Irregular Roundup, 21st August 2023

We begin today’s Weekly Roundup with the US rating downgrade.

Contents

US rating downgrade

Rating agency Fitch unexpectedly lowered the US credit rating to AA+ from AAA.

- The US rating remains higher than the UK’s, which is AA-.

The US has seen tax cuts, helicopter money, infrastructure spending and higher interest payments from rising rates push its annual budget deficit higher.

- US debt is set to hit 118% of GDP by 2025, which is triple the average for AAA-rated countries.

We also had the debt ceiling standoff earlier this year and the continuing risk of a recession in the near future.

- But the dollar remains the global reserve currency, and Treasuries are the safe haven asset in times of trouble.

When S&P delivered the last downgrade back in 2011, there were few long-term impacts.

Fitch said:

The rating downgrade of the United States reflects the expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance relative to AA and AAA rated peers.

Treasury Secretary Janet Yellen was not convinced:

Fitch’s decision does not change what Americans, investors, and people all around the world already know: that Treasury securities remain the world’s preeminent safe and liquid asset, and that the American economy is fundamentally strong.

The bond market didn’t like it, with 10-year US yields shooting up above 4%, and the VIX “fear index” popped by 10%.

- But Macro Alf pointed out that the downgrade means nothing to the US government, which issues its own money.

It also means nothing to commercial banks.

Commercial banks are huge buyers of Treasuries: they use them as regulatory liquid assets (HQLA), as collateral and also sometimes as an asset to hedge interest rate risk on their liabilities. The Basel regulatory framework introduced 10 years ago has

0% capital requirements for government bonds rated between AAA and AA-.Most banks actually choose an internal-rating based (IRB) approach based on internal models and in that case most jurisdictions apply an exception for any investment-grade rated domestic government bond which automatically assigns them a 0% risk weight.

The same is true for pension funds, insurance companies and FX reserve managers.

The Basel rules for using bonds as collateral also don’t distinguish between AAA and AA-

- Some funds will have stricter criteria, but the Fitch downgrade shouldn’t have much impact.

So Alf looked at swap spreads.

Swap spreads are the differential between swap rates and Treasury yields. OIS swap yields measure the market-implied return you can make by safely depositing money at the Fed, and hence if Treasury yields rapidly deviate from that it could be because of collateral quality considerations.

And swap spreads showed no reaction.

UK rate hike

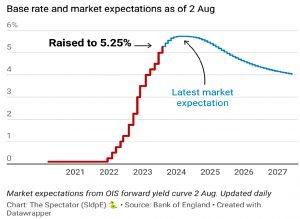

As expected, the BoE hiked for the fourteenth month in a row, taking the US base rate up by 0.25% to 5.25%.

- The last time we hit 5.25% was in February 2008.

The committee voted 8 to 1 in favour of a hike and didn’t rule out further rises.

CPI inflation remains well above the 2% target. It is expected to fall significantly further, to around 5% by the end of the year, accounted for by lower energy, and to a lesser degree, food and core goods price inflation. Services price inflation, however, is projected to remain elevated at close to its current rate in the near term.

If there were to be evidence of more persistent pressures, then further tightening in monetary policy would be required.

Futures markets are pricing in two more hikes from here, before rate cuts in 2H24.

ISA millionaires

There are now more than 4,000 ISA millionaires, according to HMRC (the data actually dates from April 2021, and was obtained by the financial advisory network The Openwork Partnership, after a freedom of information request).

- That’s up from 1,480 at the end of tax-year 2019/2020, and back in 2915/16 there were just 450.

The biggest winners have more than £8M in their ISAs, but the average amongst the millionaires was £1.4M.

Setul Mehta from OpenWork said:

Becoming an ISA millionaire takes time, money and a little bit of knowledge. But the rise in personal finance content online means the roadmap to millionaires’ row has never been more clearly signposted.

A stocks and shares ISA holder consistently maxing out their £20,000 allowance could

reasonably expect to smash through the seven figure mark after around 22 years

assuming average returns of seven per cent per annum.

Of course, 7% is a somewhat ambitious target, and the £20K annual contribution limit hasn’t been around for long.

- When Nigel Lawson introduced PEPs in 1987, the limit was £2,400.

The £1M threshold has no particular significance, but any publicity for UK tax shelters is good news.

It’s also the 10th anniversary of AIM shares being allowed in an ISa, for the triple whammy tax shelter of safety from IHT as well as income tax and CGT.

- AIM as a whole has returned just 15.4% over 10 years – its very much a “stockpicker’s market”.

After a rollercoaster decade, the PE of the market is back down at 10.6 and the dividend yield is at a record high of 2.4%.

Workshy boomers

Work and pensions secretary Mel Stride has suggested that retirees struggling with the “cost of living crisis” could get jobs in the gig economy.

He said:

There are loads of great opportunities out there for people and it’s of course good for people to consider options they might not have otherwise thought of.

He was touring the Deliveroo HQ at the time, so this has been widely interpreted as meaning they should deliver pizza.

- I would guess that Mel has little experience with pizza delivery (either on the bike or eating the pizza) or he might have thought better of this.

He reminds me of all the young people on NextDoor who think that pensioners should cycle everywhere rather than drive.

- I think it’s not a bad idea to encourage the over-50s back into the workforce, but for the idea to really get traction, we might need a tax break.

A special tax-free allowance (say £10 pa) for over-50s doing part-time jobs might do the trick.

For a long-term solution, we need to normalise part-time work for the over-50s.

- A lot of people don’t want to move from 60 hours a week to zero – a gradual trail-off over the last decade of their working life might be preferable.

Big Mac index

In their latest update on the Big Mac Index, The Economist reported that inflation had increased the US price of a Big Mac by 8.3% over the last year ( the fastest rate since July 2012) and 4% since January.

- But the US got away lightly:

From January to July the price of a Big Mac has risen more than twice as fast in the euro zone and Britain, and nearly four times as fast in Canada. Since the price of burgers is rising even faster in Europe, Japan and Canada than in America, their currencies’ purchasing power is dropping faster than the dollar’s.

Which is bringing their fair values closer to their market values.

The fair value of the euro is now $1.06, less than its market exchange rate. The euro now looks overvalued against the dollar for the first time in two years.

The dollar is still overvalued against GBP and CAD, but by less than 5%.

This fits with the “uncovered interest parity” theory:

When interest rates rise—as they did more dramatically in America last year than in many rich countries—a currency should first jump, before gradually weakening over time. Bond investors receive a high rate of interest, but suffer a gradual capital loss on the currency.

The main dollar overvaluation is against the Yen:

A dollar should buy only 81 Japanese yen. In fact it buys 142. The yen is undervalued by 43%. The gap is likely to persist until the Bank of Japan feels the need to raise interest rates closer into line with America’s.

Simplified advice

The FCA has “paused”/abandoned plans to introduce a simplified advice regime following a lack of support from the industry.

- Instead, there will be a review of the boundary between advice and guidance.

Depending on the outcome of the review, this might not be bad news, though it probably will be.

The FCA said:

Given the potential for more significant change that is now possible through the advice guidance boundary review, and given the limited support from industry for the initial set of proposals consulted on, we have decided to roll the development of these proposals, taking onboard the feedback we received, into the broader review. This will allow us to support the more substantial changes that are being asked for.

The original idea was to develop a framework that would support advice for those with small pots (below £50K, and possibly only those below £10K), who are currently too expensive to service.

- It was also likely to be restricted to money within ISAs, rather than pensions.

The new review will look at both accumulation and decumulation, which is good news.

- But what we really need is a relaxation of how much support non-regulated people can offer.

And the industry is unlikely to support that.

Quick Links

I have just two for you this week:

- The Economist said that AI is setting off a great scramble for data

- And Alpha Architect looked at The Performance of Listed Private Equity.

Until next time.