Lazy Portfolios – A Framework

Today’s post is the first in a series of Lazy Portfolios. We’ll be putting together a framework which allows us to examine the strengths and weaknesses of such portfolios.

Contents

My portfolio

Regular readers will be aware that I have a rather complicated set of portfolios.

At the simplest level, there are four:

- A passive global multi-asset portfolio made mostly from low-cost ETFs.

- An active portfolio of UK stocks.

- A multi-asset trend following portfolio, and

- A factor fund / smart beta portfolio.

Even if we just look at the passive portfolio, it’s far from simple.

- I use 54 asset classes, though 17 of these are covered by non-listed assets (mostly property and defined-benefit pensions, but also cash and VCTs).

So I actually invest in a minimum of 37 funds on a passive basis (I double up in some asset classes).

The reason I have so many is that my allocation is based around volatility parity (mean-variance optimisation, as in the academic literature).

- Anything that can reduce volatility without significantly impacting returns should be added to the portfolio, to improve its Sharpe Ratio (SR – see below for more on this).

Note that this doesn’t mean that I believe in the Efficient Markets Hypothesis, only in correlations and returns.

- The other key assumption that I support is that past returns (of an asset class) are indicative of its long-term future returns.

- In the short-term, things like momentum and mean reversion will obscure this picture.

A true volatility parity portfolio is quite safe, with more than 60% in bonds.

- In order to hit my target / fail safe withdrawal rate of more than 3% pa, I need to cap the bond allocation to 20%.

- This allows for 75% stocks and 5% True Alternatives.

I also tweak the default allocation to accommodate global ITs and themed funds, and to support some home bias.

- I plan to live and spend in the UK, so I want to limit the FX exposure of a fully global portfolio.

- I’m also keen to avoid the “away bias” of very high default allocations to the US.

Lazy portfolios

Lazy portfolios are pretty much at the opposite end of the spectrum.

- Typically they involve between two and four funds.

Their key advantage is simplicity, but we’ll look at the pros and cons in more detail below and in future articles.

At this point, I envisage six articles in this series:

- This framework

- Another post on what we should be looking for in diversifiers

- One and Two fund portfolios

- Three fund portfolios

- Four fund portfolios

- Portfolios with more than four funds.

I must confess to being slightly surprised by the popularity of Lazy Portfolios, and of “simple” investment solutions in general.

- I don’t see the big difference between buying four ETFs and a dozen, or even 50.

To quote Einstein:

Everything should be made as simple as possible, but not simpler.

Obviously lots of people disagree.

Lazy portfolios are particularly popular with investors new to the stock market, and those with very small portfolios (let’s say less than £20K).

For those afraid of the volatility of stocks, they promise “all-weather” performance and smaller drawdowns.

- But this is often produced through a low allocation to stocks, which will lead to lower performance in the long-run.

Lazy (simple) portfolios lend themselves well to regular monthly investment of small sums.

- Dollar cost averaging is often touted as an advantage of this approach, but for portfolios with a high allocation to stocks, this doesn’t work (since stocks usually go up).

- And you could just as easily collect a few months contributions together and rotate your investments around a larger collection of funds.

And as your portfolio size increases, the advantages of lazy portfolios become disadvantages.

- Who wants to hold £1M in two funds?

Let’s park this debate for now, and look at the issues involved in analysing portfolios.

Returns

Probably the most important feature of a portfolio is its expected return.

- This is why we are investing in the first place – to turn what we have now into what we will need in the future.

The big drivers of returns are stocks, so we need to look at the stock allocation first.

- Equity-like diversifiers will show positive returns, but lower than stocks.

Next down are bonds and the bond-like diversifiers, which have lower returns still.

At the bottom are the true alternative assets, which often have an insurance function, and may even produce negative real returns over time.

- Gold falls into this category.

As well as asset classes, we need to be aware of factors for outperformance, particularly in stocks.

- These include small size, value, momentum and low beta.

Volatility

The second key feature of a portfolio is its volatility – the variability of returns.

- This is often used a a proxy for risk, which is better expressed as the probability of permanent loss.

But at an emotional level, volatility as a proxy for risk makes sense.

Investors of a robotic disposition can simply take a high allocation to equities and wait out any crashes.

- Most people find this very difficult, and like diversified portfolios with less volatility (see below).

Note however that the least protection from diversification is available when you need it most, in a severe stock crash.

- At this point, correlations typically increase across the board.

Trade-offs

The trade-off between returns and volatility is helpfully simplified by the finding that risk-adjusted returns are had to distinguish across asset classes.

- This means that returns are broadly proportional to volatility.

- In order to get good returns, you need to accept more volatility.

This means in turn that correlations between assets – and in particular, correlations with the primary return-producing asset, stocks – are key.

- Adding poorly correlated assets can reduce the volatility of a portfolio without significantly affecting returns.

This diversification effect is pretty much the only free lunch in investment.

Comparison portfolios

Using the diversification approach leads to three common portfolios:

- The Max SR portfolio (which is volatility optimised)

- We’ll simplify this to be 60% bonds, 40% stocks, which is too conservative and low return for most people.

- The Max Return portfolio, which is 80% stocks and 20% bonds

- Note that (1) I swap 5% of stocks for True Alternatives, to leave me with 75% stocks

- And (2) nobody needs 100% stocks.

- A Compromise portfolio suitable for a wide range of people,

- This might be 60% stocks, 35% bonds and 5% Alternatives.

We’ll compare the lazy allocations to these three models.

Other issues

There are two other key issues, which are related:

- Home and / or Away bias, which looks at the extent to which the portfolio is allocated to the home country (or indeed, to another country)

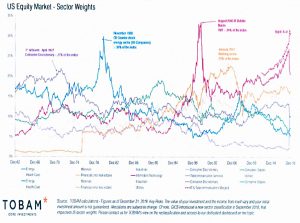

- Market cap weighting, which is the default way of constructing low-cost index funds.

- This leads to the danger of over-allocation to a large market like the US.

Home bias is a complicated topic, but there are several reasons why a UK investor might want more than 6% allocation to the UK:

- Avoiding FX risk for those who plan to earn, live and spend in the UK

- Information advantages and lower investment costs

- Accommodation of active strategies, which are best implemented using UK stocks.

Vanguard publish regular research in this area and conclude than UK investors can safely have as much as a 50% UK weighting.

- I currently have a 22% UK target weighting in my passive portfolio, though I have previously been closer to 30%.

Market-cap weighted portfolios will have a dangerous overweight to the US, which now makes up around 55% of the global equity market.

- Market-cap weighting is the worst way to systematically allocate money as it over-weights the most expensive parts of a portfolio and underweights the cheapest.

The simplest alternative approach is equal weighting, which leads to the max SR portfolio.

- After capping bonds to get to the Max Return portfolio, the US allocation would be around 19% rather than 55%.

Conclusions

Portfolios are no longer very hard to implement or maintain, and so the primary advantage of Lazy Portfolios has been gradually undermined.

When looking at a portfolio, we need to examine:

- returns, including exposure to outperformance factors

- volatility

- home and away bias

- the cap weighting problem

- Together, we can file the last two points under concentration risk

In the next article, we’ll dig into diversifiers.

Until next time.