TAA vs Long Vol – Rabener

Today’s post looks at an article from Nicolas Rabener that compares Tactical Asset Allocation (TAA) to Long Volatility Strategies (Long Vol).

Rabener

We have looked at the work of Nicolas on several previous occasions.

- He runs the analysis firm Finomial, which used to be called Factor Research.

Most recently we reviewed three of his articles on TAA.

- He has a fourth, which compares TAA to Long Vol.

Long volatility strategies aim to benefit from rising or high stock market volatility, and use options as well as risk-off assets in portfolio construction. The pay-off during a stock market crash will be lower than from a tail risk hedge fund, but there will also be less consistent losses during bull markets.

There are no Long Vol ETFs available, though there are several (US) TAA ETFs (as we discovered in our last post on Nicolas’ work).

- Unfortunately, the TAA ETFs haven’t performed very well in recent years.

In any case, Nicolas will be using rule-based approaches to simulate TAA and Long Vol.

Long Vol

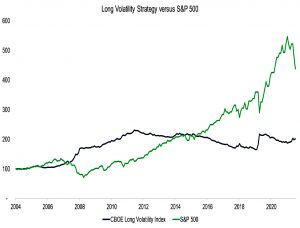

The chart shows the CBOE Long Vol index against the S&P 500.

- The index is an equally-weighted mix of 15 hedge funds.

Long Vol did well in 2008 and 2020 but underperforms over the long run.

- Long Vol is also good for diversification, with a correlation of -0.4 to the S&P from 2002 to 2022.

But there are no ETFs and we can’t invest directly in the hedge funds (high minimums and high fees).

- Nicolas replicated the strategy using risk-off assets – an equal-weight mix of gold and JPY-AUD.

It is clear that this will not always work going forward. Japan’s debt is close to 300% as a percentage of its GDP, and its population will decline by 27 million over the next 30 years, which will eventually require a debt restructuring.

It is unlikely to be accretive for the Japanese Yen. The JPY-AUD would likely change from a risk-off to risk-on asset.

TAA

TAA is designed to deliver higher risk-adjusted returns, not higher nominal returns.

Investors do not cope well with large drawdowns and TAA strategies reduce these significantly.

TAA is a close relative to trend-following – you invest in assets when their performance is good.

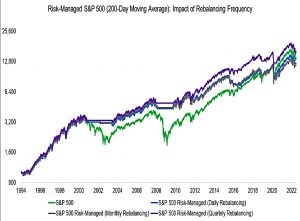

- Nicolas uses the 200-day MA to simulate this – when the S&P 500 is above its 200-day MA, invest in it (and otherwise invest in cash or bonds).

As a variation in this note, Nicolas looks at daily, monthly and quarterly rebalancing.

The strategy would have preserved capital in bear markets such as the tech bubble implosion between 2001 and 2003, as well as the global financial crisis between 2008 and 2009.

Returns are similar to the S&P 500, but with lower drawdowns, so higher risk-adjusted returns.

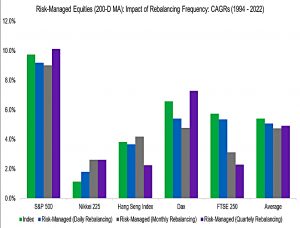

Since the US market has performed so well in recent decades, Nicolas also looked at some other markets.

There is a significant model risk, eg the return for the FTSE 250 in the UK ranged from 2.3% to 5.4% per annum. In some markets, TAA strategies generated higher returns than the index, in others lower returns. We would likely see a similar sensitivity if we change the lookback from 200 days to 100 or 300 days.

Long Vol vs TAA

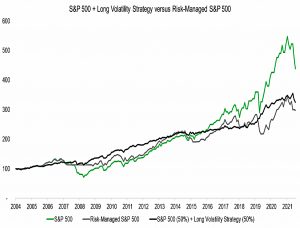

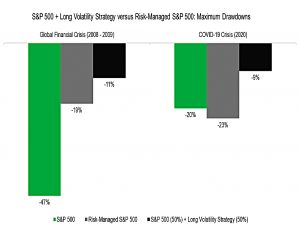

Nicolas calculated that from 2004 to 2022, the optimal allocation to Long Vol (in combination with the S&P 500) was 50% – far higher than most investors would be comfortable with.

Long volatility and TAA strategies provide different diversification benefits. TAA strategies are ideal for long and slow bear markets.

2008 is the example Nicolas provides, but 2022-3 might also qualify.

In contrast, long volatility strategies benefit from sharp increases in volatility that occur when stock markets suddenly crash, eg in March 2020.

TAA has too long a lookback period to profit.

The last decade was characterized by frequent central bank interventions whenever stocks crashed. This was a poor period for TAA strategies.

This was clear from Nicolas’ analysis of TAA ETFs in our previous post.

Conclusions

Nicolas prefers long vol to TAA because of its better risk-adjusted returns over the period in question, and because TAA has many flavours (of lookback period and rebalancing frequency).

- But there are no Long Vol ETFs and we will need to find a replacement for JPY-AUD at some point in the future.

My own preferred approach is to use modest allocations to both strategies, though the best form of implementation is not clear at this stage.

- Until next time.