Lazy Portfolios 4 – Two, Three or Four Funds

Today’s post is the fourth in a series of posts about of Lazy Portfolios. We’ll be looking at two, three and four fund options.

Contents

My portfolio

Let’s start with a quick recap of what we’ve covered so far.

My base portfolio is a passive global multi-asset portfolio made mostly from low-cost ETFs.

- I use 54 asset classes with an allocation based around volatility parity.

A true volatility parity portfolio is quite safe (and low return), with more than 60% in bonds.

- In order to hit my target / fail safe withdrawal rate of more than 3% pa, I need to cap the bond allocation to 20%

- This allows for 75% stocks and 5% True Alternatives.

I also tweak the default allocation to accommodate global ITs and themed funds, and to support some home bias.

Lazy portfolios

Lazy portfolios are pretty much at the opposite end of the spectrum.

- Typically they involve between two and four funds, though some have more.

Their key advantage is simplicity.

- This doesn’t matter much to me – I don’t see the big difference between buying four ETFs and a dozen, or even 50.

But novice investors and those with small portfolios might find them useful.

Common portfolios

Returns are broadly proportional to volatility.

- In order to get good returns, you need to accept more volatility.

So correlations between assets – and in particular, correlations with the primary return-producing asset, stocks – are key.

- Adding poorly correlated assets can reduce the volatility of a portfolio without significantly affecting returns.

This leads to three common portfolios:

- The Max SR portfolio (volatility optimised)

- We’ll simplify this to be 60% bonds, 40% stocks.

- The Max Return portfolio, which is 80% stocks and 20% bonds

- I swap 5% of stocks for True Alternatives, to leave me with 75% stocks

- A Compromise portfolio suitable for a wide range of people,

- This might be 60% stocks, 35% bonds and 5% Alternatives.

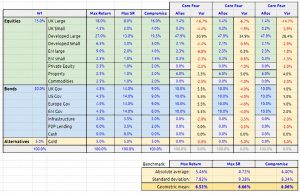

Benchmark

We need something along the same lines as my “max return volatility parity” portfolio, but with fewer funds.

- Then we can compare the lazy allocations to our simplified portfolios.

The best I could come up with was a 15-fund portfolio.

- There are six equity funds, three equity alts, four bonds funds, one bond alt and just one true alternative asset – gold.

This chart adds two more benchmarks:

- The Max SR benchmark, and

- The Compromised benchmark.

They have been derived from the max return benchmark by varying the allocations to stocks and bonds.

- Note that the two new benchmarks each include 16 funds rather than 15.

The idea is that we will compare each lazy portfolio to the three benchmarks in order to discover which type of investor it serves best (unless that is immediately obvious).

Note that it isn’t possible to produce high and stable returns from a static portfolio under all economic conditions conditions.

- Long-term investors should stick with stocks as the core of their portfolio, using diversifiers (bonds and true alternatives) to smooth their path a little.

So we will be measuring the lazy portfolios on how well they perform this task.

One fund portfolios

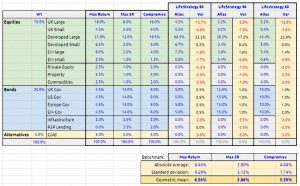

In the last article we looked at the Vanguard LifeStrategy funds.

- The three that match most closely to our three benchmark portfolios are the 40%, 60% and 80% equity funds.

Here’s how those funds look:

Relative to the appropriate benchmark:

- UK stocks are low

- Developed stocks are high

- EM is mixed – low for LifeStrategy 80, high for the other two.

- Bonds are a bit high but not too bad.

- There are no alternatives of any kind.

The variances to our benchmarks look horrific.

- We are looking for variances below 2%, and ideally below 1%.

There’s no way I could live with these errors of 3.7% to 6.5%.

Two funds

Perhaps surprisingly, although the Vanguard fund make poor portfolios, they are hard to beat with just two funds.

- Most two fund portfolios are a version of “stocks plus bonds”, and we already have that.

- We also have decent global diversification.

What we are missing is:

- Alternatives

- Higher weighting to small caps

- Emerging markets exposure

- Home bias to the UK

Fixing each of these problems is likely to require one or more funds, so it will be difficult for two fund portfolios in particular to compete.

Here are a few of the most common two fund options:

- US 60/40

- 60% S&P 500, 40% US bond

- Global 60/40

- 60% World stocks, 40% world bonds

- Buffett’s lazy portfolio

- 90% US stocks, 10% US bonds

- Grow To Retire

- 60% global small caps, 40% US bonds

- Markowitz real-world portfolio

- 50% global stocks, 50% global bonds

None of these will beat the Vanguard funds.

Three funds

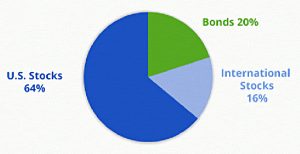

Let’s see if three funds can do any better:

- The Balance

- 40% US stocks, 30% international stocks, 30% international bonds

- My Money Wizard Equal Three

- 33% US stocks, 33% international stocks, 33% international bonds

- My Money Wizard 80/20 Three

- 64% US stocks, 16% international stocks, 20% international bonds

- My Money Wizard 60/40 Three

- 48% US stocks, 12% international stocks, 40% international bonds

- Allan Roth’s Second Grader Portfolio

- 60% US stocks, 30% international stocks, 10% international bonds

- Taylor Larimore’s Three Fund Lazy Portfolio

- 42% US stocks, 18% international stocks, 40% bonds

I don’t think any of these can beat the Vanguard funds.

- They are all still stock / bonds splits, with a big tilt to the US.

Four funds

This is where things should get interesting.

- There are a couple of well-known four fund portfolios.

Perhaps the best known is Harry Brown’s Permanent Portfolio, sometimes known as the Cockroach portfolio because it was thought to be able to survive a nuclear strike.

According to David Stevenson:

Browne was the Libertarian Party’s candidate for president and something of a hard currency, gold enthusiast.

He believed there were many threats to your wealth, chief of which were what William Bernstein called the four horsemen of the financial apocalypse, namely inflation, deflation, government confiscation and civil war devastation.

Here’s the portfolio:

- 25% cash

- 25% bonds (long term)

- 25% stocks

- 25% gold

Harry would have meant US stocks, but let’s be generous and match this to a global market cap allocation.

I find this portfolio of no interest whatsoever, as the stock exposure is so low.

Mark Hulbert of MarketWatch looked at the returns for a US fund based on this portfolio and found:

It is discouraging that the fund came out behind both stocks and bonds on a risk-adjusted basis, since it means that regardless of whether you are a conservative investor or an aggressive trader, you could have made more money with stocks and bonds.

The fund did fairly well during the 2008 crisis, through not so well as bonds.

- Let’s run the numbers anyway.

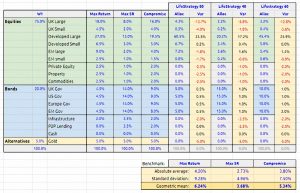

Permanent Portfolio

First I have to add a line for cash – I’ll put this under Bond alternatives.

- To support the comparison between all the lazy portfolios, I had to go back and do this for the Vanguard funds first.

The variances are now:

- 6.2% – LS80 vs Max return

- 3.7% – LS40 vs Max SR

- 5.3% – LS60 vs Compromise

As you might expect, the Permanent Portfolio does worse across the board:

- 7.7% – Permanent vs Max return

- 7.5% – Permanent vs Max SR

- 6.9% – Permanent vs Compromise

So we can forget about the Permanent Portfolio.

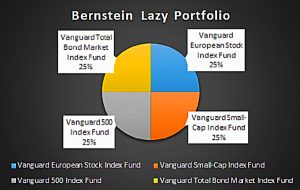

Bernstein portfolio

Another four-fund portfolio that I’ve come across is the William Bernstein “No Brainer” Portfolio:

- 25% US large caps

- 25% US small caps

- 25% international bonds

- 25% international stocks

That leaves us with a 75% stocks, 25% bonds portfolio with a worse tilt to the US than the Vanguard funds.

So we don’t need to run the numbers on this one.

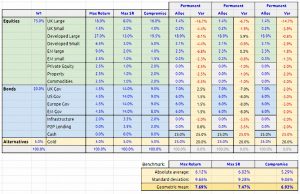

Core Four

The Core Four portfolio comes from Rick Ferri on the Bogleheads forum:

- 36% US stocks

- 18% International stocks

- 6% REITs

- 40% bonds

At last we have a new asset class, although it’s only property.

This one comes out better than the Permanent Portfolio, but worse than the Vanguard funds:

- 6.5% – Core Four vs Max return

- 6.7% – Core Four vs Max SR

- 6.1% – Core Four vs Compromise

There are variations available to the bond exposure and the international / US split, but they wouldn’t change the results significantly.

We’re still missing:

- Alternatives

- Higher weighting to small caps

- Emerging markets exposure

- Home bias to the UK

And that means that we’ll need at least five or six funds in the portfolio.

We’ll leave it there for today.

- The two, three and four fund portfolios have failed to displace the Vanguard one-fund solution.

In the next article, I’ll start to look at portfolios with five or more funds.

- Until next time.

Your mention of the Harry Browne Portfolio reminded me of this piece of work by one of the very original FIRE pioneers, John P Greaney: https://retireearlyhomepage.com/reallife20.html

Please note, he has been updating this annually for nearly 20 years.

Look out for the WEB1.0 look and feel – it is just classic!

Nice link, though difficult to read. Surprised how well Buffett has done. And you have to admire the author’s dedication. I hope I make it to 20 years.

I would have liked some analysis of volatility and Sharpe ratios. The big winner is three risky bets on themes – good themes, but not many people would allocate 100% to them.

Agree.

But I just find it fascinating – especially given that he uses open-market funds (not pure indices) – albeit, I think, before costs and that they are all US based.

Re: further analysis – you could always pull down his underlying spreadsheet(s) and play with them to your hearts content!

J.P.G. is certainly a one-off!

He has been around since the start, but nowadays seems to be largely forgotten, see e.g.

https://forum.earlyretirementextreme.com/viewtopic.php?t=10436