Weekly Roundup, 12th October 2020

We begin today’s Weekly Roundup with a look at inflation.

Contents

Inflation

Joachim Klement looked at the link between the money supply and inflation.

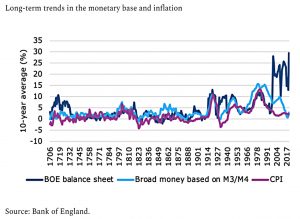

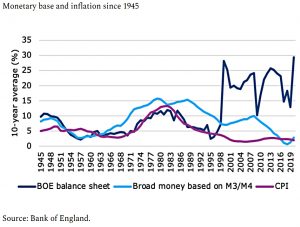

The monetarists who predict that more money in the system will create more inflation and vice versa were on to something. For more than 250 years, there was a relatively close link between the money in circulation and inflation.

The chart shows 10-year averages and also includes the BoE balance sheet.

Unfortunately, this link has broken down over the last 30 years:

Monetarists and other pundits who claim that money printing will lead to inflation are trying to ride a horse that has been dead for three decades now.

So Joachim isn’t worried that the Covid-driven money printing will lead to inflation down the road.

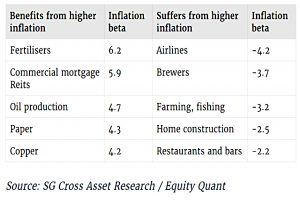

If inflation does arrive, David Stevenson has some ideas on where to invest.

- Writing on CityWire, he looked at a report from SG quant Andrew Lapthorne on the inflation beta of stocks.

Primary businesses feature heavily, with fertilisers, oil production and copper clear beneficiaries given food, metals and oil prices are key reasons for rising headline inflation. Ramping up production is [also] slower than in a factory.

On the losing side, airlines are obvious losers from higher oil prices, but the rest is less obvious. Farming and fishing for example might be a winner from higher food prices, but if their clients (supermarkets) refuse to accept cost push inflation, then margins would come under pressure.

MMT

In a second article, Joachim looked at how MMT – essentially, unlimited money printing and national debt – might work.

From history, it’s probably a non-starter for small countries:

Countries that have run large deficits for too long eventually were abandoned by bond investors and faced either a currency devaluation that triggered inflation and/or a dramatic rise in the cost of debt through higher real interest rates.

But things are different for the US:

Because your currency is the world’s reserve currency, the demand for your debt is always there, both from domestic investors as well as foreigners. Furthermore, because all commodities are priced in Dollars, you don’t get a massive spike in inflation the moment your currency weakens.

So the US can get away with MMT, and so can other countries like the UK, Germany and France:

As long as these countries run deficits that are smaller than the US deficit and as long as their debt/GDP-ratios and other metrics remain better than the metrics of the United States, they can count on enough demand for their government debt to avoid a debt crisis or a significant devaluation of their currency vs. the Dollar.

It’s a version of a race to the bottom where any position other than first is fine.

The countries with real problems are those with low debt, low deficits and an economy reliant on exports – like Switzerland and Sweden:

As long as these countries insist on solid government finances, they will face massive pressures on their home currencies to revalue, which will significantly harm economic growth and prosperity.

Joachim calls this a “world turned upside down”.

Investment trusts

In a departure from his usual focus on AIM stocks, John Lee used his regular column in the for a puff piece on investment trusts.

John is in the House of Lords, and he name-checked his fellow parliamentarian John Baron, who is the author of the FT’s guide to investment trusts (ITs).

John L. got started in ITs when his late father bought his daughters some back in 1982.

- It was just a couple of years later that I bought my first IT.

According to John,

For those who want others to do it [investment] for them, the case for quality investment trusts is overwhelming.

I’m not so gung ho – the IT structure is well suited for accessing illiquid asset classes, but for liquid assets, I prefer a passive core with an active satellite kicker – for which ITs are ideal.

John L. has been selling down his non-ISA portfolio to fund a family house purchase, despite the CGT bill this has produced.

- Sales include Gooch & Housego (all), Nichols (some) and FW Thorpe (some), plus Town Centre Securities and Treatt.

Purchases include Aviva, Christie, Tate & Lyle, STV Group and Kooth.

Growth and stock prices

Buttonwood looked at whether economic growth must boost stock prices.

- The Shiller CAPE is at 30 – lower than in 2000, but higher than in 1929.

The difference between now and 1999 is that then we had enormous optimism about future growth, whereas now we have pessimism (as evidenced by record-low long-term real interest rates).

- Buttonwood says that actually, pessimism and high stock prices make more sense.

Booms driven by technological change (in the 19th century, 1920 or 1990s) tend to end badly for shareholders.

In periods of rapid growth, shares are issued at an even faster rate than the growth in earnings and dividends. Each share has a diminished claim on the larger economy.

This dilution is largely down to technological obsolescence, and the need for new capital investment.

Another problem is that strong growth leads to higher interest rates, which reduces the values of future cashflow (dividends) and hence of stocks.

Until covid-19, American companies had been buying back shares, not issuing more. Discount rates were low, and fell further when the virus struck.

Interest rates have been falling for 500 years, as societies move from subsistence to riches:

Setting aside capital for seed or housing is desirable. But the surplus is scarce so the rewards for doing without today for the sake of tomorrow—the cost of capital—are high.

As economies grow richer, they generate more surplus capital. People are less impatient.

CDC pensions

Willis Towers Watson (WTW), the “global multinational risk management, insurance brokerage and advisory company” has claimed that collective defined contribution (CDC) pensions would be 70% higher than DC and 40% higher than DB schemes (for the same level of contributions).

- CDC pensions have fixed employer contributions as per DC, but investments are pooled and members make no investment decisions.

CDC pensions are not currently legal in the UK, but the law is expected to change next year.

- We reviewed CDC pensions back in January 2018 and concluded that they offered the worst of both worlds – with lower security than DB and less flexibility than DC.

Of course, WTW is cheating – they compared CDC pensions with a DB pot annuitised at retirement.

- Given that an indexed annuity for a 55-year-old man was this morning priced at 1.62%, I think that I could beat that by 70% as well.

The outperformance against DB pensions was explained as follows:

[DB schemes tend] to be constrained by having to protect from the risk of a

sponsoring employer being unable to make good any deficit, and as a result most DB

schemes hold lower proportions of return-seeking assets than a typical CDC scheme.

So they will beat both existing types of scheme by taking more risk.

Crypto-derivatives ban

The FCA has banned the sale of derivatives (CFDs, options and futures) and ETNs that reference crypto-assets to retail investors, on the basis that such investors are unable to reliably value these products.

- The ban doesn’t come into effect until 6th Jan 2021 (when the Brexit transition period is over) – after that point, anyone offering these services to UK investors is likely to be a scammer.

For existing investors in such products, there’s no rush to get out:

Retail consumers with existing holdings can remain invested following the prohibition, until they choose to disinvest. There is no time limit on this, and we do not require or expect firms to close out retail consumers’ positions.

The FCA offers five reasons for their actions:

- inherent nature of the underlying assets, which means they have no reliable basis for valuation

- prevalence of market abuse and financial crime in the secondary market (eg cyber theft)

- extreme volatility in cryptoasset price movements

- inadequate understanding of cryptoassets by retail consumers

- lack of legitimate investment need for retail consumers to invest in these products

I agree with the first four, but in general, investors should be free to buy what they want, on a caveat emptor basis.

- And indeed, ETNs are probably the least of many evils in terms of obtaining that exposure.

The ban comes at the end of a “consultation” process in which 97% of respondents opposed a ban, arguing that:

- cryptoassets have intrinsic value

- retail consumers are capable of valuing cryptoassets

- a prohibition was disproportionate and other measures could achieve our objectives

- our CBA did not represent accurately the costs and benefits of banning cryptoderivatives sold to retail consumers

The FCA claims that retail investors will save £53M from the ban, but that’s like saying consumers would save £18 bn a year if we banned the sale of furniture.

- I imagine we would find something else to spend the money on.

In this case, the obvious alternative would appear to be a direct investment in crypto-assets, rather than derivatives.

- The position of spread-betting on crypto prices is unclear.

Quick Links

I have seven for you this week, of which six are from The Economist:

- The Economist looked at how a digital surge will reshape finance

- And wrote about how Ant Group shows that fintech has come of age

- And looked at how best to regulate Google and the rest of big tech

- And explained why Rio Tinto and China are at loggerheads

- And claimed that covid-19 has put wind in the sails of shipping companies

- And covered the problems faced by cinemas.

- Meanwhile, the UK Value Investor revealed his best & worst stocks through the pandemic.

Until next time.

So another tick box consultation exercise – quelle surprise!

Yet, there are still loads of opportunities to buy genuine tat and junk.