Own the World 2 – Amazing facts and crucial themes

Today’s post is our second visit to Andrew Craig’s book Own The World. We’re going to look at “two amazing facts about finance” and “two crucial investment themes for today”.

Compound interest

The first of Andrew’s amazing facts won’t detain us for long, as we are already familiar with it.

- It’s compound interest.

Those who understand compound interest are destined to collect it. Those who don’t are doomed to pay it.

Andrew attributes this quote to the founders of the Motley Fool (who have famously written on this topic), but it’s more usually given to Einstein.

Andrew doesn’t have much to add to our understanding of compounding, but he does confirm our position that The Best Time To Start Is Today.

I would also mention that Andrew uses some fairly heroic rates of compounding (8% pa, right up to 20% pa) to illustrate his thesis, though at least he partially admits this:

There is no question that statistically it is hard to achieve a reliable 20, 12, 10 or even 8 per cent return on your money.

That said, it is entirely possible to achieve them if you are prepared to look at the world in a certain way and learn a little.

Here’s his compounding table:

Here’s a similar table for the then prevailing ISA allowance of £15,240:

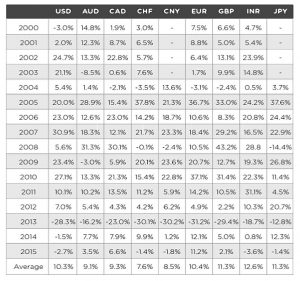

And here’s his table of famous investors who have achieved these rates:

These are some of the best investors in history, and for Andrew, they achieved these great returns despite the many disadvantages that professional investors have relative to private investors.

- See Become A DIY Investor for more details.

Andrew also points out that Costs Matter.

- In effect, you can simply deduct your annual costs from the compounding rates in the table above.

Debt

Andrew he is adamant that you should avoid leverage (borrowing money).

- Umpaid interest compounds up in the same way as returns.

- And if you hit a bad patch, leverage will multiply your losses as much as it previously multiplied your gains.

(( As an interesting side note, leverage – your mortgage – is the reason why most people think that returns on property are higher than those on stocks – when house prices are falling you will lose money quickly and can easily end up in negative equity ))

Andrew uses high interest rates to illustrate the effect of debt, and rates are much lower today.

- But in some ways that makes debt even more dangerous, as borrowers don’t make the connection with what they might owe were rates to “normalise”.

Andrew is mostly concerned with unsecured borrowing and credit card debt rather than mortgages (which he admits are a special case).

Things are great

The second amazing fact is that financial products and information are better than they have ever been.

There’s no doubt that this is true:

- It’s never been cheaper to invest.

- ETFs allow access to diverse asset classes and geographies more easily than ever before.

- The UK tax regime (ISAs and SIPPs) is very benign towards investors

Andrew bemoans the fact that most people don’t know this.

Has has three explanations:

- Most people don’t invest at all.

- Those that do often ask their high street bank for advice.

- Or if not, they use a financial adviser

We’re back to Become a DIY Investor here.

- Banks and IFAs tend to sell mediocre products at high prices, and you can do better on your own.

The economy keeps growing

That’s it for the amazing facts – now for the crucial themes.

- The first of these is that the world economy keeps on growing.

Or as Warren Buffett puts it:

There is always a bull market somewhere.

Again, we must remember that Andrew is writing his book in the immediate aftermath of the 2008 financial crisis.

- It seems obvious today that the world economy would continue to grow, but in 2009 and 2010, this was a valid concern.

At its simplest, economic growth is driven by increases in population and improvements in productivity (largely through technological development).

- More people can add more value more quickly.

The reason many people in the West haven’t noticed that the world is continuing to get richer is the famous elephant chart from Branko Milanovic.

Globalisation means that over the last thirty years, three groups have captured most of the world’s economic gains:

- The very poorest

- The very richest

- And the emerging middle class in developing nations (chiefly China and India).

Regular workers in the US and the UK have gone backwards in comparison.

- Real wages in these countries are still where they were in the 1970s.

Added to this, there have been a number of recent crisis in asset markets (property and stocks), culminating in the 2008 crash.

- Despite a 10-year recovery since then, there’s no feelgood factor.

Andrew uses this theme of global development to back up his theme that investors should “own the world” rather than just UK or US shares, and that a DIY investor is more likely to do this than one with a financial advisor.

Inflation

The second amazing fact is that there is a lot of inflation in the world.

- For Andrew, this is down to the money-printing (or as he calls it, the money-inventing) of QE after the 2008 financial crisis.

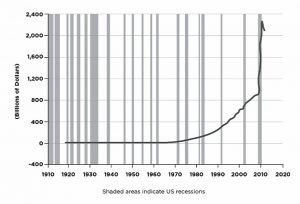

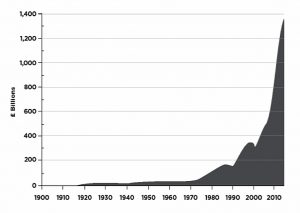

He has a couple of charts to illustrate the growth in money, though I would point out that ironically, these are not inflation adjusted.

I disagree with Andrew on the inflation point.

- Most of us expected QE to produce lots of real-world inflation.

- But it seems that with interest rates at record lows, that is not what happens.

We’ve seen lots of asset price inflation (stocks and property), but barely normal levels of real-world inflation.

- And much of that was generated by the fall in Sterling after the 2016 Brexit vote, many months after this edition of Andrew’s book was published.

Andrew invites his readers to compare the cost of things now with 10 years ago, and with when you were a child.

Unfortunately, when I do this, I don’t have the reaction Andrew expects.

- Much of what I buy today is massively cheaper than when I was young.

Technology is the clearest example.

I remember when my father bought our first VCR (( Betamax, of course )), it cost several months of his wages.

- Today you could buy a TV recorder (if you wanted such a thing now that everything is streamed) for a few hours of work.

The same thing happened to me a decade or two later when I bought my first laser printer – it costs months of the average wage.

Outside new tech, clothes, food and home energy are much cheaper than when I was young.

- Even old tech like cars (a hundred years old, remember) are entirely unlike those from 40 years ago, and much cheaper.

So I don’t buy the inflation argument.

- The official statistics don’t mean too much (except for statutory adjustments) and we all have our own personal rate of inflation (which is difficult to calculate).

But I don’t feel that my living costs are secretly escalating out of control.

- Of course, your mileage may vary on this point.

There’s no doubt that in nominal terms, prices have risen massively, and the pound has been slowly devalued.

- Andrew says that the pound is down by 90% since 1971, which sounds reasonable.

But slow devaulation, with compensatory wage increases, doesn’t make people poor.

Andrew’s basic argument that you need to own assets that protect against an inflation risk is of course correct.

- But over the long term, shares and property should do that well enough.

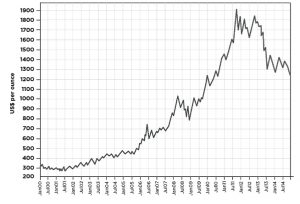

Andrew’s answer to his perceived inflation risk is to “own” inflation, chiefly via gold.

- I’m no gold bug, though having 5% to 10% of your net worth in commodities of some sort doesn’t strike me as crazy.

I would make three points, however:

- Andrew is writing at the end of a good fifteen years for gold (though the price has already started to fall, and in the four years since Andrew’s chart ends, it has gone sideways.

- Since QE and low interest rates began, stocks and property would have provided better inflation hedges.

- The recent rise of crypto-currencies seems to have affected gold’s popularity among enemies of fiat money, so it’s at least possible that the inflation hedge may not work so well in the future.

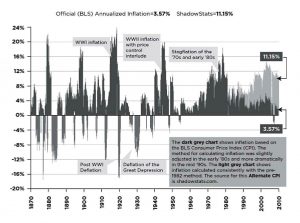

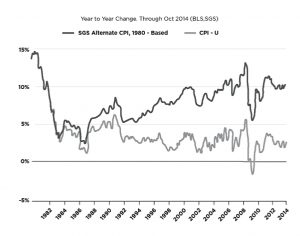

Andrew also doesn’t believe the government inflation statistics.

- He draws a parallel with the unemployment stats, where the definition of unemployment has been changed many times since the 1980s, both in the UK and the US.

Andrew outlines three ways in which governments tamper with inflation stats:

- Substitution – replacing something that is increasing in price with something that isnt

- Wild cod with farmed salmon, for example.

- Weightings – where something that has gone up a lot forms an inappropriately low percentage of the calculation

- Andrew suggests US healthcare here.

- Hedonic adjustment – where a better product is deemed to cost less per unit satisfaction

- A TV that is 20% better than last year’s model but costs the same will be deemed to have fallen in price by 20%.

- I have no issue with this, so long as the percentages used are fair.

- There seems no other way to capture technological improvements, as yesteryear’s failed tech (( Our Betamax VCR )) is no longer available, nor wanted.

- The TV I bought this year is ridiculously better than the 10-year old model it replaced, but it probably cost less in real terms.

Another factor (not government driven this time) is shrink-flation, where products get smaller but stay the same price.

- This is not a big issue for me personally, since I don’t buy many of the products affected.

- But as a larger human, I have noticed that portion sizes in decent restaurants have been adjusted downwards in recent years.

Andrew has some charts showing how these adjustments impact the UK inflation figures.

Deflation

Andrew mentions in passing that there is no real threat of deflation, and that in any case, deflation is nothhing to fear.

- It means that things are getting cheaper and living standards are rising.

- He points to a long bout of deflation during the Victorian era that coincided with a great period of wealth creation and technological advance.

That’s all true, but the problem with deflation is that if people expect prices to be lower tomorrow, they have no reason to spend or invest today.

- So it’s very easy for deflation to lead to a complete stagnation.

Conclusions

That’s it for today.

- We’ve looked at a couple of interesting chapters.

Andrew has four points, three of which I agree with:

- Compound interest is great.

- It’s never been easier to be a (DIY) investor.

- The world’s economy will keep growing.

Where we disagree is on inflation:

- the government stats do constantly einvolve, and the effect is to produce a lower headline figure

- but this may not amount to tampering

- and it might produce a number that more closely matches people’s experience.

The pound has been devalued over recent decades.

- But this hasn’t made people power.

Investors need an asset mix that can cope with inflation.

- But stocks and property will be okay in this regard over the long run.

Gold and other commodities are fine in moderation.

- But there’s no need to become a gold bug.

- Stocks are where the long-term returns are made.

Until next time.