Irregular Roundup, 14th August 2023

We begin today’s Weekly Roundup with US inflation.

US inflation

The Economist warned that America’s battle with inflation is about to get trickier.

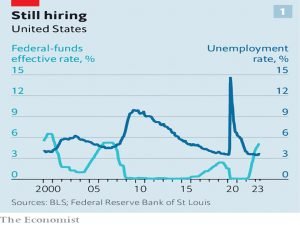

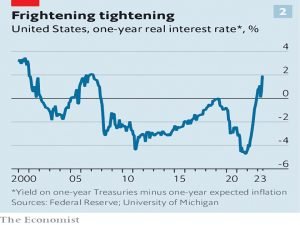

- At the end of July, the Fed raised for the 11th time in 12 meetings, but the future is less clear.

Headline inflation is down to 3%, and core inflation has started to soften.

- So there might plausibly be no more hikes.

A rebound in energy or housing prices would change things, and the labour market remains quite hot, possibly because of Covid after-effects.

- Canada has already had to restart rate rises after a pause.

Fed Chairman Powell remains hawkish:

What our eyes are telling us is that policy has not been restrictive enough for long enough.

Steven Englander of Standard Chartered uses a weather forecasting analogy:

The Fed [is] a weather forecaster who thinks there is a 30% chance of rain. It still makes sense to highlight the potential for wet weather, because predicting sun but getting rain is perceived as worse than predicting rain and ending up with sun.

If inflation continues to fall, what is the dovish option now (holding steady) will become the hawkish option later in the year.

- This means we could even see cuts, though they are much more likely in 2024.

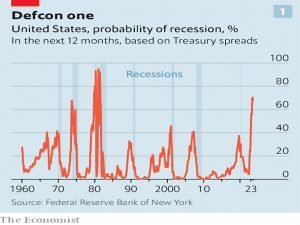

Recession

A second article looked a the probability of the US escaping a recession.

Since March 2022 the Fed has lifted short-term interest rates from 0% to 5.25%. Such rapid jumps tend to go hand-in-hand with recessions. As higher rates raise the cost of borrowing, they drag down both spending by consumers and investment by companies.

The median forecast probability of a recession amongst economists surveyed by Bloomberg is currently around 65%.

- The yield curve has inverted and puts the probability of a recession at around 70%, the highest figure since 1982.

Inversions have a perfect prediction record over the last 50 years.

- The average lag from the initial signal is 350 days, which would mean a recession starting in September.

Yet the labour market remains strong, denying the Phillips curve.

- This is partly because the workforce has expanded.

Some of the recession signals (falling sales of laptops and exercise bikes) could be the product of the end of Covid lockdowns, and the low long-term bond yields could reflect expectations of future cuts because of lower inflation, rather than a looming recession.

- It’s also the case that the 5% budget deficit props up the economy by putting money in people’s pockets, and Biden’s infrastructure spending and decarbonisation subsidies do the same.

Households are also running down “excess savings” from lockdowns and helicopter money.

Wage growth is also above inflation and the housing industry is starting to rebound.

The newspaper notes that a soft landing could still mean an extended period of subdued growth.

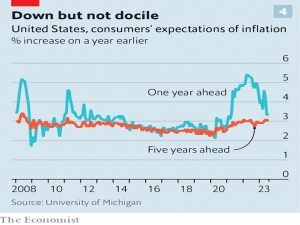

The risk to the soft landing comes from a return to higher inflation, and whether it can fall much lower without a rise in unemployment.

- Wage growth and a housing boom are also threats.

Expectations of inflation have declined, but not to pre-Covid levels.

- The Fed may have to accept inflation above its target in order to nail the soft landing.

But there is at least a chance.

UK interest rates

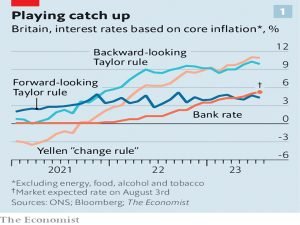

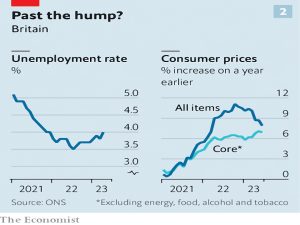

The Economist also asked how high UK interest rates should go.

- Current (time of writing) expectations were for an increase on August 3rd to 5.25%, and then another half a point before Xmas.

Not that predictions have a good record.

- The Bank was forecasting a 5% peak in November 2022, so is it still behind the curve?

The Taylor rule for setting interest rates looks at three things:

- the gap between current inflation and the target;

- how much slack is in the economy;

- and, last, the so-called neutral rate of interest, at which the central bank is neither stimulating the economy nor dampening it

This would suggest UK rates at 11.4%, last seen in 1992.

- Rates that high would crash the economy (and lose the coming election).

Inflation is one problem, with the headline rate driven by global energy and food prices, but even the domestic core number would suggest rates of 9.9%.

Even an “inertial” Taylor rule, designed to avoid big swings in interest rates would suggest the bank should immediately raise rates to 6%.

The other two inputs are estimates:

The 0.5% neutral real rate of interest and 4% equilibrium unemployment rate reflect received wisdom but have not been scientifically calculated.

Janet Yellen suggested an alternative rule based only on observable data, but that rule now suggests interest rates of 10.9%.

These rules are backwards-looking, and since it can take more than a year for monetary policy changes to affect the economy, perhaps a forward-looking rule should be preferred.

- We want to target the inflation forecast, rather than what has already happened.

Financial markets expect the inflation rate in two years’ time to have fallen to around 3%.

Ignoring the circularity that these forecasts rely on assumptions about future monetary policy, plugging them into the Taylor rule suggests an interest rate of 4.3%.

It suggests the bank is in danger ofraising rates too high. That helps to explain the dissents of doveish policymakers at the bank who have opposed recent rate increases.

But I’m not sure you can discount the circularity, and nor can we rely on forecasts.

In July 2022 the average forecaster surveyed by the Treasury expected inflation to fall to 3.6% by the end of 2023; today the expected figure is 4.9%. The less confidence you have in economists’ assurances that the inflation problem will soon dissipate, the trickier it is to

set aside the fact that the hard data say monetary policy is still too loose.

St James’ Place

In response to the new consumer duty regulations, notoriously expensive UK wealth manager St James’ Place announced that it would lower its fees for long-term customers, leading to a big fall in the company share price (16%).

- The fall was exacerbated by poor interim results which showed a bigger-than-expected decline in client inflows.

SJP expects the changes to reduce net income by £24M annually.

- Around 65K long-term clients will benefit from reducing annual “product management charges” from 1% to 0.85%.

The new consumer duty means that financial services are required to demonstrate that they are acting in the best interests of their customers.

- I’m not clear on how a 0.85% pa charge can achieve this.

SJP also charge an up-front advice fee of 4.5% and an annual adviser fee of 0.5% and an initial product fee of 1.5%.

- So the new fee structure is 6% upfront and 1.35% pa.

CEO Andrew Croft said:

We have looked at every part of our business through the consumer duty lens and where changes needed to be made we have made them.

I say run for the hills.

Annuities

In the FT, Moira O’Niell was under the impression that annuities look sexy again.

Before pension freedoms were introduced in 2015, removing any compulsion to buy one, annuities were unpopular because the income they generated was so low. That’s now improved, with a single 65-year-old with £100,000 being able to buy a level income of £7,210.

That sounds reasonable, but we also have high inflation at present, making a long-term level income look very unattractive.

Some industry commentators think that the new consumer duty will push advisors into recommending more annuities.

- This would be an undesirable outcome.

I’m closing in on 63, and the yield I can access for an annuity with a (low) 3% indexation clause (meaning it would cope with average inflation, but would still be losing ground at the moment) is just 4.26%.

- At £4,260 per year, my £100K upfront would be returned to me in 23.5 years.

That takes me to the age of 86.3, which I annoyingly beyond my life expectancy.

- And I would have thrown away 24 years of growth in my portfolio

- And I would have zero flexibility in my annual income.

- Not to mention the inability to leave anyone an inheritance.

So annuities remain very unsexy from where I’m sitting.

Some people agree with me – James Baxter, of Tideway Wealth, says:

At worst it consumes your capital, at best it’s not much better than a portfolio of gilts. The vast majority of people could make the same or more money with low-risk investment options, while they also have the flexibility to pass on their money to their family.

Ian Millward of Candid Financial Advice says:

Rates have improved significantly – up about 40 per cent from an exceptionally low base. We run annuity quotes at annual review for all clients taking pension income and nearly all opt to stay in drawdown.

Which is surprisingly sensible of them.

Tax reliefs

The parliamentary Treasury committee has requested a “systematic review” of tax reliefs, saying that are complicated and open to abuse.

- Only 365 out of 1,180 tax reliefs have official costings, and costings for the rest have been requested by 2025/26.

The biggest 105 reliefs “cost” the Treasury £195 bn in tax.

The committed wants all reliefs to have five-year reviews and to be removed if they “no longer align with policy, are vulnerable to abuse or cost more than expected.

Committee chair Harriett Baldwin said:

Our tax system is too complicated, and the proliferation of un-costed tax breaks add to that complexity. While some reliefs are very effective, others are prone to abuse or simply lie dormant, cluttering the ever-expanding tax code. The fact we only have costings for a third of reliefs is staggering – and something which needs rectifying with urgency.

Five-year reviews could be useful to investors (for example by indexing allowance limits) but I doubt that is what Harriett has in mind.

Quick Links

I have five for you this week, the first three from The Economist:

- The Economist said that Meme stocks are back from the dead

- And wondered Can Uber and Lyft ever make real money?

- And asked How real is America’s chipmaking renaissance?

- Alpha Architect looked at Value and Profitability/Quality: Complementary Factors

- And Uk Dividend Stocks asked Is Vodafone a quality dividend stock?

Until next time.