Mintus – Fractional Investing in Art

Today’s post looks at Mintus, a fractional art service that is a UK rival to the Masterworks platform we looked at last year.

Mintus

Mintus launched a few months ago, but I only heard about it this month (( Hat tip to Adventurous Investor David Stevenson, who was told about Mintus when he recently reviewed Masterworks, as we did last year ))

- Their slogan is “Own The Unownable”, which makes no sense to me – I guess they mean “own a fraction of something that you can’t afford to own in its entirety”.

I won’t run through the general argument for investing in art – which we’ve covered several times before – in any detail, but it boils down to decent returns that are somewhat uncorrelated with stocks.

As with Masterworks, Mintus buys artwork and turns each piece into a company, in which investors are allowed to buy shares.

Mintus is run by Tamer Ozmen, a former Microsoft executive, but there are people from galleries and auction houses on the board as well. Ozmen says:

Not many people can buy a £2mn work outright or know where to invest [in the art market]. The world has changed. The idea fits with the younger generation, and collectors in Asia, who are very comfortable with online bidding, for example.

Nicky Clark, previously as Sotheby’s says:

Fractional ownership of art is opening up the industry by allowing investors to own a piece of the art market. Over recent years we’ve seen investors increasingly seek alternative investment strategies to generate risk adjusted returns. We’re excited to provide them with a new way to access a passion-fuelled asset class.

The original plan was to offer £150M of art during 2022, but it looks like they will fall well short of that.

The process

There are three steps to the investment process (which Mintus present as four):

- Sign up as a sophisticated or high-net-worth investor

- This requires ID

- Choose an available painting and buy some shares in it

- The minimum per artwork is $3K

- Sell, which seems to be at Mintus’ choosing, so there are liquidity issues here

- The sale may be private or public (by auction) and is intended to take place two to seven years after the purchase

- There’s also a secondary internal market which operates once a year

The website is cagey about when the art is actually purchased, but I get the impression that if enough funds are not raised, the purchase might not take place.

- So Mintus appears to first buy an option to buy, presumably within a fixed timescale.

All artwork offered by Mintus is stored in climate-controlled, specialist art storage facilities, under a Mintus account. Current paintings are held in a facility in Delaware.

Mintus is authorised and regulated by the FCA.

Costs

There’s no upfront or management cost, and Mintus aims to keep acquisition costs low by buying privately rather than through auctions.

- When an artwork is sold, Mintus takes a 1% fee from the overall price and 20% of any profits.

What’s available?

Our Fine Art Team marries their own expertise with insights from fellow industry experts to identify one-of-a-kind investment opportunities from established artists with high-growth potential.

Our team examines metrics such as the artist’s market track record, recent price velocity and momentum, and the size of their international collector base when making investment decisions.

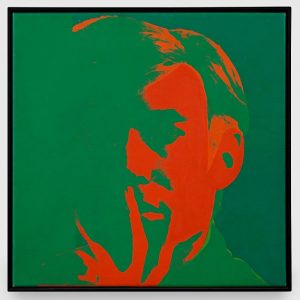

The website only trails two artists at the moment – the very famous Andy Warhol and the less famous George Condo (who appears to be a pal of Jean-Michel Basquiat and Keith Haring).

- I imagine Mintus has only one each of their paintings available for investment, but you can only “view the opportunity” once you have signed up as a high net worth / sophisticated investor.

A review of Mintus in the FT tells me that the Condo painting on offer is The Outcast, which only dates back to 2018, and is selling for £2.1M.

The Warhol is a self-portrait from 1966 selling for £3.8M.

Brett Gorvy, Mintus Chief Curator, says:

Andy Warhol and George Condo are among the most desirable and sought-after contemporary artists to collect today. Their markets are very international and both artists are currently experiencing new popular heights as a result of major museum retrospectives and record prices achieved at auction.

Conclusions

Mintus looks very like Masterworks. It had the advantage (for me) of being UK-based, and the disadvantage of being at a much earlier stage in its development.

It’s good to see a rival to Masterworks appear, but this asset class (fractional art) will need a few more years to prove itself.

- Until next time.