P2P Lending Aggregators – Orca, Goji and BondMason

Today’s post looks at a trio of P2P Lending Aggregators. We’re going to be discussing Orca, Goji and BondMason.

Contents

P2P Lending Aggregators

A few weeks ago, in a post about the IF ISA, I highlighted the drawbacks of P2P lending:

- Low returns (often below my target of 3.3% real / 6% gross)

- Outside a tax wrapper, this rises to 10% pa

- Historic lack of a tax wrapper

- This is now fixed by the IF ISA, and there is a £1K savings allowance as well.

- Of course, the IF ISA allowance is not additional to the stocks and shares ISA allowance, so I’m not likely to use it.

- Lack of diversification

- The IF ISA is offered by the individual lending platforms, so you need a large sum (say £100K) to adequately diversify.

- It would also take you five years to fill these diversified IF ISAs.

- Poor liquidity

- It takes longer to get your money out than to put it in.

Let’s take a look at the three main P2P lending aggregators in the context of these shortcomings, plus a few features applicable only to the aggregators:

- which underlying platforms do they have access to?

- what fees are they deducting from the underlying returns?

- do they offer tax breaks (IF ISA or SIPP)?

Orca

Orca started out in 2017 as a news site for P2P investing – the main rival to Alt Fi.

- I had a blog post about them that was 90% written. (( It’s still possible that it might see the light of day at some point ))

But now they have pivoted to become an aggregator, a move that introduces a conflict of interest with their news service.

- I would expect the news blog to be de-emphasised from now on.

Orca offer

Orca have a very slick website, which is broadly self-explanatory.

Their offer looks exactly like what you would expect from a P2P Lending advisor:

- Diversification

- Lack of hassle (automatic asset selection)

Orca returns and fees

Orca are targeting a 5% pa return, based on the advertised returns of their underlying platforms.

- This is after the Orca fee of 0.65% pa has been deducted.

- The fee is taken in arrears, but there is a minimum fee of 0.65% (one year’s fees).

There is also a 0.25% fee if you need to take your money out early from one of the underlying platforms which allows this.

- The platforms also charge for this and the total fee is likely to be in the range of 0.7% to 1%.

Orca diversification

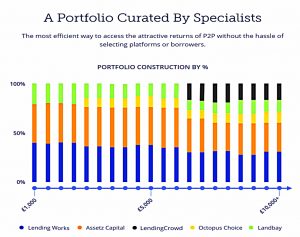

Orca puts your money into what it calls a single portfolio, but in fact, the construction of your portfolio varies with the amount of money that you invest, so the portfolios must be personal.

At the minimum subscription level of £1,000 you are added to three of the underlying platforms.

- As your investment increases (in £1,000 increments) that increases to four and then to five platforms.

The weighting seem to be blended in order to maintain the target 5% pa net return.

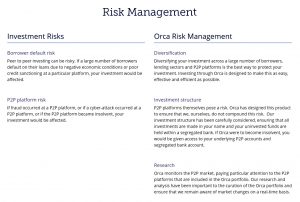

Orca opens accounts in your name at the platforms in your portfolio, but you can use any existing accounts that you might have there.

The portfolios are diversified across the consumer, business and property sectors of the P2P arena.

The big problem is that none of the main platforms (Funding Circle, Zopa and RateSetter) are represented on Orca.

- They are mentioned in the FAQs page (apart from Funding Circle), but don’t appear anywhere else on the site.

Orca lquidity

A second problem is liquidity – Orca relies on the liquidity of its underlying platforms.

- This means that while some money can be withdrawn straight away, other parts of your portfolio might take five years to be returned to you.

Orca tax breaks

Orca makes no reference to tax shelters (IF ISA or SIPP).

Goji

Goji also have a slick website, but it’s less transparent than Orca’s.

Goji appears to make up its own diversified “bonds” rather than invest on the major P2P lending platforms.

- They probably do invest on the platforms, but they aren’t as transparent about it as Orca.

A single bond seems to be created at each month-end.

- These Goji bonds have fixed terms.

I’m uncertain if the terms (and interest rates) vary between bonds as the front-end of the website doesn’t list them.

One major difference between Orca and Goji is that Goji is only after sophisticated / high net worth investors.

- That’s not an obstacle for me, but it will rule out a lot of people.

Once you’ve cleared that hurdle, the investment process is straightforward:

The minimum investment amount is £5,000, with subsequent increments of £1,000.

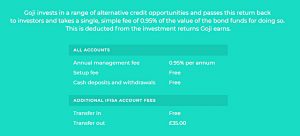

Goji returns and fees

“Returns in excess of 6%” is all that the front-end of the website says.

Fees are 0.95% pa, which strike me as pretty high..

- I don’t know whether the 6%+ is before or after these fees.

There’s also a fee for transferring out of their IF ISA, of £35.

Goji diversification

“Every investment is diversified across numerous loan classes, platforms loans and terms to help reduce risk”.

They also diversify across regions and credit grades, it seems.

Goji liquidity

There’s no information about liquidity on the front-end of the website.

- Goji says that the bonds are fixed-term, so I assume there is no early exit.

And we don’t even know what the term is.

Goji tax breaks

Goji offers an IF ISA, and it comes with a sign-up bonus.

- It’s £50 for £5K and £100 for £10K, so that’s a maximum of 1%.

The bonus turns up at the end of year one.

BondMason

BondMason offer another slightly different twist on P2P aggregation.

- If you use BondMason, you are not lending directly, but buying contracts to received the interest payments on loans.

- That means that these contracts can be traded on the BondMason platform.

The minimum investment is £5,000.

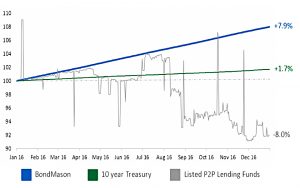

Their performance chart includes Gilts and the P2P investment trusts, which implies that they see these products as competition.

- Note the pretty woeful performance of the P2P trusts over the last couple of years.

BondMason fees and returns

Average returns to date have been more than 8% pa, but a fee of between 1% and 1.5% needs to be deducted from that.

- These are the highest fees that we’ve seen to date, but also the highest net returns.

Of course, since Goji and BondMason are not as transparent as Orca, and don’t have a vanilla “platform aggregation” product, it’s difficult to compare risk profiles across the three providers.

BondMason diversification

Diversification on BondMason appears to be acheived via an autobid tool, which means that you “can easily diversify across at least 50 loan products.

BondMason liquidity

Liquidity ought to be a strong point for BondMason, since their platform trades contracts that confer rights to interest streams.

- Indeed, they quote minimum liquidation periods of 1-2 days.

BondMason tax breaks

There’s no mention of an IF ISA on the BondMason site, but they do offer a product that is suitable for a SIPP.

- You have to convince your SIPP administrator to allow it, and there’s no list of which SIPP admins have said yes so far.

Conclusions

The three providers we’ve looked at today can all be described as P2P Lending Aggregators, but they all come at the product from different directions.

Orca has a slick website and looks like what you’d expect from a P2P aggregator, but:

- It charges a fairly hefty 0.65% pa, reducing net returns to 5% pa

- The main UK lending platforms aren’t avilable.

- Some of your money can’t be accessed for (a rolling) five years.

- There aren’t any tax shelters.

Goji is closer to the existing P2P investment trusts than to what I expect from a P2P Lending Aggregator.

- And they are just not transparent enough for me.

- I want to see how the sausage is made.

They also charge 0.95% pa.

- On the plus side, they offer an IF ISA.

BondMason trades contracts for interest, which provides liquidity and diversification.

- Its charges are the highest, but so are its after-fee returns.

- It has no IF ISA, but its product is allowed in your SIPP if your administrator approves.

I feel that I could beat the Orca offer by going DIY, and choose better (larger) platforms, so I won’t be taking that option forward at the moment.

- I will attempt to investigate how the Goji sausage is made, and try to dig deeper into the loans on offer at BondMason.

If I make any serious progress, I’ll be back with an update.

Until next time.