State of UK Crypto 2021

Today’s post looks at a report from Gemini on the State of UK Crypto in 2021.

Contents

Gemini

Gemini is a crypto broker founded by the Winklevoss twins of Facebook fame.

- They will let you buy crypto from the UK via their app, but they charge a 0.5% commission each way, which is a little steep for me.

Although the report is called State of UK Crypto 2021 – and was published in March of that year – the research was carried out in October 2020, when 2000 representative UK adults were surveyed.

- This is before the tremendous bull run in bitcoin towards the end of last year, which means that the market dynamics might have changed by now.

State of UK Crypto

Previous surveys on this topic were carried out by the FCA.

- In 2018, only 3% of respondents had half crypto.

- By 2019 this was up to 5.3%.

In 2020 this figure was up to 13.5% – a 152% increase.

- Of these, only 3.7% were active holders, with 9.8% being ex-holders.

Gemini picked out five themes from the survey responses:

- Demographics are more diverse than expected

- So are education, employment status and income levels

- More investors are based outside London than previously

- Crypto investors are largely early adopters of tech, and

- Crypto investors are saving more, despite the Covid pandemic

Demographics

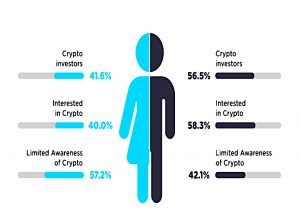

Women are up from 20% to 40% of crypto investors.

But they make up a lower proportion of the bigger investors.

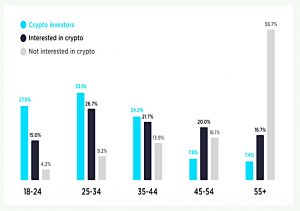

Crypto investors remain young.

- Most people my age are not interested.

Crypto investors are:

- more likely to have dependent children

- massively more likely to live with housemates

- less likely to own their own home

- less likely to be in a relationship

Gemini sees this data as progress, but apart from more women getting involved, crypto folk are still likely to be young, single and in shared housing.

Work, income and education

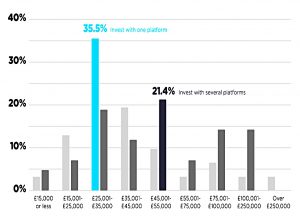

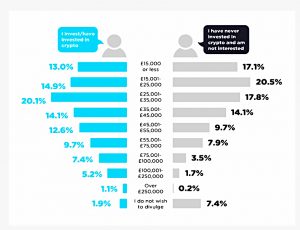

Crypto penetration was greatest at middle-income levels (£25K pa to £55K pa).

Additionally, 70.6% of previous or current investors with incomes exceeding £100,000 typically own more than £10,000 in cryptocurrency, while over half (58.8%) hold more than £50,000 in cryptocurrency. Interestingly, this group is also predominantly male (82.4%) between the ages of 35-54 (52.9%).

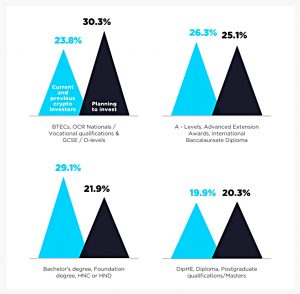

Educational levels are now more evenly distributed than previously:

As is the employment sector (though IT and telecoms remain the largest sector):

The majority (64.4%) of current UK crypto investors are employed full time, for 40+

hours per week. Only about one-tenth (11.0%) of current investors are employed part-time.

Geography

Crypto investors are spread out across the entire country and typically live in urban or suburban rather than rural areas.

London remains the most over-represented area, with the West Midlands next.

- The South East has the most people who are not interested in crypto.

Early adopters

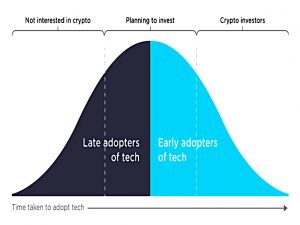

Cryptocurrency investors are exceptionally early adopters of technology, including green and smart technologies.

Cryptocurrency investors are 30-50% more likely to have smart appliances, home assistants, smart security, and accessories around the home.

Savings

One-third of all UK respondents said they planned to increase investments

over the coming 12 months. However, among current and previous cryptocurrency

investors, nearly half (47.4%) plan to increase their investments over that same timeframe.

Crypto investors were also more actively saving, with two-thirds increasing their investments in the previous six months, compared to one-third of all respondents.

Conclusions

Gemini focuses on the increasing diversity of crypto investors but acknowledges that the data also reinforces some stereotypes (eg. early tech adoption).

- Some of the new trends could be Covid-related (people moving from high-cost cities to rural areas, and some people having excess disposable income to invest, plus the free time to invest it).

They end on an upbeat note:

We are seeing momentum growing, with consumer interest supported by increasing activity from institutional investors, the more positive tone of news stories and the proliferation of easy, safe and secure platforms to invest.

Onward and upward!

Until next time.