Authority (ASA).

- The same ad was also plastered on the side of London buses.

Disclosure: I opened a Luno account as they are one of the cheapest way to buy crypto in the UK (though I haven’t used the account as yet).

Apparently, there were just four complaints about the ad:

- Three of them said the ad was misleading and failed to illustrate the risk of the investment.

- One said the ad took advantage of consumer’s inexperience or credulity.

The ASA said the advert was misleading and left out “important” risk warnings.

- Luno has agreed that future ads would include a risk warning.

ASA rules say that investment ads must make it clear that the value of investments can go down (unless they are guaranteed).

- The lack of regulatory protection (in contrast to centrally insured bank accounts) should also be mentioned.

The ASA said:

We considered that consumers would interpret the statement ‘it’s time to buy’ as a call to action and that the simplicity of the statement gave the impression that bitcoin investment was straightforward and accessible.

We understood that Bitcoin investment was complex, volatile and could expose investors to losses. That stood in contrast to the ad. The audience it addressed, the

general public, were likely to be inexperienced in their understanding of cryptocurrencies.We concluded that the ad irresponsibly suggested that engaging in bitcoin investment through Luno was straightforward and easy.

Back in March, the ASA banned a press ad for Coinfloor that said “there is no point in keeping your money in the bank” and described Bitcoin as “digital gold”.

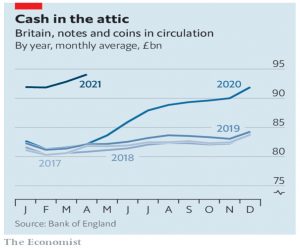

Cash

The Economist noted that the pandemic has surprisingly led to an increase in the amount of cash in use in the UK, from an already high base:

The rise of internet shopping and contactless payment cards pushed the share of transactions involving physical money down from over two-thirds in the early 2000s to under a quarter by 2019. Yet over the same period, the value of banknotes in circulation rose from just over 2% of GDP to over 3%.

Low inflation makes keeping savings in note form (under the mattress?) more attractive, if still somewhat misguided.

Demand for cash as a medium of exchange has fallen but demand for physical money as a store of value has more than compensated. And over the past 15 months, even as many pubs and retailers have insisted on cashless payment, the amount of money in circulation has risen even further.

According to Link, a lot of cash was withdrawn just before the first lockdown, which makes sense – money was stockpiled alongside pasta and toilet paper.

- After that, withdrawals fell sharply, but the amount of cash leaving circulation fell even more quickly.

Treasury officials suspect that much of the rise has been caused by growth in the undeclared cash-in-hand economy since the early months of 2020. Four million Britons are still furloughed from their jobs; some of them are no doubt looking to top up their incomes.

For these people, cash is still king.

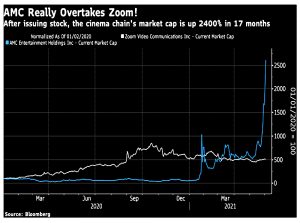

AMC

John Authers looked at the AMC sideshow.

- AMC rocketed last week, overtaking Zooms performance since the start of 2020.

If you add in the extra shares that AMC has issued, the market cap situation looks even more dramatic:

Zoom is up 400% and AMC 2400%, more even than the previous meme stocks of 2021 (GameStop).

- At the moment, the Redditors are in profit, but there is much less of a short squeeze here than with GameStop (only 19% of AMC’s shares are sold short).

But that doesn’t make AMC a good company – it remains just a good story.

For the new army of investors, who call themselves “apes,” this is like Planet of the Apes, or Robin Hood. This is a mission to stick it to Wall Street and the hedgies, and to reverse inequality by redistributing money from rich to poor.

John is not convinced.

The huge paper gains can only be made real by selling the shares — which will require someone to buy them. The likelihood is that the AMC saga will end by making a bunch of poor people even poorer, having paid fees and commissions to some rich people along the way.

He also notes that the AMC saga is much less of a general market phenomenon than was the GameStop episode.

- Most people aren’t interested this time around – the S&P isn’t crashing, and bitcoin is range trading some 40% below its high.

I agree with John, though I remain impressed by the ability of Reddit to organise a bunch of people who don’t really know what they are doing into a force that can move the market so significantly.

Viagers

We’ve looked previously at tontines, the French investment scheme also known as a death pool.

- Members pool money and receive dividends from a certain age.

- As members die, the dividends are divided amongst fewer people, and so survivors get more.

This is a form of longevity insurance with the unfortunate side-effect of providing an incentive for members to kill each other (hence they have been illegal in the UK since 1774.

(( In practice, the biggest problem was fraud – parents would give new children the name of an older, dead sibling in order to keep the dividends in the family ))

- I think they’re due for a comeback now that big data and forensics make getting away with murder quite difficult.

Tontines 2.0 could also use crowdfunding and blockchain anonymity, but there’s been no sign of a revival to date.

This week the Economist looked at a revival of a similar French financial scheme, the viager.

In sales of property en viager a buyer pays upfront for a residence while getting the keys only when the current owner dies. Typically the seller gets cash for around a third of the value of the home at the time of the sale.

Monthly payments from the buyer should add up to something nearer the full value of the property—assuming the seller dies at the time suggested by actuarial tables.

The most famous example was that of Jeanne Calment, who sold her house in 1965 (at the age of 90) to a 47-year-old lawyer.

- He died 30 years later without moving in, but his widow had to keep up the payments to Jeanne, who lived to be the world’s oldest human and died aged 122.

The estimated 5,000 viager deals signed in France every year represent less than 1% of all property sales.

As with tontines, there are similar concerns about incentives:

Some buyers have been suspected of hurrying nature along.

Our rules on money and death are strange: life insurance and annuities are (or were, in the case of annuities) mainstream products.

- But on this side of the channel, we are too squeamish for tontines and viagers.

Quick Links

I have five for you this week, all from The Economist:

- The newspaper warned that someone has to pay the bill for empty offices

- And looked at what a work from home revolution means for commercial property

- The Economist also said that OPEC’s discipline would be tested as oil demand picks up

- And explained how to be the next Tesla

- And wondered whether corporate Europe can ever recover.

Until next time.