Lightyear

Today’s post looks at a new trading app – Lightyear.

Contents

Press release

A press release caught my eye this morning – “Fintech veterans launch new trading app”.

- I usually click on links like this, and usually, I am disappointed.

But perhaps not this time.

The app is called Lightyear and it has just started onboarding UK clients from a 5000-strong waitlist.

- They plan to roll out to the rest of Europe during 1H22.

They have also just raised another $8.5M, taking their total funding to $10M.

Lightyear (LY) is run by a couple of guys from Wise (formerly Transferwise).

- It also has employees from Revolut and from Robinhood’s aborted UK launch team.

Founder Martin Sokk said:

10 months ago Lightyear was just an idea, so we’re really excited to have raised a total of $10m, hired a world-class team and to be launching the first iteration of our app.

There are more people in Europe investing now than ever before, but there’s still a very long way to go. Our goal is to give all of Europe access to the world’s markets without hidden fees and to make investing cognitively easy.

What is it?

For my purposes, Lightyear is a free trading app.

- There’s also a multi-currency account attached, which will be useful for investing in US stocks.

The app has elements in common with Freetrade, Trading 212, Stake and Wise.

- I’ll do a quick comparison to each of these at the end of the article.

Fees

The fee situation is refreshingly simple:

- There are no commissions, even for fractional shares.

- There are no account fees.

- There is a currency conversion fee of 0.35% (moderately competitive) but the first £3K each month is free and converted at the interbank rate.

Investment universe

From the Lightyear blog:

On Lightyear, you have access to over 1,000 global stocks. Predominantly the US markets (NASDAQ and NYSE), with global stocks available through ADRs.

I couldn’t find a list of the actual stocks, but let’s assume the S&P 500 plus NASDAQ, which is fine for a UK investor looking to add a US account.

Here are there on the website, there are mentions of “ETFs for professional investors” as well.

- When I find out what this means in practice, I’ll let you know.

Security

From the help page:

Your USD account, which can include your investments and any dollars held in cash, is protected up to the value of $500,000 under the Securities Investor Protection Corporation (SIPC). Your money is held in separate accounts with tier one banks.

$500K should be more than enough.

Further to the idea that this is a genuine US account, there are “pattern day trader” restrictions:

You will be considered a pattern day trader if you “day trade” 4 or more times within 5 business days and your day trading activities are greater than 6 percent of your total trading activity for that same 5 day period. A “day trade” is defined as buying then selling or selling short, then buying the same security on the same day.

You need $25K in your account in order to day trade.

Website

There’s no website at the moment, just the phone app.

Tax-sheltered accounts

There’s only a GIA at the moment.

- It sounds like an ISA is in the pipeline, but there’s no sign of a SIPP.

Account size

The minimum account size is £1, but I want to talk about the maximum.

GIAs are hemmed in by the UK tax system.

- You pay capital gains tax on annual (realised) profits of £12.3K

- You pay income tax (strictly, a dividends surcharge) on income over £2K pa

The S&P 500 yields much less than the FTSE All-Share – it’s 1.3% vs 3.3% at the moment.

- That gives a natural cap for a US-focused GIA of £154K, which is not bad.

The US withholding tax complicates this, but let’s ignore that for now.

- I don’t think many people will want to put £150K into a brand new trading cap.

The capital gains picture is more nuanced.

- For a £150K account to generate £12.3K of gains, it needs to add 8%.

If your annual target is 10%, you might prefer an account size of £120K. (( I’m not saying that 10% is achievable, only that a lot of investors I meet would see that as an absolute minimum annual return ))

- At £3K of free FX per month, it will take you more than three years to reach £120K.

Let’s call it three years if we add in the 10% pa in gains.

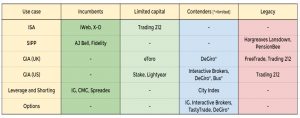

Comparison to other apps

Let’s look at the competitor apps:

- Like Freetrade, Lightyear’s free account has a restricted universe of stocks.

- But LY has US stocks, which are probably more useful within a GIA.

- Like Stake, LY offers a USD stock account.

- But LY has £3K of free FX trades each month.

- T212 lets you invest in US stocks, but there is a small FX charge on each transaction.

- LY bypasses this.

- Wise lets you hold cash in multiple currencies.

- LY has fewer currencies (just £, $ and €) but also has £3K of free exchange each month.

So I think Lightyear deserves a place on my broker map:

I’ve signed up and added my name to the waitlist – my position is just above 5,000.

- I’ll be back with an update once I’ve managed to play around with the app.

Until next time.

What have I missed – at £3k per month FX free; how do they make any money?

Well, it’s a US account, so I assume they will sell order flow. And presumably, some people convert more than £3K per month (I probably will to begin with). I think the actual cost of trades is very low though, so there isn’t much in the way of marginal costs to make back.

I’m not clear whether any of the free trading services make money directly from the free account, but most operators (T212, Freetrade, eToro) seem to use it as a loss leader for more lucrative services.

Thanks. Look forward to hearing how this progresses. Personally, I would be a touch nervous about it being non UK.

Perhaps I wasn’t clear – it’s a UK company but a US account. That’s primarily what I use our GIAs for. And a dollar account works better because you don’t have FX on each trade.

As for risk, our GIAs are 2% of net worth, and protections in the US are better than in the UK ($500K of insurance).

Perhaps I am just overly suspicious/cautious, but that sounds a bit like getting the best of both worlds. As a UK company are you really entitled to US protection limits, or are they just stated as ‘marketing literature’ – for want of a better phrase?

Actually, maybe it does, see: https://www.sipc.org/for-investors/what-sipc-protects