Tether and Bitcoin

Today’s post is about the relationship between Tether and Bitcoin.

Contents

Tether and Bitcoin

We’re partway through a series of articles on how best to buy bitcoin in the UK, in the wake of the FCA’s ban on crypto derivatives for retail investors.

- But perhaps we shouldn’t be buying bitcoin at all.

In recent months there have been a number of articles linking the boom in BTC to the issuance of Tether, another cryptocurrency.

- Let’s take a look at a couple of them.

Magic internet money

First up is Magic Internet Money, by Alex Pickard of Research Affiliates.

Bitcoin was designed to be a digital cash system. Unfortunately, the first real use case was Silk Road, an online marketplace for buying and selling illegal drugs.

In fact, the public blockchain and increasing use of KYC (identity confirmation) make BTC less than ideal for criminals.

But the tiny transactional capacity of the network (350K per day), and the fees charged to move small amounts (now $10), as well as the off-the-scale volatility of BTC when measured in fiat currency, means that original target (digital cash) remains out of reach.

- Moving money is cheap and easy these days when compared to Bitcoin’s birth in 200. – everyone has a smartphone and a choice of half a dozen payment apps.

The bitcoin narrative has changed in recent times to “digital gold” – a long-term store of value.

- The fact that I can’t buy it cheaply from any household name in finance prevents me from describing it in that way.

But recent institutional interest has nudged in a little down the road, perhaps to the status of diversifying asset class (with some potential upside as well as a considerable potential downside).

- The central case revolves around the fixed limit of 21M bitcoins, and the lack of centralised control (by a body that might it some point be in favour of devaluation).

- BTC is also described as unseizable (( Though it’s definitely open to fraud, hacking, theft, government confiscation and simply being lost by its owner )) and as resistant to censorship.

The key obstacle to the “store of value” idea is the price volatility.

In practice, most new crypto converts are speculators, watching their balance increase on Coinbase, Revolut or Cash.

- This makes sense because (like gold) it doesn’t generate cash flows (income).

Tether

Tether (formerly Realcoin) is a “stable coin” whose value tracks the dollar.

- Tether (USDT) is in theory backed by dollar deposits in banks.

It’s the third most widely held crypto coin by value (after BTC and Ethereum).

- It isn’t decentralised like BTC, but rather is owned and issued by a single company.

- Which means in turn that it isn’t transparent.

Most crypto exchanges don’t have “onramps” and “offramps” into the world of fiat currency ($ and £) – largely because of KYC and money-laundering fears.

- You need to have crypto already to trade, which is where a stable coin comes in.

I get the upside, but it would make more sense to me if it were issued by a reputable financial institution (JP Morgan or Goldman, or PayPal) or a tech firm (eg. Libra from Facebook, now renamed Diem) or a government.

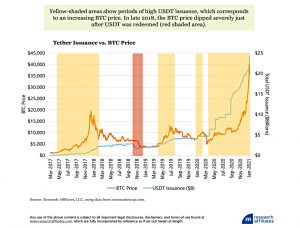

Alex refers to a paper by finance professors Griffin and Shams (2019) – “Is Bitcoin Really Un-Tethered?” – matching Tether flows to the BTC price, and to another piece by Mizrahi (2019).

Tether is currently being sued by some investors who allege that no one is actually buying USDT from Tether Limited, but are minting USDT out of thin air, bypassing the supposed one-to-one (USDT/USD) backing.

Tether has been under investigation by the New York Attorney General for fraud unrelated to market manipulation since April 2019. As part of the court proceedings, Tether has admitted USDT is only backed by 74 cents on the dollar.

It should be noted that a 2020 study by Lyons and Natraj found no evidence that stable coin issuance was driving crypto prices.

How?

The mechanism allegedly used by Tether to inflate BTC is:

- issue USDT with no $ backing

- buy BTC with USDT on exchanges like Bitfinex and Binance (Bitfinex, in particular, is managed by Tether’s executives)

- this pushes up the BTC/USDT rate, and since 1 USDT = 1$, also pushes up BTC/$

- sell the BTC for $, and deposit most of them as backing for USDT, pocketing the profit

This sounds like a perpetual motion machine.

- Step 3 must push the BTC/$ rate back down (to where it began, ceteris paribus), so the people who sell BTC in this step must lose the money that Tether gains.

There are two issues for me:

- Who is selling BTC and why (since they quickly lose money)?

- How does the entire cycle push up the BTC price?

Or perhaps Tether isn’t selling back the BTC (yet)?

- Perhaps they are using BTC to back USDT.

In which case they (or rather, their windfall gains and their currency) are as exposed to the bubble/scam as everyone else.

Alex concludes:

If the market manipulation story is true, then BTC is not in a bubble in the traditional sense but is in the midst of something that could be much worse.

If Tether were to be shut down, and if, in fact, artificial demand from Tether was supporting the price, the losses from a BTC crash may not be recoverable.

Tether: The Story So Far

A second useful article – “Tether: The Story So Far”, from 2019 – comes from Patrick MacKenzie, who notes that if Tether is not stable and fully backed, then:

If you believe the asset is riskless for long enough, it will find itself in the infinite variety of structures which need a riskless asset. And when those structures suddenly have a hole where their riskless asset should be, calamity quickly follows.

Which is a bit scary.

The Bit Short

The third article is “The Bit Short”, posted on Medium by “Crypto Anonymous” (CA).

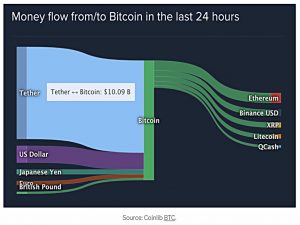

- CA starts with money flows into/out of BTC – the numbers in the chart are typical for January 2021.

Over two-thirds of all Bitcoin — $10 billion worth of it — that was bought in the previous 24 hours, was being purchased with Tethers. What’s more, this pattern wasn’t unique to Bitcoin. I saw the same thing for all the other popular cryptocurrencies.

CA provides similar charts for Ethereum, Litecoin, Cardano and Bitcoin Cash.

The next step was to dig into exchanges, by comparing flows on “legit” exchanges like Coinbase to those on Binance, Bit-Z and HitBTC (the three largest by nominal volume).

- Flows into Coinbase were mostly dollars, while on the other three they were Tethers.

Binance, Bit-Z and HitBTC are “unbanked” exchanges. That means they don’t have direct access to the US financial system — most likely because no US institution is willing to serve as their correspondent bank domestically.

Coinbase, Bitstamp, and several other high-quality exchanges manage it [getting a correspondent bank] by maintaining strong know-your-customer (KYC) and anti-money-laundering (AML) controls internally.

More importantly, Coinbase and Bitstamp don’t allow Tether trades.

If Tether was on the level, there’d be no reason for them to forego the fees on that trading pair — unless their risk and compliance departments had deemed the token too much of a liability to carry.

CA’s next chart shows the market cap of Tether through time, and hence its rate of issuance.

- As the NY investigation (by the Office of the Attorney General, or OAG) of Tether progresses (after the first red arrow) the rate of issuance increases.

The second arrow is when the OAG orders the disclosure of Tether documents.

Beginning in September, Tether Ltd. begins to issue multiple large blocks of Tethers per day. The pace accelerates.

This was consistent with the possibility that, as Tether Ltd.’s various legal challenges failed one after another in the New York courts, Tether Ltd. was choosing to issue Tethers faster and faster to maximize the amount of value it could extract from the crypto ecosystem before being shut down.

CA also notes that the three periods of highest Tether issuance coincide with BTC price increases.

- This worried CA and on 9th January 2021, he liquidated his crypto position for a “life-changing” amount of dollars.

Following that, a chat with a friend revealed a few more features of these unbanked offshore exchanges:

- They offer leverage of up to 100X

- They have lots of promotions that allow you to earn Tethers

- They are illegal in the US, so you need to use a VPN to spoof your location

The Tether-denominated amounts that Bybit, Binance, and other similar exchanges were giving away to people like Bob seemed inconsistent with the revenue those exchanges could expect to generate from an average user.

CA also found that Tethers were being issued in round number blocks (200M, 400M etc) which isn’t consistent with issues representing aggregated USD deposits.

- This contrasts with the random (and smaller) numbers of USD Coin (USDC – Coinbase’s own stable coin) being issued.

CA also checked the dollar deposits in Bahamas banks, since Tether uses Deltec bank, which is based there.

From January 2020 to September 2020, the amount of all foreign currencies held by all the domestic banks in the Bahamas increases by only $600 million. But during the same period, total issued Tethers increased by almost $5.4 billion.

CA’s conclusion is that the unbanked exchanges are used to extract dollars from retail investors.

Imagine you could stand at a metaphorical booth, where Coinbase’s exchange connects with the US financial system. If you could do that, you’d see two lines of people at the booth. One line would be crypto investors, putting dollars in — and the other line would be crooks, taking dollars out.

The fact that the offshore exchanges don’t support USD is a feature, not a bug: preventing USD and Tether from meeting on a transparent market is crucial for ensuring that the true price of Tether stays opaque — making it hard for an outsider to dispute its $1 peg.

CA speculates that Tether buys up all the Tether traded on Kraken – the biggest USD-banked exchange on which Tether is traded – to maintain the peg.

- This would require real dollars, and Tether running out of dollars might make the scheme unravel.

Conclusions

I think all this sounds very fishy.

But I can’t say that the case for fraud has been proven because I don’t fully understand how the proceeds can be extracted without leading to downward pressure on the BTC price.

- If buying BTC with Tether pushes up the BTC price, why doesn’t selling BTC for Tether push back down the price?

It could have something to do with the leverage available on the offshore exchanges or with the USDT/$ change rate – which is artificially high if USDT isn’t fully backed by $ (as it appears not to be).

- Which would make Tether more like a regular Ponzi scheme.

And of course, people extracting value from Tether might be expected not to care too much about the impact on bitcoin, so long as the entire system doesn’t crash.

- If you have a better understanding, please let us know in the comments.

So there is a non-zero chance that Tether might collapse, and given the flows described above, that might impact the bitcoin price.

- But the bitcoin price is ridiculously volatile in any case.

If your strategy is to DCA into a small allocation to BTC that you intend to HODL, does all this put you off buying bitcoin?

- That’s a question that you’ll need to answer for yourself.

Until next time.