Weekly Roundup, 22nd October 2019

We begin today’s Weekly Roundup with Neil Woodford.

Woodford

The demise of Neil Woodford was the big story of the week – I must have read 40 articles about it.

- I bet I can’t find 40 useful points within them, though.

Here’s the story in brief:

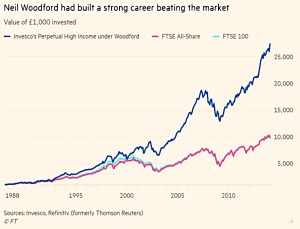

- Woodford built up a stellar reputation over many years at Invesco (formerly Perpetual) for contrarian and value-based equity income investing

- He avoided technology companies during the dotcom bubble and sold out of banks in the run-up to the financial crisis

- His fund went up 25 times over 25 years and he ended up running £33 bn of investments

- He left in 2014 to set up his own fund to get a bigger slice of the pie

- As well as a Ferrari and lots of eventing horses

- Hargreaves Lansdown and St James place were amongst his boosters

- HL offered discounts on his funds and added them to best buy lists

- He changed styles and started a Patient Capital fund for private companies alongside his Equity Income funds

- Somehow the biotech, renewables and AI startups from the new fund made their way into the old funds (despite not paying an income)

- Market conditions changed and the value of Woodford’s income blue-chips fell

- This meant that he breached limits on unlisted holdings

- He tried various ruses to get around these limits, including listing stocks in Guernsey that were never traded and some optimistic revaluations of untraded stocks

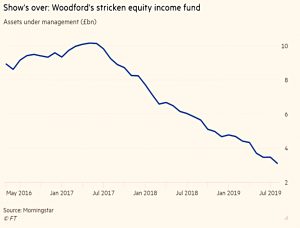

- When a big investor tried to withdraw their cash, the income fund had to be gated because of insufficient liquidity

- Gating a fund doesn’t stop the manager continuing to be paid, though HL waived thir platform fees

- St James’ Place immediately dumped Woodford, but HL was slower to disown him

- Selling off the liquid assets to meet redemptions depressed prices and further increased the percentage holdings of low-quality illiquid stuff

- Eventually, the administrators of the fund sacked Woodford

- Note that these administrators were originally chosen by Woodford and were paid by him, in what is clearly a conflicted governance system

- Woodford resigned his other positions and decided to close his firm

- Investors in the funds will have to wait to see how much money they get back, and how quickly

Here are the lessons to be learned by private investors:

- Investment stars don’t burn bright forever and personality cults don’t usually end well

- Especially when a manager steers away from his winning style

- And/or leaves the investment house which may have been keeping him on a short leash

- A style which has worked in the past might not work in the future

- In other words, past performance is no guide to the future

- Particularly relatively short-term past performance

- Illiquid assets don’t belong in open-ended funds

- And small companies are a poor match with huge funds

- Ignore best-buy lists and model portfolios from platforms with an incentive to point you at particular funds

- Keep your costs down – in most cases, you aren’t getting anything for the extra fees you pay to active managers

- Use ETFs rather than OEICs in order to stay away from the well-funded industry marketing machine

- Diversify, diversify, diversify

The lesson that I hope people don’t learn instead is not to invest in the stock market.

- Stocks are risky, but not investing in them is even more risky over the long run.

Here are a few quotes:

Insufficient progress on the repositioning meant there was not reasonable certainty as to when the fund could be reopened. The orderly wind up also seeks to limit the loss of value which would be the key risk if the illiquid assets were sold on a forced or fire sale basis – Link, the fund administrators.

I personally deeply regret the impact events have had on individuals who placed their faith in Woodford Investment Management and invested in our funds. [The decision to close the fund] is one I cannot accept, nor believe is in the long-term interests [of investors] – Woodford.

We have apologised to clients for the distress, uncertainty and inconvenience caused by the gating of the fund. We share their deep frustration at what has happened – Danny Cox, head of communications at HL.

There is a structural problem in open-ended funds, a problem that is not our direct responsibility but a problem in terms of fairness for the individuals who invest in these [funds believing they are akin to a bank account where you can get money out at any

time – Bank of England governor Mark Carney.As those holdings are liquidated, obviously that’s going to harm the share price. In some cases, I think it’s worth buying more of the affected shares at a distressed level — and other seasoned private investors I know are thinking the same. As small-cap investors, we are comfortable with the risks of investing in less liquid assets. However, I think it is shocking that the Financial Conduct Authority (FCA) allowed the Equity Income fund to become so exposed – David Stredder, ShareSoc director.

The reality is platform buy lists, especially the Hargreaves Lansdown one, have been key to the fortunes of some fund managers. Maybe the Woodford issue will mean people take them with a pinch of salt in future – Peter Hargreaves, HL founder and largest shareholder.

Given the very small number of funds on the HL Wealth 50 list, how could HL have

allowed the Woodford fund on the list over an 18-month period? These recommended lists are no more than marketing ploys which the FCA did highlight in their 2017 assessment study but it has failed to take action on – Gina Miller, co-founder of wealth manager SCM Direct.

First-time buyers

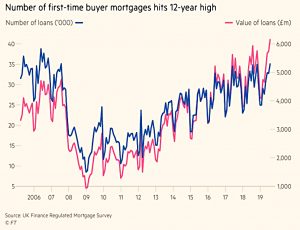

Katherine Gemmell (( Still no picture )) reported that the number of first-time buyer mortgages has risen to a 12-year high.

- The value of the loans has risen above £6 bn.

Low interest rates, high wage growth and employment figures, first-time buyer exemptions from stamp duty and the Help to Buy equity loan scheme are all factors.

- The only downside is the increase in the number of long-term loans of up to 40 years.

These are cheaper in the short run – which makes it easier to pass the affordability tests now required by regulation – but more expensive in the long run.

Despite the higher number of mortgages, only 27% of 25-34-year-olds own their own home, down from 65% in the 1990s.

- The average age of a first-time buyer is now 32.

The weakest link

Tim Harford looked at the work of Professor Michael Kremer, who has just won the Nobel Prize in Economics (with two others).

- His O-ring theory is named after the rubber seals that lead to the Challenger space shuttle disaster in 1986.

In many production processes, the weakest link is what matters.

- This means that the best talent wants to work with each other, to produce the best work.

Which in turn means that inequality is endemic.

- The best workers are hugely more productive and command much higher wages.

Another implication is that O-ring economies are self-perpetuating and hard to improve.

- And education is wasted on those who can’t or won’t relocate to a job market full of other skilled people.

Shrinking UK equity market

In the Economist, Buttonwood looked at the UK’s shrinking equity market.

America’s stock of equity has been getting smaller for a while, because of share buy-backs, a secular fall in the number of new listings and the growing incidence of leveraged buy-outs, in which low-interest debt replaces equity.

The same thing is now happening in the UK – outstanding equity is down by 3% since the start of 2018.

- Buttonwood says that the key factor is shareholder accountability – activist investors can get results here.

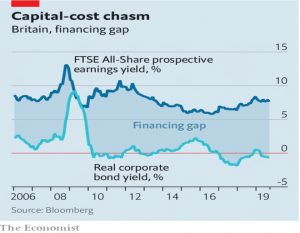

The relative cost of debt and equity is also important.

- The earning yield on the FTSE All-Share is 7.6%, compared with a negative real yield on bonds.

The gap between the two is the reward demanded for holding riskier stocks. It is also, by symmetry, a measure of the relative cost to companies of issuing equity versus debt.

This is known as the financing gap.

There is plenty of scope to replace dear equity capital with cheap debt.

More than 70% of the earnings of companies listed in Britain come from overseas; around a quarter comes from North America alone. There is thus an opening for American investors or companies to buy dollar earnings on the cheap.

Inflation

The inflationary increases to the pension lifetime allowance (LTA) – and to the state pension itself – have been announced.

- CPI for September was 1.7%, so the LTA will increase from £1.055M to £1.075M (the increases are rounded to the nearest £5K).

The State Pension has a triple lock, and so the earnings growth figure from July will be used.

- This was 4% and so the annual pension will increase to £9,118.

Quick links

I have seven for you this week:

- Flirting with Models looked at Risk-Adjusted Momentum

- Alpha Architect wrote about Active Share

- And about Crowded Trades

- The FT looked at a quant fund’s attempt to crack the value code

- Musings on Markets wrote about Disrupting the IPO process

- The Economist looked at Sirius Minerals

- And at British Airways’ profits.

Until next time.

I would also hope in light of the Woodford sage- that investors don’t turn away from the very real benefits of investing with the few active managers who really do add value consistently. Obvious examples are:

Terry Smith – for an AMC of 1% he has beaten the IA Global benchmark by 119% and his Fundsmith offering is Top Quartile over 1, 3 and 5 years

Nick Train – for an AMC of just 0.7% his Finsbury Growth and Income Trust has beaten the UK Equity Income benchmark by over 206% and his Trust is also Top Quartile over 1, 3 and 5 years

Keith Ashworth-Lord’s Buffettology fund charges 1.2% but has beaten the UK All Companies benchmark by 198% and is also Top Quartile over 1, 3 and 5 years.

All three share the same broad process that they have got an investment strategy which a) has been shown to work consistently well and b) they have stuck to that process irrespective of what market conditions or critics say. Woodford moved away from b) which was a tragic mistake!