Bitcoin Investment Thesis – Fidelity

Today’s post looks at a recent report from Fidelity on the investment thesis for Bitcoin.

Contents

Investment Thesis Series

The report – published in October 2020 – comes from Fidelity Digital Assets (FDA), a subsidiary of Fidelity that I hadn’t come across before.

It’s apparently part of a series of reports:

To examine the perspectives that are driving interest and investment in bitcoin today and those that may evolve and gain traction in the future.

The first report in the series (from July this year) looked at bitcoin as an aspirational store for value.

- That’s a bridge too far for me at present, but we might revisit it in the future.

Today’s report looks at Bitcoin as an alternative asset class – something that I am interested in.

International Digital Assets Survey

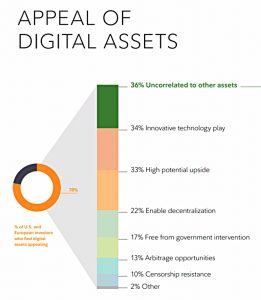

FDA also carries out an annual survey of institutional investors and in the 2020 report, 65% of investors believed that digital assets belonged in a portfolio.

- 60% of those investors thought that crypto should be considered alongside other alternative investments

This is not surprising, given that the primary attraction of digital assets is their lack of correlation.

- Note also that they are seen as having high potential upside, which is true of some but not all alternatives.

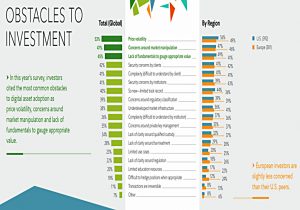

The list of obstacles to investment is also interesting:

- Price volatility comes top, but volatility shouldn’t be an issue with a diversifying alternative asset

- Market manipulation is second, and lack of fundamental valuation methods is thirds – two more concerns over price.

- My own issue with crypto – security, in the sense of no trusted providers who I can rely on to return my money when I need it – is fourth.

Alternative investments

Alternative investments can be anything that is not public equities, investment-grade bonds or cash.

The goals for alternatives are:

- Lack of correlation with mainstream assets

- Access to risk exposures and sources of return outside mainstream assets

One important point is that alternatives need not provide excess returns (and indeed, compared to listed equities, most will not).

The main downside for the key alternatives is a lack of liquidity, though this can be an advantage during times of crisis if it comes with a lack of marking the asset’s price to market.

The main alternatives at present are private equity (leveraged buyouts) and venture capital, property, infrastructure, commodities (including precious metals) and hedge funds.

- FX futures and other derivatives (such as structured products) can also be seen as alternatives.

- Royalty streams (eg. from music) and contingent returns (eg. litigation funding) are also emerging as alternative assets.

Alternatives are estimated to make up 12% of the global investible market – up from 6% 15 years ago – though many private investors will have a lower exposure than this (other than to property via their main residence).

- This is partly down to a hunt for yield in the wake of lower interest rates, but also because of the publicity surrounding the success of the university endowment model of investing (which relies on a high proportion of alternatives – an average of 43% allocation).

Pensions funds have also shown an increasing appetite for alternatives, and the delay in startups transitioning to IPOs has forced institutional investors to look at private markets.

Bitcoin

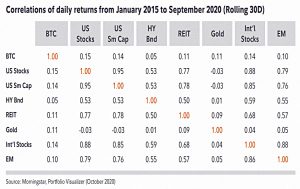

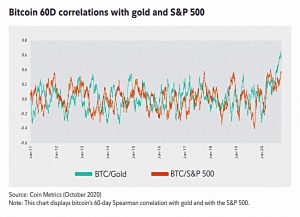

As we saw above, bitcoin ticks the main box for alternative investment in that it is not highly correlated to mainstream assets.

- From 2015 to 2020, BTC’s average correlation to other assets was just 0.11

BTC suffers from a lack of yield generation, but low interest rates (and hence low bond yields) minimise the opportunity cost from holding bitcoin.

Risk factors

There are two factors to consider when assessing this low correlation:

- Are BTC returns driven by the same factors that drive other asset classes, or are they different factors?

- Is the lack of correlation explained by the lack of overlap between market participants (typically young retail investors for BTC)?

- If so, correlations could increase as institutional investors come on board.

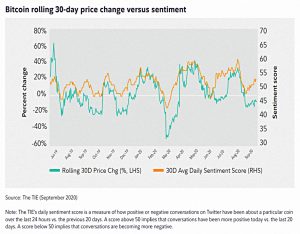

The answer to the first question appears to be “No”.

- Studies have found that the BTC price is driven by momentum, sentiment and investor attention (particularly Twitter posts and Google searches).

“Fundamentals” like the health and growth of digital assets and networks don’t seem to be a factor.

- Note also that bitcoin fundamentals are not much affected by the Covid pandemic, since there are no cash flow or production impacts).

Demand shocks, impacts to corporate profitability and an increase in the money supply are also not negative for BTC.

- And if BTC comes to be seen as a “safe haven” asset, they could be positive.

Convergence

The second question is much harder to answer, but convergence remains a risk:

If the lack of consensus on bitcoin’s narrative persists, it may continue to be uncorrelated with all other assets. On the other hand, if bitcoin’s narrative converges on a single thesis, its correlations to other assets with similar investment cases could converge as well.

BTC’s correlations with gold and the S&P 500 have increased during 2020, but this could be down to the pandemic and the response to the crisis.

- A rush to gold and tech stocks could have similar drivers as bitcoin demand.

In the past, bitcoin has experienced brief periods of elevated correlations with particular assets, including gold and equities, but the relationships break down over longer time horizons.

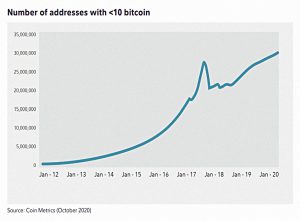

To measure the extent to which bitcoin remains a retail phenomenon, the report looks at the number of BTC addresses which hold less than 10 BTC (around £100K as I write).

- The number of such accounts has been increasing, so BTC as a largely retail phenomenon would appear to be alive and kicking.

We saw evidence of the contrasting behavior of retail and institutional investors

during the March 2020 sell-off.Retail-focused companies like Coinbase, River Financial, and Simplex reported record levels of retail investors buying the dip as traders and institutional investors unwinded [sic] their positions.

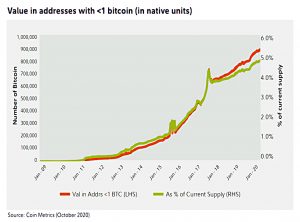

However, the extent of the downturn suggests that even though there are many retail holders, nonretail holders account for significantly higher levels of bitcoin.

Addresses with less than 1 BTC (around £10K as I write) control less than 5% of the total supply of bitcoin.

Acceptance

BTC definitely has greater acceptance amongst younger generations, and so as these generations control a greater proportion of global wealth in the future, the acceptance of bitcoin and crypto generally can be expected to grow.

- The report draws a parallel with the way that emerging markets were gradually accepted by investors in the 1980s and 1990s.

Portfolios

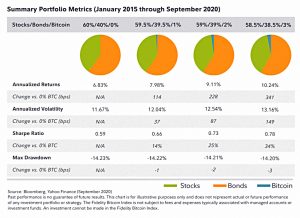

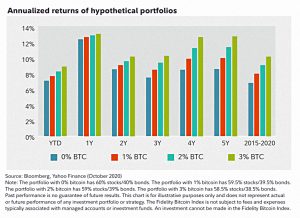

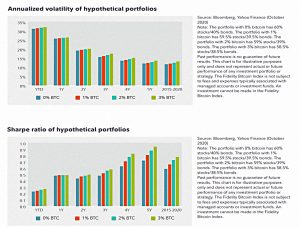

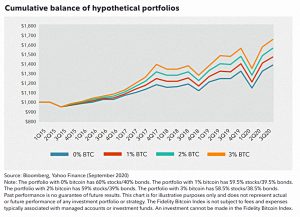

To examine the effect of bitcoin as an alternative asset, the report looks at the effect of adding BTC allocations of 1%, 2% and 3% to a traditional 60/40 stock/bond portfolio.

- The BTC allocations are stolen equally from stocks and bonds, not in a 60/40 split.

- Commissions and fees were ignored, and quarterly rebalancing was used.

The period in question is Jan 2015 through Sep 2020.

- Bitcoin had a good run during this period, so its addition boosts the returns of the portfolios.

It also increased volatility, though not by enough to impact the Sharpe Ratios.

And max drawdowns also decreased slightly.

Conclusions

It’s a reasonable demonstration of how BTC can help a portfolio, even at small allocations – but exceptional returns are the key factor here.

- On the other hand, the extra volatility was less than commensurate with the higher returns and so the Sharpe ratio improved (and the drawdowns reduced slightly).

It’s important to note that returns could be lower (or negative) in the future, and that correlations with mainstream assets might increase.

But if I could find a suitable (safe) way to access BTC over the medium term, I would be interested in bitcoin as an alternative asset.

- As far as I know, this isn’t possible at the moment here in the UK.

Until next time.