Irregular Roundup, 29th January 2024

We begin today’s Weekly Roundup with uranium.

Uranium

For Bloomberg, Merryn Somerset Webb noted that Everyone Seems to Want Uranium.

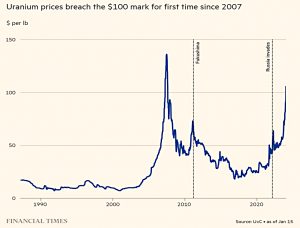

- The uranium price is up by 90% in the last year and has reached a 16-year high.

The enriched uranium market is one of the most price inelastic in the world. If you need it, you really need it.

Plants are expensive to shut down and even more so to switch back on.

You can’t flick a switch once your ore has arrived; restarting means new safety checks and regulatory approvals that can take months if not years.

Uranium is also only a small part of the cost of running the plant.

The penny seems to be dropping that wind and solar are too unreliable to get us to net zero, so more nuclear will be needed.

At COP28, 22 countries committed to a trebling of nuclear capacity by 2050. Uranium demand is expected to rise by 28% by 2030 and to double by 2040.

A long-term supply overhand appears to have cleared, and there has been little investment mining whilst prices were low.

- Investment funds like Sprott and Yellow Cake have also been taking physical uranium off the market to hold for investors.

The current supply is 25% short of demand, though many utilities hold two to three years of inventory.

- More will come online, but this could take years, and current levels of geopolitical tension don’t help.

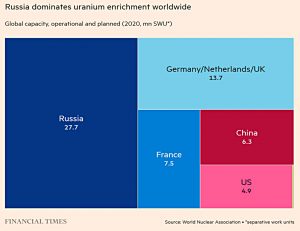

Enrichment of the raw ore is also politically tricky.

- The FT had more on this, and Russia’s domination of the enrichment market.

The US has a plan to regain control.

I have been buying uranium stocks, and I expect to add more.

VCTs

It’s VCT season once again – though I already have my funds for 2023/34 (and half of what I need for 2024/25) – and there have been plenty of articles on the topic to drum up business.

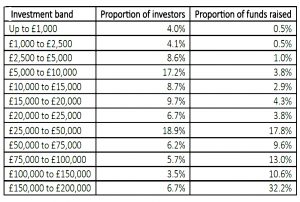

Wealth Club reported that the number of VCT investors in 2021/22 (the last year for which there is data) rose by 32% to 26K (still not very many people).

- Total investment was up by 61% to £1.04 bn (though I expect that the abolition of the LTA might have put a dent in those numbers subsequently).

Those investing more than £150K made up just 7% of investors, but more than 32% of funds.

For Wealth Club, Nicholas Hyett said:

Over half of all VCT investors [claimed] relief on less than £20,000 of investments. [This] is great news for UK start-ups, driving a 61% increase in tax relief-qualifying VCT investments and significantly increasing the funding available to UK entrepreneurs through the scheme.

The scheme could be even better, though. There are signs the £200,000 a year limit on VCT investments, unchanged for nearly 20 years, is capping the funding available. Almost all [of those investing more than £150k] are hitting the £200,000 a year maximum. The £200,000 limit is overdue a review.

You can’t argue with the data, but I think £200K pa is not too shabby.

- In general, though, all thresholds and contribution limits should be index-linked.

For the FT, Tara O’Connor called it a record-breaking year (quoting a government report).

- I’m not too sure about that – I think there have been a couple of bigger years.

HMRC said:

Covid impacts may have been lower than expected, or the success of certain sectors and businesses during the pandemic in conjunction with investors having more time and capital resources to spend allowed for an earlier rebound.

Additionally, the freeze on pension allowances and the income tax personal allowancehas enhanced the tax advantages of investment in a VCT.

Also for the FT, Martha Muir reported that VCT contributions in the first nine months of this tax year had fallen by a quarter.

- Data from Wealth Club suggests that contributions fell from £540M last year to £366M.

For Mercia asset management, Paul Mattick said:

The last couple of years have been historic highs, but we’re getting back towards norms now. There are fewer VCT products available this year, and less demand due to challenging economic times.

He also highlighted the downturn in tech (which has since largely reversed):

You need to look towards listed technology stocks, as outside the so-called Magnificent Seven, there was a period of writedowns which caused downward pressure on the UK venture capital market.

And of course, the LTA has gone. Madeleine Ingram of Calculus Capital said:

VCTs in the market last year have seen quite significant NAV drops, with some losing around 8 to 20 per cent.

There’s also the impact of interest rates on savings accounts. Nick Hyatt again:

VCTs are higher risk, so they tend to be more volatile and responsive to economic conditions. And compared to a year ago cash rates are much higher, so if you want to invest in a VCT for tax relief you can afford to leave it until later in the tax year and be paid interest on your cash.

Christiana Stewart-Lockhart of the Enterprise Investment Scheme Association highlighted regulation – Chancellor Jeremey Hunt recently extended the tax breaks on EIS and VCT from 2025 to 2035.

I think some investors were waiting to see what announcements there would be in the Autumn Statement. The government announcing an extension is likely to boost confidence.

Moving on to specific funds, Fuel Ventures, a “disruptive” EIS manager has launched a follow-on VCT to fund later-stage businesses. Nick Hyatt said:

Fuel Ventures has built an impressive investment record – with early exits to tech giant Adobe and US equity management platform Carta delivering proceeds of £29 million and a 6.2x return on cost.

The focus on marketplaces, platforms and of course SaaS means its investments tend to be low in capitalin tensity with the potenti al for explosive growth and high margins. The manager will hope its new VCT cans open up the manager’s portfolio to investors who are put off by the higher risk nature of EIS or SEIS investing.

Fuel will benefit from an existing portfolio of potential follow-on opportunities and a cohort of EIS and SEIS investors who should be pretty happy with their investments to date.

It looks interesting, but new VCTs often don’t pay dividends for a few years, so I’ll put it on the back burner for now.

- Speaking of which, Blackfinch Spring VCT is about to pay its first dividend.

Self-certification

I have mentioned several times before that the self-certification regime in the UK for qualifying as a high net-worth or sophisticated investor is pretty relaxed (£250K in assets or £100K in income, from memory).

- This week I was sent an open letter to sign to oppose change to the regime from the end of the month (ie. this week).

The main impact of the increases (to £430K in assets or £170K in income) will be on access to VCT and ESI schemes.

- Company Directors will need to run firms with a turnover of £1.6M, and the exemption for investors in unlisted companies is being removed (since online crowdfunding has made this very easy, and no longer the preserve of business Angels).

The new limits are intended to catch the top 1% of the population, which seems a little restrictive to me.

- VCTs are niche, but I would imagine that a lot more than 1% of pensioners would benefit from using them.

Hipgnosis

Another week, another story about SONG.

The new board appears to be out to sack the fund’s manager Merck Mercuriadis as they have begun to investigate claims that he cherry-picked catalogues with higher-than-average growth rates when looking to sell around 20% of the fund’s assets last year.

- The sale of 29 catalogues for $440M – to a Blackstone fund also run by Mercuriadis – was blocked by shareholders who believed the 17.5% discount to NAV was too large.

New chairman Robert Naylor (formerly of the Round Hill music royalty fund) said:

The newly constituted board is investigating whether this is the case, and if so, whether this was properly and fully disclosed to the previous board in the investment papers, which included the recommendation provided by Hipgnosis Song Management, and therefore whether the previous board were provided with the relevant information to enable them to make a decision in the best interests of shareholders.

For SONG’s brokers JP Morgan, Christopher Brown and Adam Kelly said:

We have undertaken our own analysis today and, based on what is publicly available, find there is no evidence of “cherry picking”.

RobinHood

I opened a trading account with RobinHood (RH) a couple of weeks ago – transactions in US shares are free., and there is no FX charge (plus the account offers US insurance, which runs to $500K).

I’m very happy so far, but I learned from Reddit that RH in the States is offering a 1% bonus for any funds you move over.

- On $500K that would be $5K, which is very nice.

It seems that the average account size at RH is only $4K, and they are keen to increase it.

- There’s even a 3% bonus for moving a “Roth IRA”.

The 1% offer also appears on the UK site but with a link to a US page detailing a US transfer process and US account eligibility.

- The offer ends on 31st Jan, so I’m probably too late in any case.

A re-run of this offer in the UK would be very welcome.

Rent Freezes

The Scottish Government’s experiment with rent freezes appears to be ending badly, with the admission that the policy has led to shortages of – and increases in rents for – unprotected properties.

Bitcoin

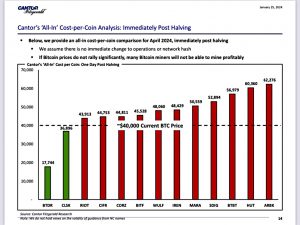

The Bitcoin ETFs in the States have failed to push up the BTC price (it’s fallen 20% since their launch).

- This week I came across a chart showing that unless the halving boosts the price, most miners will be losing money.

Quick Links

I have eight for you this week, the first three from The Economist:

- The Economist said that Wall Street titans are betting big on insurers. What could go wrong?

- And that Private equity’s insurance binge brings new risks to global finance

- And asked What could bring Apple down?

- Alpha Architect looked at Moving Average Distance and Time-Series Momentum

- UK Dividend Stocks offered his FTSE 250 valuation and forecast for 2024

- A Wealth of Common Sense looked at New All-Time Highs After a Bear Market

- Carson Group offered Six Things to Know About All-Time Highs

- And Discipline Funds looked at The Purpose of Work.

Until next time.