Irregular Roundup, 15th June 2023

We begin today’s Roundup with a catch-up.

What have we missed?

I haven’t written what used to be known as a Weekly Roundup for a couple of months now.

- Some unexpected real-world events conspired to rob me of all my spare time, but things are returning to normal now.

For the first couple of weeks, I was pretty anxious about breaking a run of posts dating back quite a few years, but then I became acclimatised to not writing them.

- A bad habit replaced a good one.

So I’m uncertain as to what will happen from here.

- I doubt that this will be the last ever Roundup, but equally, I’m not committing to writing one every week for the foreseeable future.

We didn’t miss much while we were away.

- There was a bit of a pantomime about whether the US debt ceiling would lead to a default on US bond interest payments, but it never does, and it didn’t this time.

AI has also blown up even more than before the break (see Quick Links below).

Although inflation is falling, it’s also providing stickier than thought, which means we could have higher interest rates for longer (and we probably haven’t reached peak rates yet).

- Nobody seems to have told my portfolio, which is up slightly from the date of the last Roundup.

Pension dashboards

Pensions Minister Laura Trott announced another delay to the Pensions Dashboard, which won’t be around until 2026.

- This is after the next general election, so it’s clearly not a priority and could be even less of one after that.

The idea – to consolidate multiple pension pots into one consolidated total – has been around for many years now, without too much progress – the original launch date was 2015, and the dashboards were due to be available in 2019.

The logic is that people don’t save for retirement because they don’t know how much they already have saved, and the “one pot per job” of workplace auto-enrolment (launched in 2012) has only made it harder to keep on top of pension savings.

- The superficial complexity of the State Pension (minimum years, pro-rata entitlements, moving goalposts for the eligible age for receipt etc.) doesn’t help either.

But I don’t entirely buy this argument – people don’t save because they would rather spend their cash now and because they have no idea how much they will need to be comfortable in retirement, and a dashboard won’t fix these problems.

- Mandatory contributions (as in Australia) would be a better idea.

Global Losers

We’ve fallen way behind with Joachim Klement’s recent output, but there’s only space this week to start with the catch-up, by looking at global losers.

- He quotes the fined of Charlie Ellis that the correct approach for problems like investment (and tennis) is not to pick winners but to avoid the losers (unforced errors).

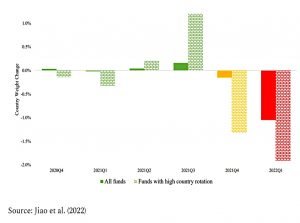

A recent study of the country exposure of actively managed global equity firms backs this up.

Funds with higher country rotation outperformed funds with a more static country allocation. This is aligned with the observation that high turnover funds on average outperform lower turnover funds after fees.

The explanation is not that the higher turnover funds could spot which countries were about to outperform, but rather that they reacted quickly when a country got into trouble.

- In other words, they cut their losses, and let their winners (or at least their non-losers) run.

When a country gets into trouble (be it a recession or some exogenous event) all stocks in that country suffer. One extreme case study was provided by the Russian invasion of Ukraine. The average fund did not reduce exposure before the invasion and only sold [Russian] stocks once the damage to the portfolio had been done.

Crypto

The Economist reported on a crypto crackdown in the US: the SEC has sued Coinbase for failing to register as a broker of unregistered securities.

- It also sued Binance for the same failure, plus putting customer funds in accounts owned by the boss of Binance (CZ).

American law defines securities to include any “investment contract” that produces an

asset for which an owner can expect to accrue returns depending on the effort of a

promoter.

The SEC has said that Bitcoin is not a security, and has avoided making a call on Ether.

- But SEC Chairman Gary Gensler thinks that most other crypto coins are securities.

They mostly do seem to act like equity, but this is now for the courts to decide.

- The counterarguments would be that coins are decentralised and don’t have a promoter, and stablecoins are used for liquidity rather than investment/speculation.

But if the courts rule in the SEC’s favour, the US will in effect have banned crypto (like 25 others of the 45 main trading jurisdictions).

- Which will both send crypto abroad (perhaps to Dubai) and also hit its value.

On this side of the pond, The Financial Conduct Authority (FCA) has introduced a 24-hour cooling-off period for first-time crypto investors.

- The rules come into effect in October and mean that new customers need to reconfirm their interest after a day.

Sheldon Mills, FCA executive director, said:

Our rules give people the time and the right risk warnings to make an informed choice. Consumers should still be aware that crypto remains largely unregulated and high risk. Those who invest should be prepared to lose all their money.

The latest FCA survey shows that 10% of people now own some crypto, which translates to almost as many people as own a stocks and shares ISA.

Quick Links

There’s quite the backlog to make up this week – too many links to count until they are all in the article.

- The Economist outlined A flawed argument for central-bank digital currencies

- And said that After debt-ceiling negotiations, America faces a debt deluge

- The newspaper also outlined The struggle to kill King Coal

- And warned that Global fertility has collapsed, with profound economic consequences

- And that It’s not just a fiscal fiasco: greying economies also innovate less

- They asked What does the perfect carbon price look like?

- And wondered Can carbon removal become a trillion-dollar business?

- And Is the luxury sector recession-proof?

- They noted that Nvidia is not the only firm cashing in on the AI gold rush

- And that The AI boom has turbocharged Nvidia’s fortunes. Can it hold its position?

- And warned that Samsung should be wary of Intel-like complacency

- They also explained How to invest in artificial intelligence

- And asked What does a leaked Google memo reveal about the future of AI?

- But noted that Your job is (probably) safe from artificial intelligence

- And that The tech giants have an interest in AI regulation

- And looked at Big tech and the pursuit of AI dominance

- The Economist also asked What the First Republic deal means for America’s banks

- And said Welcome to a new, humbler private-equity industry

- And that Private markets remain attractive, even in a higher-rate world

- And asked Is mining set for a new wave of mega-mergers?

- And watched as Hindenburg Research takes on Carl Icahn

- And as Britain shoots down Microsoft’s $69bn Activision deal

- And wrote about The business trend that unites Walmart and Tiffany

- And said that Big pharma’s patent cliff is fast approaching

- And that Everything about carmaking is changing at once

- But explained Why crashing lithium prices will not make electric cars cheaper

- And said that America’s economic outperformance is a marvel to behold

- And described The lessons from America’s astonishing economic record

- And asked What luxury stocks say about the new cold war

- And said that Inflation has yet to dent big food’s earnings

- And that Copper is the missing ingredient of the energy transition

- Alpha Architect asked Can ChatGPT Help You Read Financial Statements?

- And looked at Negative Screening and the Sin Premium

- And at the Intangible-Adjusted Profitability Factor

- And introduced Submergence: A Tool to Assess Drawdowns and Recoveries

- And looked at Reducing the Impact of Momentum Crashes

- And at Gold as a Safe-Haven Asset

- And at Box Spreads: An Alternative to Treasury Bills?

- And at The Reddit Road to Riches?

- And at Improving the Quality Factor by Incorporating Intangible Intensity

- And at The Drivers of Booms and Busts in the Value Premium

- And at How factor exposure changes over time: a study of Information Decay

- And at Merger Arbitrage as Diversification Strategy

- And at Index Investing and the Informational Efficiency of Stock Prices

- And at Combining Reversals with Time-Series Momentum Strategies

- And asked Is a Naive 1/N Diversification Strategy Efficient?

- UK Dividend Stocks explained How to avoid dividend traps with excessive debts

- And how to Find quality dividend stocks using these profitability ratios

- And How to identify stocks with high-quality dividend growth

- And How to find quality companies with consistent profits and dividends

- And said they were Selling Hikma Pharmaceuticals after a 40% share price gain in 7 months

- And looked at Secure Trust Bank: Is its dividend secure and trustworthy?

- And wrote about The pros and cons of savings vs dividends for retirement income

- The FT reported Inheritance tax soars as result of UK’s fiscal drag

- Asymmetric Finance wrote about One Indicator That Has Not Failed in 100 Years

- AQR reported on Re-Emerging Equities

Fifty-six links – definitely a record.

- Until next time.