Weekly Roundup, 14th November 2022

We begin today’s Weekly Roundup with inflation.

Contents

Inflation

The Economist looked at why tight policy is not bringing down inflation.

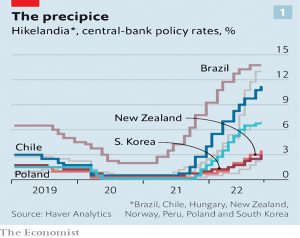

- Their focus was not on the UK or the US, but on a group of eight countries that began to tighten more than a year ago – they call this group Hikelandia.

In the year to October the median economy in Hikelandia raised rates by six percentage points.

That’s a lot more than the Fed, even after another 0.75% raise at the November meeting.

- The rises have slowed the local property markets and cooled economic activity.

Goldman Sachs produces a “current-activity indicator”, a real-time measure of economic strength. Hikelandia’s economy is weakening relative to the global average.

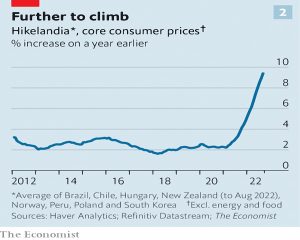

But they haven’t fixed inflation.

In September core inflation in Hikelandia hit 9.5%, year on year, up 3.5 percentage points from March. Worse still, the gap between global core inflation and Hikelandia’s reading seems to be widening, not shrinking.

The Economist offers three possible explanations:

- There is always a lag between tighter monetary policy and lower inflation, and when a strong dollar is pushing up the price of your imports, that lag can be a long one.

- Perhaps rates need to be even higher, and budget deficits should be smaller than the current 3% of GDP (through tax increases and/or cuts to public spending).

- Such austerity would not be popular with the public, however.

- Perhaps inflation is much harder to stop than people thought.

The Bank for International Settlements has suggested a behavioural explanation:

In a “low-inflation regime” no one paid much attention to prices, ensuring they did not rise quickly. But in a “high-inflation regime”, such as in the 1970s, households and firms start to track inflation closely, leading in time to “behavioural changes that could entrench it”.

This sounds plausible, but what is the fix, apart from higher rates for longer?

- And in the rich world, what will central banks do when this approach breaks something?

Value comeback

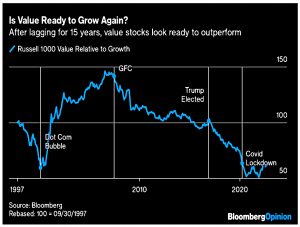

John Authers looked at when old-school value investing (( Rather than value-based factor investing or smart beta )) might have a comeback, quoting David Einhorn of Greenlight Capital:

I don’t know that it ever comes back. Most of the value investors have been put out of business. It used to be we could buy something at a reasonably low multiple, and other investors would see what we saw six months later or a year later and would re-rate the shares. That isn’t happening any more because there’s nobody to notice. Nobody knows what anything is worth.

It’s a variation of the “passive is Marxism” view, this time aimed at quants.

- The argument is that if no one does the fundamental analysis, stocks will be mispriced.

During the 1990s bull market, clients pulled money from value funds (at what turned out to be exactly the wrong time) as tech stocks went through the roof. Some value managers lost their jobs — perhaps most famously Tony Dye [at Phillips & Drew – he was sacked at the very top of the tech bubble].

Those who weren’t sacked lost AUM, and hence compensation.

Value did well after the dot com bust, then terribly after the 2008 crisis.

- In the last few years, it has made back some ground.

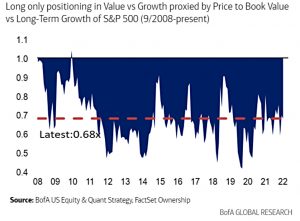

Fund managers are not convinced that the recovery will continue, and remain underweight value.

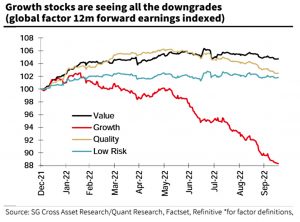

Earnings downgrades – which are hugely concentrated in growth stocks – should help the case for value at the aggregate (factor) level.

- But absent the fundamental analysts that Eichorn mourns, who will provide the catalyst for the stocks in concentrated value portfolios?

Economics Nobel

I forgot to mention that a few weeks back the Economics Nobel was given to three economists who had worked on bank instability before the 2008 crisis hit.

- The Economist covered the story at the time.

The three laureates’ central insight was that banks are not the neutral intermediaries between savers and borrowers that other economic models had assumed.

Instead, they offer vital services to the wider economy: gathering information on borrowers, providing a liquid means of saving and deciding to whom to extend credit. From this insight flows an important conclusion: because banks are crucial to the economy, they are also dangerous.

It’s hard to believe that “Too Big To Fail” (or more accurately, “Too Unfathomably Intertertwined To Fail”) wasn’t a thing until fifteen years ago.

- Particularly when Bernanke’s work focussed on the 1930s Depression:

When banks failed in the 1930s, new entrants could not easily replace them. Knowledge about borrowers is hard won. This meant that farmers, small firms and households all found credit more difficult to obtain during the Depression, ensuring a vicious downturn.

Other ideas behind the prize award include:

- A central bank acting as a “lender of last resort” can prevent bank runs as depositors won’t expect their bank to fail.

This didn’t seem to help Northern Rock, though as the Economist mentions, it worked rather better in It’s A Wonderful Life.

Renewables price cap

Although nothing is certain in politics at the moment, the government has proposed a “cost-plus revenue limit” for renewable energy firms – also known as a price cap or windfall tax.

- Starting from 2023, over a certain level, the government would claim most of the revenue.

The intention is that the government take would be used to help fund the consumer energy price cap.

- A lot of renewables funds and energy supplies sold off on the news.

Renewables firms have been making huge profits in recent months as the spot price for electricity is calculated from the highest-cost producer (currently gas-fired power stations).

- The government said the cap would make sure that firms did not profit unduly from an energy crisis caused by Russia’s Ukraine invasion.

Tom Glover, chair of German utility RWE – which owns UK offshore wind farms – said:

A cap is a de-facto windfall tax on low-carbon generators that, if not designed and implemented correctly, could have severe negative consequences for investment in the renewable and wider energy market and so for the energy transition.

The actual numbers don’t seem to be set in stone at this point, but a mooted £60 per megawatt-hour (MWh) would be little more than a third of the EU price ceiling (€180 per MWh).

- The average price before the Ukraine invasion was £133 per MWh, well above the proposed cap.

Later reports suggested that £60 was just a starting point for the discussions.

- There’s also a voluntary contract for difference (CfD) scheme which guarantees (lower) prices over a longer time frame.

A cap is not a terrible idea, but maybe it would be simpler to just remove the rule that the most expensive fuel sets the price for everyone.

- And if the cap is much lower than the European one, it’s hard to see how we can incentives further investment in UK renewables.

Hargreaves Lansdown

HL seems to be in the news all the time just now.

- We have two stories this week.

In the Investors’ Chronicle, Leonora Walters reported that HL is to stop offering non-sterling classes of ETFs.

- Around 170 funds are affected.

The investment platform only trades and settles stocks in sterling, and many of the market makers it uses to trade do not provide quotes or settle non-sterling investments into sterling. Hargreaves Lansdown says that this means it cannot be certain it is always getting the best prices on trades.

Trading will also involve more phone calls. hence higher costs and lower profits for HL.

That said, it’s not as bad as it sounds:

- Anyone holding these share classes can continue to hold them – they just can’t buy any more.

- And only ETFs that also have a sterling class are affected – in an ETF only trades in dollars, you can still buy it.

I wouldn’t recommend HL in any case, but is you are still after the non-sterling classes, AJ Bell remain happy to sell them to you.

In FT Adviser, Sally Hickey wrote that HL will make £200M in interest that they don’t pass on to their customers.

- As interest rates head higher, the profits on cash balances increase.

HL has £119 bn in AUM, and 13% of this (£15 bn) is in cash – up from 10% in June 2021.

- HL keeps a spread of around 1.3% to 1.5%.

I think this is far too fat, but some platforms don’t pass on any interest at all.

- I’m at 5% cash just now, but I might increase it towards 10% should central bank interest rate raises continue.

Most of this is not inside investment accounts, however, and is earning somewhat better interest.

HL’s external relations manager, Alex Lambert, said:

Our priorities are to protect clients, offer them a great service and market-competitive rates, actively tell them when they are holding too much cash for too long, and encourage them to use our active savings service.

Charts

I’ve signed up for a new service – chartr.

- Three times a week they send you some nice charts for free.

Here are some good ones from the past week.

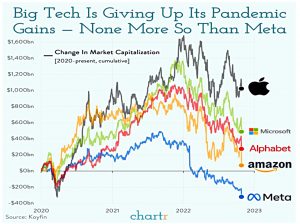

The first shows that Big Tech is giving up its pandemic gains.

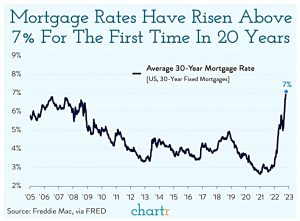

The second shows that (US) mortgage rates are now above 7% pa for the first time in two decades.

Quick Links

I have seven for you this week, the first three from The Economist:

- The Economist watched Financial markets bet on an end to China’s “zero-covid” policy

- And asked Can American liquefied natural gas rescue Europe?

- And wrote that As tech lay-offs spread, Meta sacks 11,000 workers

- Alpha Architect looked at The Role of the Secular Decline in Interest Rates in Asset Pricing Anomalies

- And at The Cross Section of Stock Returns Pre-CRSP data: Value and Momentum are confirmed as robust anomalies

- UK Dividend Stocks asked Is RM a Good Choice for Dividend Investors?

- And Maudlin Economics had Recession Thoughts

Until next time.