Mode

Today’s post is about digital broker Mode.

The Holy Grail

Throughout 2021, I’ve been looking for a cheap way to access crypto.

- My plan was to reach a 0.5% allocation by the end of 2021 and then 1% or more during 2022.

At the start of the year, the FCA put a dent in my crypto trading plans when it banned crypto derivatives (including spread bets) for retail investors.

- But that still left buy and hold.

I looked at all of the crypto brokers but was put off by the high commissions (usually 1% or more each way).

- So I began with proxies like Blockchain ETFs, miners, Microstrategy and Coinbase.

Recently I’ve opened direct holdings through eToro, simply for convenience (since I was trialling the social trading features of eToro).

- I’m at a 0.3% allocation at the moment.

But now we have a free broker, for a time at least.

I looked at Mode over the summer, when their fees were 0.99% each way.

- But for the rest of 2021, they have waived the fees.

Of course, the fees will be back in 2022, and I’ll need to pay to get out.

- But I’d still like to take advantage unless I can uncover some deal-breakers.

Why?

Here’s the explanation for the move from the Mode blog:

We believe Bitcoin is the future. It will be at the center of all financial activity for the next two to three decades. With more participants in Bitcoin, there is less volatility, which is in turn attracting more retail and institutional investors and further promoting its stability.

We also believe that a number of obstacles remain which are slowing the adoption of the cryptocurrency and deterring cautious people from buying into Bitcoin. In fact, one of the top reasons for not buying into cryptocurrencies was ‘not knowing where to start.’ Other customers are said to be deterred by the fees associated with trading Bitcoin, which can be as high as 4.99%.

Our goal is to remove barriers associated with Bitcoin, and ensure we’re making it more appealing for new and existing Bitcoin holders, to confidently enter the Bitcoin world and maximise their Bitcoin holdings. The elimination of fees may incentivise newbies to take the first step into the market. Mode is taking this critical time to tap into the growing Bitcoin market, and expand it.

Mode

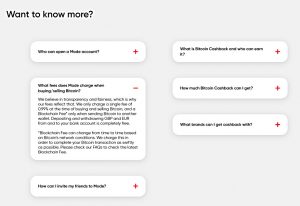

Here’s the Mode offer in a nutshell:

- UK-based and listed on the LSE (as MODE)

- It’s a micro-cap (£39M) whose share price has been tanking through 2021

- Simple

- Once you’re through the sign-up, the app is straightforward

- It’s easy (and free) to add sterling (through a TrueLayer lookalike) and convert that to Bitcoin

- Secure

- Mode is FCA regulated and its crypto is insured up to $100M

Mode holds your Bitcoin in custody with market leading crypto custodian, BitGo. The majority of our customers’ Bitcoin is stored in ‘cold storage’ which is not accessible from the internet, and is therefore protected from cyber attacks. Crypto funds held in cold storage with BitGo are also insured up to US$100M, by Lloyds of London.

Additionally, all GBP funds are held with our FCA authorised and EMI licenced partner Modulr, who hold an account in the Bank of England’s Real-Time gross Settlement (RTGS) system, allowing them to directly settle with participants and remove their reliance on third party providers.

All is good so far.

Payments

Mode also pushes itself as a payments app.

- You load in your cash to Mode or use a linked bank account as your source of funds.

This sounds like a debit card to me, which means no Section 75 protection on large purchases, but I know lots of people like to pay for smaller items with their phones.

- Even then, wouldn’t an Apple or Google app feel safer?

So I don’t really get this.

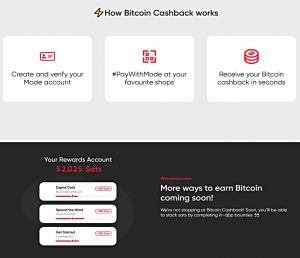

Crypto cashback

The sweetener for using Mode as a payment app is that you can receive cashback in the form of Bitcoin.

The website lists thirty retailers offering crypto cashback, but unfortunately, I don’t use any of them.

The plan

I didn’t find any deal-breakers, so I went ahead and opened a Mode account.

- I’ve moved cash into it, and I’ll buy some BTC next week.

Here’s my crypto plan at the moment (to be reviewed at least once a year):

- Get to 0.5% allocation (of total net worth) by end of 2021

- Get to 1% by end of 2022

The allocation has three parts:

- (UK) ETFs – 33%

- Listed proxies (usually in the US) – 33%

- Direct holdings – 33%

- The rough allocation for these will be 50% BTC, 25% ETH, 25% others.

The direct holdings will be split across five or more brokers, of which two will be eToro, and now Mode.

- I’ll have an update on how things are progressing in the new year.

Until next time.