InvestEngine

Today’s post looks at a new ETF platform called InvestEngine.

InvestEngine

InvestEngine (IE) is a new (( to me – apparently it launched in 2019 )) ETF platform that looks like it might warrant a place on our broker map.

IE offers three types of accounts, each with a minimum investment of £100:

- ISA

- GIA

- Company account

There’s no SIPP as yet.

- We’ll look at the business account in more detail later.

Within the accounts, you can choose between a range of 150+ ETFs within the following categories:

- Bonds – developed gov, emerging gov, corporate

- Equities – US, UK, Europe, Japan, Asia, Emerging, Global

- Real Estate – UK, developed, Asia, global

- Private Equity

- Commodities – gold, silver, platinum, palladium

- Thematics – tech, healthcare, ESG

The minimum investment in each ETF is just £1.

You can’t access individual shares via IE, and there are no investment trusts.

DIY vs managed

IE offers managed portfolios for growth and income, and also allows you to do your own investing.

- The DIY option includes setting up your own portfolios which can be automatically rebalanced when you add more cash to your pot (like the pies available on Trading 212).

- There’s also “one-click rebalancing” without adding any new cash.

The managed portfolios are not visible until you sign up and take a risk assessment, so I can’t tell you in detail what’s in them.

- My understanding is that there are 10 growth portfolios and 3 income portfolios (targeting 1.5%, 2.7% and 4% pa).

Fees

The main attraction of IE is its low fee structure:

- no set-up fees

- no withdrawal fees

- no dealing fees

- no custody fee for the ISA

- no management fee for DIY investing

- 0.25% pa for managed portfolios

You also pay the underlying ETF cost (average 0.15% in the growth portfolios and 0.25% in the income portfolios) and the ETF market spread (estimated at 0.07% pa).

- It remains to be seen if the managed portfolio fees are enough to keep IE afloat, or whether more charges will be introduced eventually.

Business Account

The company account comes with FSCS cover for small businesses (whatever that is) and IE will even supply you with a free LEI number (Legal Entity Identifier – required for company investing) for the first year.

- The account is open to limited companies and partnerships (but not sole traders).

The IE ETFs are domiciled in Luxembourg and Ireland, so any dividends count as overseas interest.

- This could be important because it might mean that corporation tax is payable on them (UK dividends are generally not taxable) – IE is not clear on this point.

- Non “micro-entities” will also need to declare unrealised gains/losses from ETFs with more than 60% in bonds/cash.

There’s also the risk that your company could be re-classified as a trading company.

- This will affect the use of Entrpreuneurs’ Relief (which used to be a £10M exemption, but has now been cut to £1M and renames Business Asset Disposal Relief).

- Trading companies also don’t qualify for Business Property Relief (an IHT exemption).

Security

All of the accounts have FSCS cover, and the website bigs up the separation of cash holdings and investments, and IE’s level of online security.

Limitations

The main limitation (other than the lack of a SIPP) is the restricted list of 150 ETFs.

- Deals are also batched and take place between 2.30 pm and 4.30 pm each trading day.

Prices within the app are also only updated twice per day (at 10 am and 2.30 pm).

Promotions

IE has a £50 promotion for anyone who signs up before the end of 2021.

- It also has a £25 referral scheme (£25 for both the referrer and the referee).

To access the promotions, you need to put in at least £100 of your own money within 30 days of opening the account.

- You also need to remain invested for 12 months.

For the referral bonus, both parties need to fund with £100 and keep it with IE for a year.

If you want to help me out, you can use my referral link when you sign up:

Conclusions

InvestEngine looks interesting.

- It’s a lot like the free version of FreeTrade, but with more ETFs, no ISA fee, a company account and 1-click rebalancing of personal portfolios.

I plan to open a business account in the near future.

- If that goes well, I will look at using IE for our ISAs in April 2022.

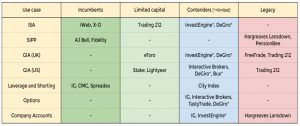

Here’s our updated broker map:

Until next time.