A Better Commodities Portfolio – AQR

Today’s post looks at a paper from AQR on how to build a better commodities portfolio.

Contents

The old approach

We’ve covered elsewhere how useful commodities can be as a defence against inflation.

AQR begin by noting the shortfalls of the old passive index-tracking approach to commodities:

Unfavorable contract roll costs, a lack of sector diversification, and missed active opportunities.

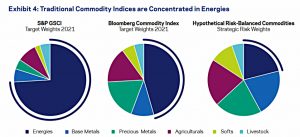

The indices are based on production quantities and market liquidity, so sectors like energy dominate.

Commodity sectors have shown low correlations to one another, so a portfolio that balances risk across sectors can better diversify idiosyncratic risks and therefore deliver higher risk-adjusted returns.

This paper, from 2Q22, looks at three potential enhancements:

Better risk balance across sectors, dynamic risk management through time, and active tilts based on intuitive strategies that have been well-compensated historically.

Benefits of commodities

AQR explain a commodities risk premium like this:

Commodity producers tend to have concentrated businesses, reliant on only one or two crops, metals, or other products. To mitigate their risk, they hedge by selling commodity futures, creating a premium for investors who go long. Hedgers are willing to pay an insurance premium to stabilize future revenues.

There is also positive sensitivity to economic growth.

- Against this must be set productivity gains/lower costs of production over time.

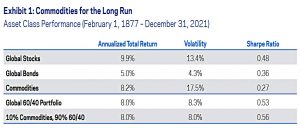

Over the very long-term (looking back to 1877), commodities have lower returns and risk-adjusted returns (Sharpe Ratio) than stocks.

- But because the correlation between commodities and stocks (and commodities and bonds) is low, adding 10% of commodities to the 60/40 portfolio reduces the volatility of its returns and improves its Sharpe.

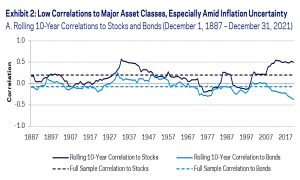

The paper notes that the diversification benefits increase during periods of heightened inflation sensitivity:

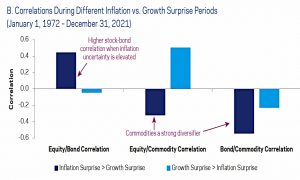

Returns from commodities are also higher under inflation:

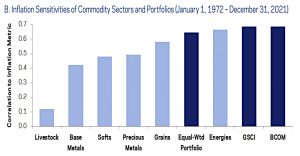

While inflation sensitivity varied across sectors, it was positive for all of them, and broad portfolios (whether equal- or production-weighted), by diversifying idiosyncratic risks, had sensitivities as high as the highest individual sector.

A better commodities portfolio

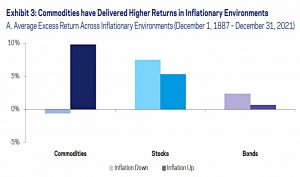

Passive commodity portfolio trackers (such as ETFs) are cheap, but they are concentrated in energies and they don’t use dynamic management of asset exposures to target a constant level of volatility. (( This volatility targeting is similar to the risk parity approach in regular portfolio construction ))

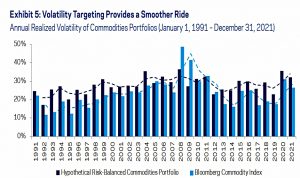

Spikes in risk historically exhibited by commodities can be managed by targeting a pre-specified level of volatility.

The realized volatility of the risk-managed portfolio stays much closer to its target, whereas the volatility of the Bloomberg Commodity Index spikes to much higher levels, especially during bear markets. A dynamically managed portfolio may experience a smoother ride and realize less severe negative tail events.

The dynamic approach will have higher trading costs and will involve greater use of less liquid contracts.

- It will also necessarily have a significant tracking error to passive indices and will underperform them at times.

This is not an issue where commodities are simply one sub-group within a larger portfolio (perhaps using a core and satellite approach).

- Few private investors will allocate more than 10% to commodities.

Active management

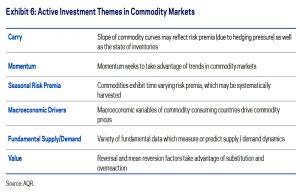

AQR recommend active commodities management, based on fundamentals, trend and carry.

- Here, positive carry means that the futures price is below the spot price (and will move towards it as the future expires).

They also have tips on contract selection and roll management.

Unfortunately, commodities fundamentals are complicated, and staying on top of them takes time.

Every commodity has its own unique supply and demand characteristics. High or rising inventories may indicate excess supply, and lead to falling prices, whereas falling inventories may indicate strengthening demand.

There is also seasonality to think about:

Agricultural commodities with a dominant growing season have a large supply entering the market during northern hemisphere harvest seasons, which tends to lower futures prices and increase hedging demands for those months. The winter surge in demand for natural gas and heating oil has the opposite effect.

And macroeconomics:

Since Asia accounts for nearly 60% of global copper consumption, but only 32% of global crude oil consumption, copper is likely to benefit more than oil from strong Asian growth.

There are also relationships between commodities:

There is a fundamental relationship between the prices of crude oil, heating oil, and gasoline, known as the “crack spread”. If the spread narrows too much, refineries will slow production and schedule maintenance in order to protect profit margins.

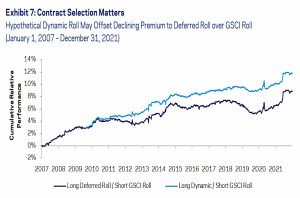

Contract selection

A passive commodity portfolio is usually active since futures contracts need to be “rolled”.

- This just means selling the contract about to expire and then buying one further out in time.

Standard commodity indices roll on a fixed schedule, and are vulnerable to traders who position themselves ahead of this predictable flow – buying the longer contracts ahead of time and selling them to passive index holders at a higher price.

AQR recommend a more sophisticated approach to deal with this:

Using return and cost forecasts to dynamically manage the process has conferred a more sustainable advantage.

Conclusions

AQR recommend five improvements to the old style of commodity portfolio:

- Risk balancing across commodity sectors

- Targeting constant volatility

- Using trend and carry to dynamically change weightings

- Trading on fundamentals

- Using return forecasts to improve roll management

These become increasingly difficult for private investors to implement as we move down the list.

- Most PIs will only attempt the first three items, but even these should produce worthwhile improvements.

Until next time.