Weekly Roundup, 10th February 2020

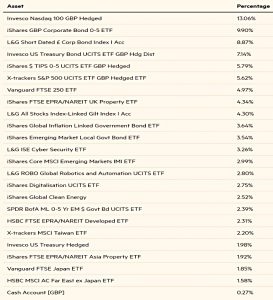

We begin today’s Weekly Roundup in the FT with John Redwood’s regular update on his ETF portfolio.

Redwood Portfolio

It was yet another thin week for news in the mainstream media.

John Redwood warned that the coronavirus is casting a shadow over the markets, but he wasn’t too worried:

The epidemic is likely to direct investors away from China where the economy will be damaged, but is unlikely to have more than a short-term worldwide impact unless it takes off in other large economies and interrupts production.

John sold out of China last year.

The portfolio is up 2% in 2020, after a 15.7% gain in 2019.

- Two-thirds of the fund is in sterling, or hedged to it, as John felt that the $1.21 exchange rate from late last year was too cheap.

Fees

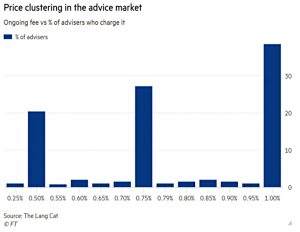

Imogen Tew had a couple of articles in FT Adviser on fees.

The first looked at price clustering in the advice market.

- Lang Cat research has found that most advisors charge 1%, 0.75% or 0.5% pa as an ongoing fee.

Mike Barratt from Lang cat warned that the FCA might see this as evidence of an uncompetitive market:

In 2015, the regulator looked at a chart of asset management fees and found a stark price cluster. The FCA thought it was an indicator the market was not competitive and took action. I think the same will happen with financial advice.

The second article promised that the race to the bottom on fees has only just begun.

- I think we may have different definitions of low fees here.

Imogen was reporting from 7IM’s 2020 summit, where Chris Justham claimed opinions were changing:

A couple of years ago, when we all first started talking about Mifid II, the consensus of the total cost was around 2 per cent. This has come down over a very short time period.

Well, perhaps – but not by nearly enough.

- 7IM found that 50% would like fees to get below 1.5%, and only 20% were targeting total fees below 1% pa.

You really can’t afford to pay 1% pa in fees over a 50-year investing career.

- Australia uses flat fees per client, and I think that we have to head that way too.

Smokers

Joachim Klement had a couple of good articles this week.

- The first was about smokers and their underperformance as investors.

The study he quoted looked at 13,500 investors in Germany between 2012 and 2018.

- Their after-fee returns were 2.57% worse than for non-smokers, and their annual portfolio turnover was 7% higher.

For a person saving €1,000 per month from age 25% into a portfolio with a real return of 3% pa, this is the difference between a pot of €905K at age 65 and one of €457K.

- As Joachim says, smoking is a pretty expensive hobby.

Of course, it’s really a proxy for poor self-control:

Other indicators of lack of self-control like obesity and the use of illegal drugs are unreliable because they often lead to severe health consequences that reduce an investor’s ability to save or invest.

Smoking, on the other hand, is socially acceptable and typically only leads to adverse health consequences at an older age, so it doesn’t typically interfere with the career path of the investor.

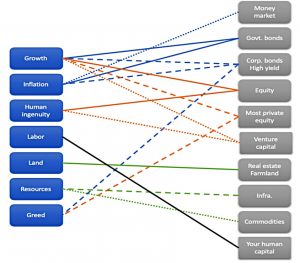

Asset classes

Joachim’s second article looked at what defines an asset class. His definition is:

A group of assets with similar exposure to the fundamental drivers of the

economy.

I would put it the other way around – it’s a group of assets that will sometimes respond differently to those drivers than will other groups of assets.

- There’s also a practical point – you need to be able to buy it through ETFs and ITs (lots of things that I’d like to own a piece of would fail this test).

Joachim provides a neat mapping of fundamental drivers to asset classes:

Many alternative asset classes aren’t truly different. This usually becomes painfully obvious once a crisis hits and the seemingly uncorrelated alternative assets suddenly become highly correlated with stocks or other assets.

In fact, the chart above can help you identify how alternative asset classes might react in a crisis because then, all markets do is focus on the exposure to these fundamental drivers and their expected future development.

This is true, but the benefits of diversification are not largely to do with what happens in a crisis.

- Semi-active management (eg. trend following) might be a better source of crisis alpha than asset allocation.

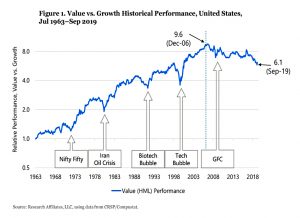

Value

John Authers also had a couple of interesting articles this week.

- The first revisited the idea that value is dead, using a new report from Research Associates.

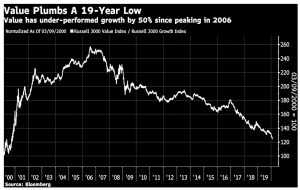

Value outperformed growth from 1963 to 2006.

But value has underperformed by 50% since then.

Using simple price-to-sales ratios, one of the hardest metrics to manipulate, value

stocks are roughly as cheap now as they have been for much of the time over the last 20 years; while growth stocks are twice as expensive. The gap hasn’t been so wide since 2001.

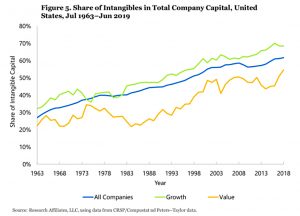

The explanation seems to involve rising levels of intangibles (brands, patents and other IP):

John concludes:

Value as formerly calculated may never revert to the previous mean, because tangible book value is a less important measure these days.

Meanwhile, if we use book values including intangibles, we have a big divergence that looks quite a lot like the dot-com boom, and there is no great reason why that shouldn’t regress to the mean.

Therefore it is reasonable to expect that value will at some time before much longer start

to beat growth.

Magazine covers

John also reminded us that previous epidemics – and their impacts on asset prices – have peaked around the time that the story appears on magazine covers.

This week we had three:

Quick Links

I have seven for you this week:

- Flirting with Models looked at Payoff Diversification

- The Economist explained why Intercontinental Exchange wants to buy eBay

- and why traders have lost interest in the monthly US jobs report

- and that Boeing’s next problem is defence

- UK Value Investor explained why he sold Aggreko

- Pragmatic Capitalism looked at why shorting stocks is so difficult

- And FT Adviser reported that 27% of Hargreaves Lansdown’s profits come from interest on client cash.

Until next time.

re QL7:

27% of HL profits generated from an interest rate of < 0.5%!

If ever an example was needed to illustrate the real consequences of a little number multiplied by a big number (e.g. low probability/high impact risk events) then this looks like a pretty good candidate.