How to protect your portfolio

Today’s post is a look at the steps you can take to protect your portfolio against a possible downturn.

My portfolio

Before we look at the steps we can take to protect our portfolios – or even what the threats to those portfolios might be – let’s take a look at what’s in my portfolio.

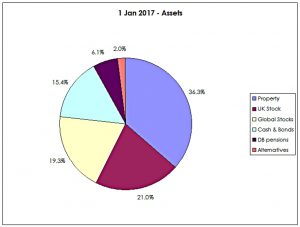

The pie charts shows the breakdown of my assets as at 1st Jan 2017.

- Things will have changed slightly since then, but not enough to affect today’s analysis.

Looking at the assets in order of increasing risk:

- 15.4% is in cash, which as safe as it gets (apart from the long-term effects of inflation)

- 6.1% is in DB pensions, which act like an annuity

- 36.3% is in property – this is not so safe, but I am unlikely to sell any of my properties in the short-term (I see them as assets with utility, rather than pure investments)

- and I don’t know of any products that will let me hedge against UK residential house prices

- 21% is in UK stocks

- 19.3% is in foreign stocks

- see the next section for why these might be considered to be safer than UK stocks

- 2% is in alternatives (non-stock assets, VCTs, EIS etc)

- these are not particularly liquid and are intended as diversification in any case

- I don’t hold any bonds, so I won’t be able to take advantage of any techniques to de-risk that asset class

The point of all this is that I’m really only trying to protect the 40.3% of my assets that is in stocks.

- The rest is either already safe or diversifying, or difficult to hedge.

Timeframes

Let’s start with timeframes.

- I’m not worried about the long-term future of capitalism, or of my portfolio.

- It’s a reasonably well-diversified global multi-asset portfolio.

So I’m really thinking about what might happen in the next two years:

- Lots of assets, and in particular US stocks, are very highly valued. (( You might argue that London property is similarly highly-valued but as discussed further up the page, I can’t think of a way to hedge that ))

- QE is coming to an end, and will start to be unwound.

- Interest rates should start to edge upwards.

- And the UK is in the middle of the Brexit process.

And in terms of implementation:

- Year end is when I traditionally analyse and value my entire portfolio.

- So that’s when I would develop any plans for rebalancing.

I’m not expecting a major crash in the next six months (though it could happen, of course)

- I don’t yet see any of the over-confidence and exuberance that usually comes before the end of a bull market (apart from in crypto-currencies).

- There’s no “fear of missing out” (FOMO) and no stock tips from bellboys (though once again, a lot of very young and inexperienced people are buying cryptocurrencies).

So let’s target the end of the tax year (April 2018) to put any plans into practice.

Protect against what?

There are lots of “normal” risks that I’m not particularly bothered about:

- I’m not worried about inflation (though it could increase) – or deflation.

- I’m not concerned with counterparty risk.

I’m worried about two things in particular:

- A crash in stock markets, particularly in the US

- A botched Brexit leading to a slump in the value of sterling

Ways to protect

We’ll approach this in two stages:

- What can be done?

- What products are (easily) available to implement the various strategies?

Here’s a textbook classification of Portfolio Protection Strategies, erring on the side of “too many” at this stage: (( Initially from Investopedia, not a textbook ))

- Diversification

- Multiple asset classes (and geographies) reduce unsystematic risk (company risk), leaving only systematic risk (market risk).

- I think we have this one pretty much covered already, though there’s always room for improvement.

- More foreign assets would be particularly helpful against a fall in sterling.

- Non-correlating assets

- This is the same thing again – though sometimes people use diversification simply to refer to multiple stocks from different sectors.

- Bonds, commodities, currencies, property, infrastructure, hedge funds and absolute return funds are the commonly used asset classes.

- Correlations between classes have increased since the 2008 financial crisis, and the era of permanently-low interest rates.

- Regular rebalancing is a key part of this approach, to ensure you are always ready for a crash.

- Gold is the perennial favourite as a safe haven, though it doesn’t always prosper under rising interest rates.

- Some people include alternative assets like art, wine and cars, but I have always felt that the transaction costs are too high – and liquidity too low; there’s also rarely an income.

- More cash

- You can limit your downside risk by increasing your exposure to cash, and reducing your exposure to stocks and / or other risk assets.

- I already have 15% in cash, which is towards my upper bound.

- More importantly, this 15% represents many years of living expenses.

- So increasing my level of cash would only make sense if I expect a prolonged downturn in equities (10 years plus).

- I do not, so I probably won’t increase my cash levels.

- Hedging

- You can sell (go short) indexes against your stock positions, effectively reducing your exposure.

- It can be cheaper and easier than trading (selling) a large number of stocks.

- And if your stocks outperform the index (as you hope) you will outperform even more.

- You can short via spread bets (preferably) or via inverse ETFs.

- Stop Losses

- You can use hard / guaranteed stops or trailing stops against stocks or spread bets.

- This limits your downside risk to whatever you find acceptable.

- But this strategy can be time-consuming and / or expensive to apply to large portfolios.

- Options (covered puts)

- If you buy out of the money puts on stocks you own (or an index), then as the stock falls towards the strike price, the value of the put will increase.

- You can sell the more valuable put to offset the fall in the value of the stock.

- If the stock increases in value, all you have lost is the (relatively small) cost of buying the put.

- You can use spread bets instead of real options, and ETFs that track indices rather than the indices themselves (as the underlying).

- Structured products

- You can sometimes find structured products (some of which may be exchange listed) which guarantee capital in exchange for reduced growth.

- Sometimes the guarantee is tied to a minimum level of an index, often 30% or 40% below the value of the index when the product is issued.

- I don’t know enough about this area at the moment.

- Dividend stocks

- Reinvested dividends account for a large proportion of long-term total returns in stocks.

- There’s also evidence that companies with generous and growing dividends can also grow earnings quickly, leading to long-term capital gains.

- So companies that are likely to continue to pay dividends through a downturn offer a cushion against falls in stock prices, and even more so if the dividends are reinvested at these low prices.

- Low-beta stocks

- An alternative to dividends for the active UK stocks portfolios would be to switch to low-beta stocks – those less correlated with moves in the index

- On balance I prefer the dividend approach, coupled with stop losses in the more active portfolios.

- But I will look into this further.

- Sector rotation

- In theory, over allocation to sectors likely to outperform, and under allocation to sectors likely to underperform should be good for your portfolio.

- But this technique is probably better used as a source of alpha during the good times, since in a real crash, all sectors will be affected (though not equally).

- I’m not ruling this out, but it isn’t at the top of my list.

- Bonds – lower duration and increased quality

- If you have bonds, you can address interest rate risk (risk of rates rising and prices falling) by shortening the duration (effective maturity) or your portfolio.

- You can also increase the quality (credit rating) of your bonds.

- I don’t hold bonds.

- Increase liquidity

- In practice, this means “sell your illiquid assets while you still can”.

- And it duplicates the “more cash” strategy above.

- My illiquid assets are houses and flats, which I will be hanging on to.

- Market neutral (long / short) pairs trading.

- We identify pairs of similar stocks in the FTSE-100, buy the one we like best and sell the one we like least.

- Protection from local currency collapse through exposure to foreign earnings.

- The FTSE-350 has plenty of stocks with a good amount of foreign earnings, so this is not too hard to implement here in the UK.

On top of these, it’s also a good idea to prepare yourself psychologically:

- you should be thinking in terms of “when” the crash comes, not “if”

- and you should have a plan ready for what you will do in the heat of battle

Even better, you should have a plan for what you will do before the crash (which is the point of this post).

Practicalities

So on to the things that I might do:

- I can move money away from UK stocks and into globally diversified, multi-asset funds.

- There are lots of suitable investment trusts on our master list, in the Alternative section (yellow).

- We could also add ETFs in the commodities, infrastructure, property and private equity areas.

- But this is a big job if I want to seriously move the needle, and it may end up as a deckchairs on the the Titanic gesture.

- And some of these options (private equity, property, infrastructure) come with their own risks.

- I can add stop losses and alerts to my active UK stock portfolios (and to any spread bets).

- But the active portfolios are only a small part of my net worth.

- I have a spread bet account, so I can easily short indices or individual stocks (or use bets on options).

- This is the most promising option to date.

- Technically, using spread bets is increasing my leverage, and hence my risk, but if they are shorts against existing positions, this isn’t true in practice.

- At worst, I will need some free cash to meet any margin calls if the bets move against me.

- I can build a defensive dividend portfolio.

- I’m very interested in this approach, though it will only fix a small part of my overall portfolio.

- I’ll probably use an existing ISA for this, which might need to be moved onto a platform with lower trading costs.

- Note that other income driven products (infrastructure funds, REITs) will have a similar effect.

- I can investigate UK structured products, and in particular the listed structured products from SG.

- I can investigate the use of low-beta stocks as protection.

- I can look into the use of sector rotation through market crashes.

- I can look into market neutral pairs trading.

- I can put together a portfolio of UK stocks with high levels of foreign earnings.

I’ll report back in a few weeks on how I’m progressing with this task list.

Until next time.

An excellent post, well worth reading. Thank you. Having been an adviser for many years and most recently an academic teaching undergraduate advisers, I could safely say that 99.999% of all private investors would not have addressed any of the issue’s you have. I could also say (rather cynically) that 99% of advisers would probably have failed to address any of the points you raised for their client’s benefit.

The regular rebalancing of portfolio weightings to the original risk intentions is to me probably the best overall safety valve a portfolio could have. Often overlooked, and usually, because equities are booming, the greed of investors clouds their judgment until too late.

Interestingly you mentioned negative correlation in addition to diversification. It seems to me that many investors miss this point in favor of a spread across markets and sectors. With the introduction of Robo advice, index ETF ‘s seem to have become ‘de rigueur’ as regards the ultimate balanced portfolio. No doubt Millenials will be learning a valuable lesson about index investing during the next prolonged bear market!

I certainly enjoyed your post. Adrian

Thanks for the kind words, Adrian.

As usual, the proof of the pudding is in the eating. It will take me a few months to work through all the protection options, so I just hope that my nightmare scenarios don’t come to fruition in the meantime.

Hi Mike

Just wanted to say great article and looking forward to following / participating in the discussions. It has always struck me that the finance industry’s advice has basically been quite simply;

1. Diversify

2. Grin and bear it as nobody can predict the timing of market crashes.

There seems to be alot of concern of an increased risk of market correction posed by higher market valuations. Yet because the ‘trigger’ of a correction is unpredictable – very little attempt is made to link a risk management strategy to market valuations .

In the same way advisors recommend feeding a lump sum into the market gradually to avoid unfortunate timing when investing – isn’t there a case for a similar gradual withdrawal from the market as risks (valuations) rise which lay the groundwork for the pyschology for ‘trigger’ events ?

Surely it is possible to come up with something better than ‘grin & bear it’

Regards David

Nb I found your list of possible risk management techniques very impressive …… and helpful

I think that the reason most people don’t advise gradually withdrawing cash as the market rises is that a lot of us then find it difficult to redeploy the cash after the market has fallen. It’s actually very hard to buy at the bottom.

The second problem is that valuations – while a very good guide to long-term returns – are notoriously bad at predicting crashes. So you need to take the money out quite gradually.

I’ve been taking out cash since 2010, doubling my position to 18%. But now I think we are in the blow-off phase and I’m starting to look for ways to use some of that actively (rather than in passive indexing). I aim to pull it all back quickly if there is a crash, but let’s see.

I’m also quite interested in trend-following strategies, which are another version of market timing.