Wealth in Retirement – no sign of Lambos

Today’s post is about a recent report from the Institute for Fiscal Studies, on the the use of Wealth in Retirement.

Wealth in Retirement

When George Osborne relaxed the rules around pensioners accessing their pots in 2015, the main worry was of them spending the money too quickly, perhaps in part on a Lamborghini.

- This report from the Institute for Fiscal Studies (IFS) suggests the opposite – they aren’t likely to spend the money fast enough (for some observers, at least).

The study looked at pensioners’ wealth from 2002 to 2015 (ie. before the “pension freedoms” were introduced).

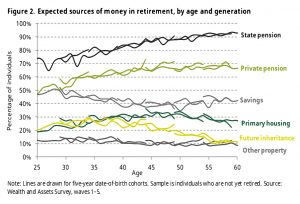

It seems that most people aim to live on their pensions (state, and in some cases, private) and try to avoid both using their savings / financial assets and selling their home or downsizing to unlock their house equity.

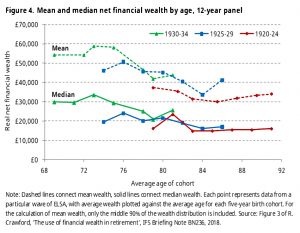

Financial wealth is drawn down at just over 1% pa on average.

- Just 31% of net financial wealth has been spent between the ages of 70 and 90.

- Only 17% is consumed between the ages of 70 and 80.

Wealthier pensioners drawdown at a slightly higher rate, but not quickly enough to exhaust their larger pots.

Housing

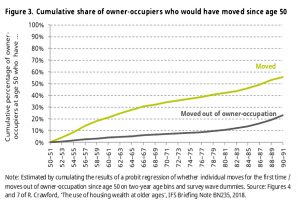

Around 80% of over-50s are homeowners.

- The average housing wealth of those aged 55 to 64 is £185K.

But less than half of them move house after the age of 50 (around 30 years on average).

- And most moves are not financially motivated – people move to better areas or to find better homes, or to be closer to friends and / or family.

Not surprisingly, divorced, separated and widowed people are more likely to downsize than those who remain married.

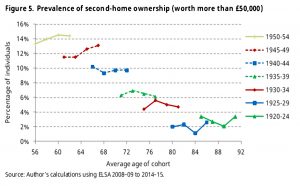

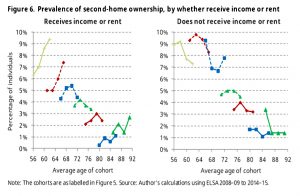

Even most second homes – one in six of those aged between 55 and 64 has a second home – will not be sold during retirement.

Financial wealth

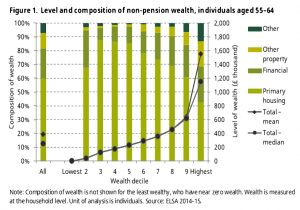

Those aged between 55 and 64 have an average of £80K (median £33K) in financial assets (cash and shares).

- Business assets, land and antiques took the total average wealth of those in that age group to £390K (excluding pensions).

- Median wealth was £250K.

Most pensioners will hang on to the money until their 80s, if the behaviour of previous cohorts is anything to go by.

Why?

The two main reasons for holding on to money are held to be:

- Wanting to leave an inheritance.

- Needing to pay for end-of-life social care.

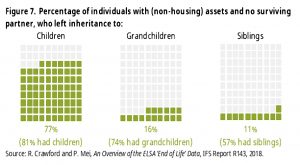

Inheritances from couples go first to the surviving spouse, and then largely to children.

- With so much wealth held in owner-occupied housing, this is not a surprise.

The second point is a bit of a red herring, since the state will fund social care if you don’t have any money.

- It’s also very inefficient, since only a minority pay significant amounts towards social care.

The study found that just 6% of individuals paid for medical treatment, and 7% paid for home care assistance.

- 21% stayed in a residential care home, but only 7% were there for more than six months.

- It’s not clear what proportion of these were paying for the care personally.

Impacts

In one sense, the impact of (non-)spending behaviour in retirement is that pensioners don’t enjoy the standard of living that they might.

- But in some senses, that is almost inevitable.

Those who have been savers throughout their working life – and many of those in the study would have lived through the Depression, a world war and rationing – are unlikely to suddenly switch to being spenders once they are in retirement.

- And as I wrote in a recent Weekly Roundup, dying with nothing left in the bank is a laudable aim.

- But in practice it’s difficult to achieve when you don’t know the date of your death.

The key wider impact is the locking up of the housing market, which could be alleviated in part by cutting stamp duty.

The second impact is an increase in wealth inequality, since inheritances are very unevenly distributed.

- More than 40% of estates are shared by three or more people, which implies that wealth is being spread around.

But increased life expectancy means than many bequests are left to people in their 60s, who have already had to self-fund most of their working life.

- Those who inherit tend to be wealthier than average already, so in practice inheritance doesn’t help the distribution of wealth.

Trends

The move away from DB pensions to DC pensions means that an increasing proportion of wealth in retirement will be held in forms which people seem unwilling to spend.

- But of course, the lack of DB pension income will put more pressure on future pensioners to deviate from the behaviour we have seen in the past.

Conclusions

I’m a bit puzzled by this report, and by the media reaction to it.

As the pension freedoms were introduced in the year that I turned 55, I was always sceptical that those with large pots would quickly blow them.

- So the headline finding that people spend slowly in retirement is not surprising.

It is slightly more surprising that so few people move house after the age of 50, and that so few second homes are sold.

- But if you accept that most people want to leave behind an inheritance, it’s not a great shock.

Further, since the data in the report comes from before the freedoms existed, and focuses on housing and non-pension wealth rather than (DC) pensions, it takes quite a leap of faith to infer that succeeding cohorts will show the same behaviour under a new regulatory regime.

The final point is that if pensioners choose not to spend their money so that they can leave a bequest, so what?

- It’s their money, and they are free to do whatever they want with it.

Even if what they want to do with it is nothing.

Until next time.