Weekly Roundup, 25th January 2021

We begin today’s Weekly Roundup with a look at the changing nature of retail investing.

Retail investing

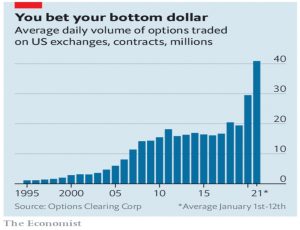

The Economist pointed out that everyone is now an options trader. (( In the US, at least – things are a little more difficult for the UK retail investor ))

- US options volume was up 50% in 2020, to almost 30 million contracts per day.

- In 2021 so far, we are running at 40M per day.

A lot of this extra volume comes from small investors looking for leverage.

A high-profile stock, such as Tesla or Apple, will have 57 varieties of contract listed. Tesla calls expiring on Friday January 15th were available at $5 intervals. There were some 27,000 contracts with a strike price of $1,000 (Tesla’s share price was around $860).

This kind of call option—deeply out-of-the-money and close to expiry—is favoured by the new cohort of retail investors. It has the features of a long-odds sports bet.

On the other side of the trade are institutions, larger traders and hedge funds.

[They] are content to take the premiums from options buyers and to manage the risks of occasional big losses should the punters’ bets pay off. One hedge for a call option is simply to own the stock, which is why long-only equity funds are increasingly being drawn into the market to juice up their returns.

Sometimes this goes wrong, as with GameStop (GME) last week – reported on The Verge.

- Trading was halted as the price of the stock rose by 70% on the day.

The stock is up 250% already this year, and after short-seller Citron publicised its bet, retail traders from the Reddit board r/wallstreetbets started to buy.

The hype generated by r/wallstreetbets helped create what’s known as a “short squeeze”. The problem with shorting is that one’s losses are theoretically infinite; if a stock begins an upward run, some short sellers will abandon their short and buy shares at the higher price to return [to flat].

This, in turn, makes the stock go higher, burning any other shorts who remain in the stock, some of whom may, in turn, choose to cover their own shorts.

GME was 138% shorted.

Citron said it would no longer comment on GameStop because of “the angry mob who owns this stock.” Citron Research editor Andrew Left wrote that the backlash had included criminal activity he planned to report to the Securities and Exchange Commission.

This is an interesting development – will shorters be afraid to go public, and if so, how will they drive the stock price down?

On Epsilon Theory, Brent Donnelly looked at the new media for retail investors – what he called Off Wall Street and Off-Off Wall Street.

Here’s his map of the territory – new sources are in green and the really wild stuff is in yellow.

- I still use The Economist, FT and Bloomberg, though they are not as good as they used to be.

- FinTwit is the only green source I use.

- I am also a 14-year veteran of Reddit, though r/wallstreebets is not a subreddit I follow.

- I have not braved Tik Tok to date.

Brent says there are four reasons why you should care about his chart:

- There is interesting and unique analysis on Twitter and Reddit that you won’t see anywhere else.

- Retail opening new accounts and gambling with stimulus checks is the rocket fuel driving bubblicious, crazy moves in single names. [See Gamestop]

- Retail is an important driver of the bull market / bubble in financial assets.

- It’s fun!

I agree with all of these except the last – it used to be fun, but the calibre of the contributors has plunged over the past five years, and especially since lockdown began.

- There is still lots of useful information out there, but there is no longer much benefit to debating points with those who disagree.

Dividends

In FT Adviser, Imogen Tew warned that UK dividends are unlikely to get back to pre-pandemic levels until 2025.

- The pandemic has removed eight years of growth in dividends, with total dividends for 2020 down by 44% to £61.9 bn.

Two-thirds of companies cut or cancelled their dividend payments in 2020.

- Forty per cent of the cuts came from the financial sector, as the BoE leaned on banks and insurers to suspend their dividends.

Oil stocks were responsible for another 20% as the oil price crashed.

- Shell cut its dividend for the first time since World War 2, and BP halved its payout.

In addition, the government said that any firm using covid support schemes should not also be sending money to shareholders.

- FTSE-100 payouts fell less than those for smaller companies (down 35% compared to 56%).

- Defensive sectors like healthcare, consumer basics and food fared best.

David Smith, portfolio manager of Henderson High Income Trust, remained optimistic:

There will be pockets of strong dividend growth within the market this year for

the selective investor. Despite the terrible year for income in 2020, a dividend yield of 3.1 per cent for the UK market is still attractive.

So did Simon Young, manager of the AXA Framlington UK Equity Income fund:

We are optimistic for the future of UK companies, which in the main, have shown a great deal of resilience, pragmatism and often ingenuity in dealing with a fast-moving virus that has warranted changing government policy with little or no notice. We expect dividend growth of 5-10% this year.

I think this is called talking your book.

Property

The Economist reported on a new paper that looked at the long-term returns from property using data from the endowments of four Oxbridge colleges.

Only a small fraction of houses change hands each year. They may not be representative of the overall stock, and thus of changes in housing wealth.

In contrast, this time around:

The study’s authors dredged for detailed data on sales and purchases (from transaction ledgers) and on rents and maintenance costs (from rent books) over the period from 1901 to 1983.

They tracked rents on individual properties to produce a cash flow-based index of gross yields, subtracting maintenance costs to arrive at net yields.

- The real return on residential property was 2.3% pa, which is fairly low.

Perhaps the Oxbridge sample is not representative of the returns that could have been achieved. Put bluntly, the colleges might have had duff portfolios (or especially bad tenants).

But more likely the study is correct:

Portfolios were well-diversified by region and type and were managed with a strong eye to long-term returns.

Top-down housing data in Britain before around 1970 adjusts for neither mix nor quality. What looks like price appreciation or rising real rents may simply be quality improvement.

So property was never such a great investment, even before the pandemic.

Marcus invest

Goldman Sachs has announced that its Marcus Invest platform will launch in the UK in the second half of 2021.

- The service is currently being tested by GS insiders and will launch in the US during 1Q21.

David Solomon, chairman and chief executive of Goldman Sachs, said:

We are particularly excited about the launch of the Marcus Invest platform, which for the first time brings the investing expertise of Goldman Sachs directly to mass

affluent customers.Marcus Invest will offer individuals the ability to invest as little as one thousand

dollars in our proprietary asset allocation strategies, with options ranging from index funds to ESG-focused ETFs.Digital investing features will be integrated into the Marcus app and website, and will combine the accessibility, simplicity and transparency of Marcus with our leading investment advisory capabilities.

This sounds like another ETF-based robo advisor, so it will all come down to the fees.

- The employee beta is using a “special offer” annual fee of 0.15% (presumably on top of ETF fees).

- That would make the service a market leader in the UK, but let’s not count our chickens.

The beta has three investment options/strategies, but I have no information on what those might be.

- Nor is there any detail on whether tax-sheltered accounts (ISAs and SIPPs) will be offered.

Bitcoin

Before we go, a quick round-up of BItcoin news.

Ruffer has said more about its move into BTC:

We have a history of using unconventional protections in our portfolio. This is another example, a small allocation to an idiosyncratic asset class which we think brings something significantly different to the portfolio.

Due to zero interest rates the investment world is desperate for new safe-havens and uncorrelated assets. We think we are relatively early to this, at the foothills of a long trend of institutional adoption and financialisation of bitcoin.

Think of bitcoin’s bad reputation as a risk premium – as we move through the process of normalisation, regulation, and institutionalisation, the compression of this premium can have a dramatic effect on the price.

This seems like one possible outcome for me, but I’m struggling with working out its probability.

The FT reported the fund manager reaction to the FCA ban on crypto derivatives for retail investors:

Hector McNeil of HANetf said:

The FCA’s decision has basically pushed retail investors from a regulated product on a regulated exchange to the wild west underlying crypto markets … from a regulated environment on to unregulated markets and market infrastructure where abuse, fraud and errors will be significantly increased.

Townsend Lansing of Coinshares said:

The FCA’s initiative will do little to hinder digital asset adoption overall, but represents significant disadvantage for UK investors.

We believe that although digital assets are indeed innovative, wrapping them into exchange traded products is a fairly normal extension of the industry’s unique ability to offer exchange traded access to a diverse set of underlyings.

Adrian Whelan of Brown Brothers Harriman, said:

There is an amount of cognitive dissonance in the regulatory space on crypto at the moment.

On the one hand, regulators are moving quickly to implement a solid foundation of laws and regulation for crypto investing, while at the same time they have taken enforcement actions and banned some corners of the crypto market.

Meanwhile, Federico Manicardi and John Normand of JP Morgan questioned the ability of bitcoin to work as crisis diversification.

They called BTC:

The least reliable hedge during periods of acute market stress. Mainstreaming is reducing diversification benefits and leading to underperformance during crises.

And Business Insider reported on a “double-spend” scare:

Bitcoin fell as much as 11% on Thursday after a report from BitMEX Research suggested that a critical flaw called “double spend” had occurred in the Bitcoin blockchain.

Double spend is a highly feared scenario where a user is able to spend their bitcoins more than once. Ultimately, a double-spend event did not actually occur, according to the CTO of Bitfinex.

Quick Links

I have seven for you this week, the first five of which are from The Economist:

- The newspaper reported that chip-making is being redesigned

- And that the struggle over chips has entered a new phase

- And wondered whether banks have now got too much cash

- And invited a Tesla bull to debate a Tesla bear

- And noted that the online sales boom is killing supermarket profits.

- Musings on Markets had its second data update of 2021 on the price of risk

- And from the archives – prompted by a podcast – Flirting with Models looked at Liquidity Cascades.

Until next time.