Hamptons on Buy to Let 2023

Today’s post looks at a recent report from the property agency Hamptons on the state of the UK buy-to-let market.

Contents

Higher interest rates

We recently looked at Hamptons 2021 report on but-to-let (BTL), which focused on the impact pf Covid and whether slowing house price rises meant that the door has been closed on BTL (it had, for me at least).

- At the time that report was written, we still had low inflation and low interest rates.

Now we don’t, and the title of the 2023 report is “Re-Writing The Rules: Have higher interest rates broken BTL”?

- Let’s find out.

The BTL mortgage was introduced in 1996 and is the driver of the explosive growth in the market.

- 66% of landlords have a mortgage, which means that rising interest rates have a significant impact.

Unfavourable tax changes in recent years have meant that more homes have been sold than bought by landlords since 2017.

- So will higher interest rates accelerate this trend?

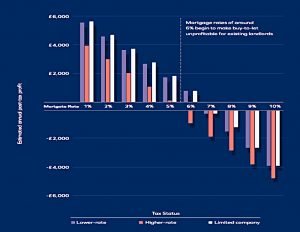

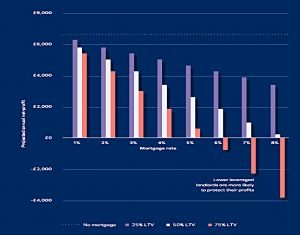

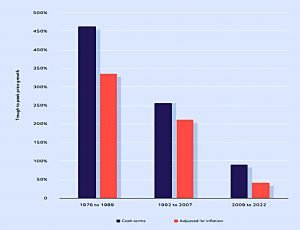

The chart shows net profits on a £200K property with a 60% LTV, and the national average gross yield of 6% pa.

- Higher-rate taxpayers have no profit when mortgage rates hit 5%, whereas lower-rate taxpayers are still profitable with mortgages at 6%.

- So are limited companies.

My own target for an investment is a minimum 3% return plus long-term inflation – say 5% in total.

- With a 200K property and 120K mortgage, my target on the £80K of capital tied up in this rental would be £4K.

So a higher-rate tax-payer needs mortgage rates to be down at 1%!

- If you invest through a limited company, you can tolerate mortgage rates of a massive 2.5%.

Yield on cost

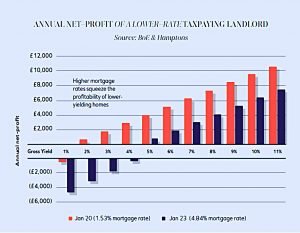

The next section of the report uses the misleading measure “yield on cost” (also a favourite of dividend investors) to argue that things aren’t as bad as they seem.

- As inflation drives up rents over time, the yield on the price originally paid for the property increases.

But this has nothing to do with the true yield on the capital tied up in the property.

- Either the value of the property has also increased, and so has your equity – which would tend to mean that the actual yield has fallen – or it hasn’t, in which case inflation has eroded your capital.

There’s no way around the triple-whammy impact of slowing capital growth, unfavourable tax changes and much higher interest rates on net profits.

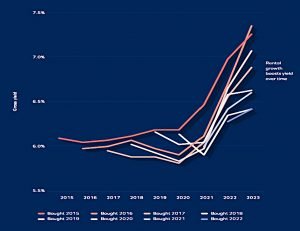

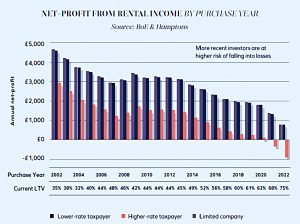

The upward drift in equity from rising capital values does mean that the purchase year has an impact on the risk of falling into losses:

Younger investors who maximised their borrowing to purchase a buy-to-let more recently who are at considerably higher risk of falling into losses due to rising mortgage rates. Older landlords, especially those who haven’t released equity, will be less affected.

This chart shows the effect of leverage on profits (for lower-rate tax-paying landlords).

Market segments

The average BTL investor is aged 59, with only 15% of landlords under 45.

The report looked at data from the Skipton Building Society which suggests that the average re-mortgaging landlord in 2022 had an average LTV of 55% (which means they are not particularly likely to fall into losses.

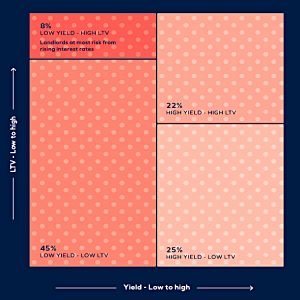

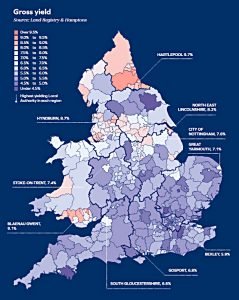

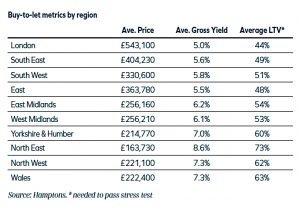

Hamptons segment the market into four:

- low-yield and low LTV (gross yield below 5% and LTV below 60%)

- This segment is the largest at 45% of all rentals, and 40% of landlords have no mortgage debt at all

- These landlords will have low returns, but they won’t go negative.

- high-yield, low debt (25% of the market)

- These guys are mostly in the Midlands and the North and have the least to fear from higher interest rates.

- high-yield, high debt (22% of the market)

- These landlords have been extracting equity, presumably to grow their portfolios.

- The most likely impact of higher interest rates will be an end to their expansion plans, and possibly a sale or two.

- low-yield, high debt (8% of the market, or 450K homes)

- This group is the most vulnerable to higher interest rates.

These tend to be those who bought relatively recently (predominantly within the last five years) and are disproportionately based in the south of the country where yields are lower. As their larger mortgages reach the end of their fixed-term, landlords will face paying down some debt and hiking rents as far as they can or, ultimately, selling.

Pay down or re-invest?

The next section looks at whether landlords should continue to extract equity from their existing portfolios in order to invest in new properties.

- With rising interest rates, should they pay down debt instead?

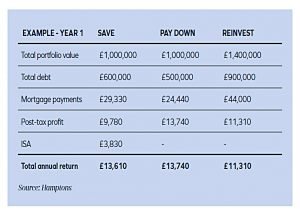

There are actually three options for the hypothetical landlord with a £1M portfolio at a 60% LTV who has £100K of cash in the bank:

- Leave things as they are (but re-mortgage at current rates as their deal has expired)

- Reduce the LTV to 50%

- Purchase another property (say a £400K property at 75% LTV)

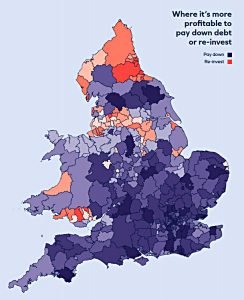

Generally, investors in lower yielding parts of the country will be better off paying down their debt. However, in higher yielding areas, investors can still profit from growing their portfolios.

So far so obvious – when you borrow money, you need to invest in something with a higher rate of return than the interest you are paying in order to come out ahead.

There are 67 out of 330 local authorities in England and Wales where the average investor could make bigger returns by using their savings to fund a 25% deposit on an additional buy-to-let, rather than paying down debt on their existing mortgage. 69% of these areas are in the North of England.

The next generation

The next section looks at what new BTL investors need to do.

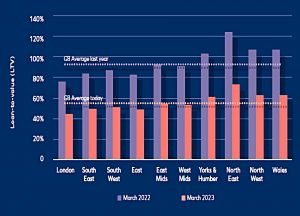

Affordability for a buy-to-let mortgage is usually assessed by looking at the interest coverage ratio (ICR) – the ratio of gross rental income to mortgage interest payments.

This ratio is typically set at 125% for a lower-rate taxpayer, rising to 145% for a higher-rat taxpayer because of the Section 24 tax changes.

- But the stress test also includes adding another 1% or 2% to the prevailing interest rate.

When the report was written, 2-year fix BTL rates were at 4.8% (they have risen since then), meaning the stress test would be at 6.8%.

- With the average UK yield at 6%, this is a problem.

So new investors need larger deposits – an average of 46% (56% in London) with rates at 4.8%.

- In the North East, at 73% LTV is still viable.

Last year, when rates were lower, the average investor would theoretically have passed stress testing at an LTV of 93%.

The average higher-rate taxpaying investor will now need to earn a gross yield in excess of 7% in order to make even a small profit in year one. Lower-rate taxpayers have more wiggle room and only need a yield greater than 5%, which opens up more locations across the country.

Limited company investors have more profitable options up North.

Profits

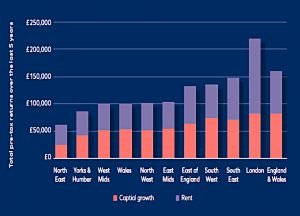

Using 2022 at the top of the price cycle, it’s clear that returns across the cycle have been much lower than previous cycles, despite falling interest rates.

The average landlord who sold in England and Wales last year having bought five years ago sold their buy-to-let for £81,310, or 31%, more than they originally paid for it.

Total returns (after mortgage, maintenance and tax) were £106K – 49% of which came from rental growth and 51% from capital growth.

This equates to an annual net yield of 7.8%.

Which is pretty decent, but not stellar for the amount of work involved.

- Hamptons say that longer-term holders have done better – but it’s not likely that the same returns will be available in the future.

Energy ratings

The government plans to require rented homes to have an EPC rating of at least C from 2025.

A record 58% of EPCs carried out in all privately rented homes in 2022 were rated A-C, up from 32% five years ago.

New builds are more expensive than older homes (but they rent for around 15% more).

- More importantly, 96% of new builds have a rating of C or above, so they may become more popular.

The Home Builders Federation (HBF) estimates it would cost over £70k to upgrade an older three-bed semi-detached home with all the features of a new build.

Perhaps a bit of talking their book there, but I’m sure the upgrades are not cheap.

The future

The final section of the report includes a SWOT analysis for BTL:

- Demand is good and rents should hold up

- Barriers to entry for new landlords are getting higher

- Section 21 reform will make evictions harder

- Higher interest rates mean lower leverage which means lower returns

- Weaker forecast house price growth means lower capital returns

- Rent controls could be introduced by a Labour government

Mortgage rates are unlikely to return to 2% (4% is more likely by the end of 2024) and a growing proportion of future BTL returns will come from rents rather than capital growth (as has been the case in the North for some time).

- Hamptons expect rents to rise in the South, and the yield gap with the North to close.

I find that hard to see.

- An £800K flat near me renting at £25K pa yields just over 3%.

- To get to the national average 6% yield, the rent needs to pass £50K pa.

Building a portfolio will also become more difficult, as there will be less capital growth to extract and re-invest.

That’s it for today.

- As with the 2021 report, it’s been an interesting read for the interested bystander.

But the attractions of BTL to investors continue to elude me.

- Until next time.