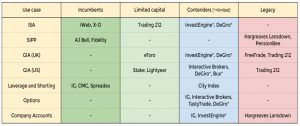

Shares App

Today’s post is about another free share trading app, this time called Shares.

What am I looking for?

Before we dig into Shares, let’s think about what I want from (yet another) brokerage account.

My TradFi incumbents are:

- SIPPs – AJ Bell (£100 pa) and Fidelity (£45 pa for a restricted list of ETFs)

- ISAs – iWeb (£5 per trade) and X-O (£5.95 per trade)

New brokers would have to beat these on cost.

None of the new guys seems interested in SIPPs, so for me to use them for an ISA they need to have some/most of the following:

- no annual fee

- FSCS protection for £85K

- transaction costs below £5

- a good range of investments

So for example Freetrade fails on the restricted investment list and the £36 pa fee.

- Whereas Trading 212 has a good range and no annual fee

It’s worth noting at this point that I am in the market for multiple ISAs because I don’t want any individual account to grow beyond the £85K insurance limit.

There are restrictions on what you can put in ISAs, so I like to use taxable accounts (GIAs) for these exotics:

- US shares, using a $-denominated account to minimise FX fees

- crypto

- options

- leverage

- social (copy) trading

- pies (user- and platform-defined collections of stocks/ETFs which facilitate copy trading)

Any of these features would be attractive in a newcomer.

The story so far

Let’s run through the cheap brokers I have looked at so far:

- DeGiro

- Pros: cheap enough (<£2 per transaction)

- Cons: no tax shelter, EU protection limited to <£20K

- Verdict: I don’t use it anymore.

- Freetrade

- Pros: free transactions

- Cons: £36 pa for an ISA, restricted stock list, FX fees and no $ account

- Verdict: I don’t use it anymore.

- Trading 212

- Pros: free transactions, free ISA, pies

- Cons: FX fees and no $ account

- Verdict: I use it for an ISA

- eToro

- Pros: crypto, social trading, $ account

- Cons: fees are not the lowest for some products

- Verdict: I use it for a GIA (mostly crypto)

- Stake

- Pros: free transactions, $ account

- Cons: US stocks only

- Verdict: I use it for a GIA (US stocks)

- LightYear

- Pros: free transactions, $ account

- Cons: US stocks only, no tax shelters

- Verdict: I use it for a GIA (US stocks)

- InvestEngine

- Pros: free transactions, free ISA, company account, pies

- Cons: restricted ETF list

- Verdict: I use it for an ISA and a company account

To summarise:

- I use T212 and InvestEngine for ISAs

- I use InvestEngine as a company account

- I use Stake and LightYear as GIAs for US Stocks

- I use eToro as a GIA for crypto

- I don’t use Freetrade or DeGiro

I heard about Shares because they had an affiliate promotion running as we headed into the end of the tax year.

- Lots of people were posting their links on social media.

This is appropriate, since Shares sell themselves on their social aspects.

- Trading 212 and Freetrade have some of these features, but I haven’t explored them too much.

eToro also launched on its social aspects, but I think a lot of people are now attracted by its support for crypto.

Social investing is a nice idea, but in practice, the problem is finding a peer group.

- I’ve been on Reddit for 16 years and Twitter for 8, and while the level of discourse was never great, social media is now very much a case of “an empty vessel makes the most noise”.

- It’s the same on eToro – the leading “experts” (strictly, peers) are usually people with just a few years of investing experience.

So while my idealised version of social would be nice to have, it won’t outrank low costs and a wide range of instruments.

The Shares website is very attractive, but it’s light on detail.

The firm’s mission statement is:

We created Shares to satisfy everday people’s need for community, ease of investment, learning and long-term financial wellbeing.

What I did manage to discover was:

- You can only trade US stocks, albeit in fractional form

- The underlying broker is Alpaca Securities

- There’s no sign of an ISA (let alone a SIPP)

- Transactions are free

- FX charges are 0.4% each way (there’s no $ account)

The regulatory regime is not explicitly declared but the complaints procedure refers to the FCA (and also, confusingly, to KiFID, the Dutch Institute for Financial Disputes).

So Shares don’t earn a slot on my dance card:

- They don’t offer an ISA or crypto

- They charge FX fees on US stocks (unlike Stake and LightYear)

Articles

Since its own website doesn’t give too much away, I looked around the web for articles on Shares.

- They were mostly about Share raising funding (including from Peter Thiel) and often described Shares as a “social and investing” app.

The firm has raised at least $50M to date.

Shares is based in Paris and was founded in 2021 by Benjamin Chemla and François Ruty.

We’ll close with a look at my broker map, which hasn’t changed.

That’s it for today.

- We didn’t find a new broker, but the search continues.

Until next time.