Weekly Roundup, 31st July 2018

We begin today’s Weekly Roundup in the FT with the Chart That Tells A Story. This week it was about the pound / dollar exchange rate.

Contents

Cable

Michael Hunter (( I couldn’t find a picture )) looked at how the sterling / dollar exchange rate has tracked the progress of the Brexit negotiations.

- After the referendum result, the pound fell from close to $1.50 to $1.30 and then down towards $1.20.

When a deal looks likely, sterling drifts up towards $1.40.

- When things are bad (as they are now), we head back down towards $1.30.

Of course, the dollar is doing well of its own accord, both because of the tax cuts, interest rate rises and generally booming US economy, but also because of the dollar’s safe haven characteristics.

Another monthly interest rate decision is due from the Bank of England this week, and there’s a good chance that rates will go up to 0.75%.

- If they do, they will be ignoring both undershooting inflation and the lack of a Brexit deal.

Michael recommends a summer holiday in Turkey, a country whose currency is even weaker than our own right now.

Pensions tax relief

Kate Beioley reported on the recommendations from the Treasury select committee’s annual review of household finances.

- The ones making the headlines were all about pensions tax relief.

The committee wants to see a lower annual allowance and flat tax relief, and they would also scrap the LISA.

- I think there is scope to reduce the annual allowance somewhat, since it is more than adequate to crash into the lifetime allowance of £1M.

- But perhaps a better idea would be to increase the LTA, which is now too low at £1.03M – or scrap it.

- Flat tax relief is also difficult to oppose, so long as the new rate is higher than the 20% relief (equivalent to the 25% government bonus in the LISA).

- There is a technical problem with tax relief at lower than marginal rates, in that offsetting income tax becomes cash flow negative.

- But that isn’t the Treasury’s objective in offering the tax relief, and if the annual allowance is reduced much further, then the point will become moot anyway.

- I’ll be glad to see the back of the LISA since it is ageist, and interferes with the proper working of our existing savings shelters (SIPPs and ISAs).

- We only need on EET pot (SIPP) and one TEE pot (ISA) to cover all the bases.

- The LISA was obviously designed – like Help-to-Buy – to prop up the housing market, and I can’t see the argument for privileging one form of consumption over another.

That said, the committee has no power to set policy.

- The chances of these changes making it into statute depend on (1) the Tories clinging to power and (2) current distractions (Brexit, leadership) receding into the background.

Trump

In their regular columns, Ken Fisher, John Redwood and John Authers all talked about Trump.

Unsurprisingly, Ken thought that Trump’s rhetoric was bullish for markets.

- He thinks it’s all bluster, and can’t derail a bull market.

Proposed tariffs from both sides are a maximum of 25% on £105 bn of trade – so £25 bn in tariffs.

- That’s 0.04% of global GDP.

Even if new proposed tariffs materialised, the maximum payments would by £80 bn, which is 3% of this years growth in GDP (£2.4 trn).

- Ken also expects a lot of tariffs to be dodged though the use of substitutes and shipping through third parties and other countries.

- International brokers can be used for many commodities, for a 1% fee.

Ken thinks its all about foreign policy, not trade.

- Trump wants China to cooperate on North Korea, and later on Iran.

In contrast, John Redwood is worried.

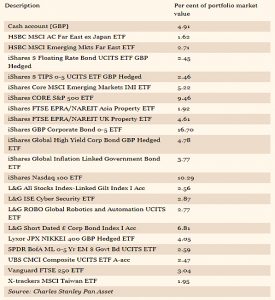

- His FT fund is 47% in cash and short-term bonds, and he has been avoiding China and Germany.

He’s doing something right, however, as the fund is still up 1.5% during 2018.

John does see the potential for beneficial effects (eg. more transparency from China), but he’s less certain they will be delivered than is Ken.

- Apart from China, other areas to watch include Trump’s relationship with Russia, and the actions of the new Italian government.

John Authers focused on the rapid growth of the US economy in the wake of Trump’s tax cuts.

- Annual growth was 4.1% real after 3% estimated inflation – that’s more than 7% nominal.

Corporate profits are up more than 20% on last year.

- And QT continues, without spiking bond yields or spooking stock markets (despite a crash in Facebook).

John worries about a trade war, but accepts that the consequences are too difficult to predict.

- He sees the resolution of the trade dispute between the US and China as the most important issue for the rest of 2018.

Sin taxes

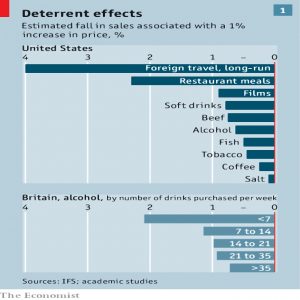

The Economist looked at sin taxes – on alcohol, tobacco and now sugar and sometimes salt.

- They are less efficient than we would like, but since people are irrational and cannot control their own behaviour, the taxes do improve public health.

The taxes change behaviour, but they are blunt instruments.

- They tax moderate users as much as addicts, and they affect addicts less.

A better (though more complicated) approach might be heavier levies on the products that the addicts like (spirits, strong lagers etc).

- Others have suggested taxing BMI rather than sugar, though any weightlifter will tell you that BMI is a poor measure.

Taxes also affect poor people more than rich ones, since they can less afford the tax.

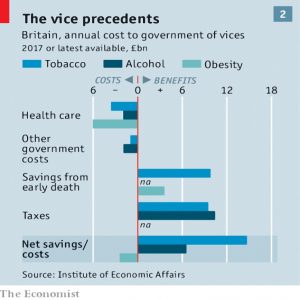

Beyond curbing the behaviour, the secondary purpose of the taxes is to counteract negative externalities – the cost borne by the rest of society for the consequences of the behaviour.

- Unhealthy people cost more to look after.

- But they do helpfully die earlier, so they don’t collect as much pension.

On this score, tobacco and alcohol are already in profit, but there is some way to go on obesity.

Rebalancing

Buttonwood looked at rebalancing.

- While index trackers have made diversification easy, they haven’t solved the problem of asset allocation.

The article recommends a 60:40 stocks / bonds portfolio because it is easy to stick to.

- It says that rebalancing back to your target is more important than the allocation you initially choose.

This is too simplistic.

- It’s true that rebalancing works as an automatic “buy low sell high” strategy.

- In this sense it’s similar to a multi-asset trend following system (MATS).

But there are lots of better asset allocations than 60:40 stocks bonds, which ignores other asset classes and issues of geography.

Three other considerations are:

- Your goals, risk profile and other assets outside your main portfolio.

- Whether you are in accumulation or decumulation.

- You’ll need a higher stock allocation than 60% (or a very low SWR) if you are planning a long retirement.

- Valuations, and in particular equity valuations.

- You’ll need some kind of dynamic allocation / rising glide path to cope with stock valuations that are high at the start.

Yield curve

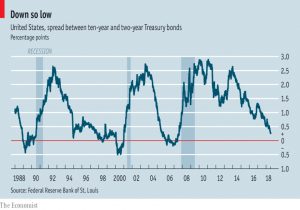

The Economist also looked why bond yields reliably predict recessions.

- The phenomenon is known as the inverted yield curve, but really it’s just a negative spread between the 10 year and two year yields (for the US – sometimes shorter “short” bonds are used elsewhere).

Inverted just means that long bonds (which are riskier, and should therefore yield more) offer less return than short bonds.

Short-term bonds are driven by central bank lending rates.

- Long bonds should reflect the average short rate over their lifetime, plus a premium for the risk of making a loan over an extended period.

There are several reasons why an inversion might occur:

- Future short-term rates are expected to be lower, in response to a weak economy.

- Less premium is needed to hold long bonds, either because inflation will be low or because long bonds are a safe haven in times of trouble.

The point at which the central bank is about to switch from tightening (raising rates) to easing (cutting) is the most likely.

It ought to be the case that the inversion acts as a warning signal to central banks, so that they can take evasive action.

- There is some evidence that the signal has become weaker since 2000.

- But Fed chairmen have a habit of publicly ignoring the signal.

The good news is that as the chart shows, the inversion gives the rest of us about two years to prepare.

Gentrification

Following on from last week’s defence of gentrification, I dug out an Economist article from last month which says the same thing.

- Studies show that existing poor residents usually stay put, and are rewarded with lower crime and better amenities.

- If they own property, they also get richer.

And even if they decide to leave, so what – the area has still improved.

Deposit loans

This week’s bonkers lefty idea is reported as usual, by the Guardian.

- The Housing and Finance Initiative (HFI – a think tank that I haven’t come across previously) has suggested that the state should provide loans to first time buyers for their house deposit.

The idea is that – like student loans – the deposit loan should be repaid by a tax on salary once that crosses a threshold.

Let’s look at some of the problems here:

- The student loan system is very unpopular with its “victims”.

- The people are already paying 20% income tax, 12% NIC and 9% student loans – a total of 41%.

- There’s not much scope to add another repayment on top of their mortgage.

- The student loan pays for something that might reasonably be expected to make repayment easier – an education, which should lead to an higher salary.

- In contrast, the deposit loan will convert a 90% borrower in to a 100% borrower, making them significantly more likely to default.

- As I mentioned in the discussion of the LISA above, it’s hard to justify offering support for one form of consumption over another.

Us Brits really do seem to have a hang-up with property.

Quick links

I have six for you this week, the first three of which are from FT advisor:

- PensionBee (of whom I am a fan) have increased their assets by a factor of five.

- The rush to exit pensions can impact values for those who remain behind.

- The FCA cound force banks to pay a minimum savings rate.

- UK Business Insider found that you can get rich by working for someone else.

- The Adventurous Investor says worse is to come for infrastructure and utilities.

- And Alpha Architect had some factor investing insights.

Until next time.