Weekly Roundup, 17th February 2020

We begin today’s Weekly Roundup with the big story of the week – the resignation of Chancellor Sajid Javid.

Once again, the headlines were dominated by the coronavirus and there was little financial news other than speculation about possible market reaction to the potential impacts.

Sajid Javid

I’ve always had a bit of a soft spot for Sajid Javid.

- He was born in the same village as me and also worked in the City (albeit more successfully than me).

So it was a bit of a surprise to find that he had resigned this morning, with less than a month to go before his first budget.

- It appears that Boris would only let him stay on as Chancellor if he agreed to have his special advisors (SpAds) replaced with members of a joint team more acceptable to Number Ten.

This has been widely interpreted as meaning working for Dominic Cummings, who sacked one of Sajid’s top advisors last year without asking him.

- You can’t blame Sajid for saying no to that offer.

What’s more difficult is working out whether his departure is a good thing or a bad one.

- Since he never had the chance to give a budget, we can’t know what kind of a Chancellor he would have been.

Certainly, there have been some very un-Tory leaks to the press in recent days:

- 20% pension tax relief and a mansion tax are both bad ideas (and the former would kill pensions).

But we don’t know whether Sajid’s SpAds have been leaking these stories without Boris’ approval, or whether Boris himself is behind these tax and spend moves.

- Which means we’ll have to wait until next month’s Budget to figure out whether we’ll miss Sajid.

Sajid’s successor is Rishi Sunak, a Treasury minister (Sajid’s number two by rank) and Yorkshire MP – about whom I knew absolutely nothing this morning.

- I now know that he is just 39 years old – pretty young for a Chancellor (Sajid is 50).

He’s from Southampton and went to Winchester, where he was Head Boy, then Oxford (first in PPE), then Stanford (MBA).

- After that, he joined Goldman’s before starting his own investment firm (Theleme).

He’s also quite possibly the richest person in parliament since he is married to the daughter of the Indian billionaire who founded Infosys (N. R. Narayana Murthy).

- And he is a Brexiteer who stood in for the PM in two of the televised election debates (I didn’t watch).

Alignment between Numbers 10 and 11 is normally a good thing, but if Boris is set on a big government, high-spending budget, I may not be cheering.

Value

John Authers returned to last week’s theme of value investing.

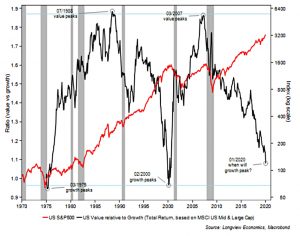

Value goes through long cycles of two decades or more. It rose after the collapse of the “Nifty Fifty” growth stocks at the beginning of the 1970s, to reach a peak in 1988, gradually fell during the dot-com era to a low in February 2000, and then enjoyed another upward cycle that peaked in March 2007.

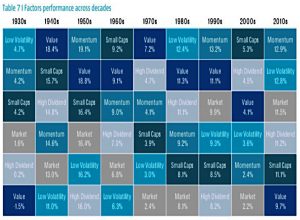

Another way of looking at the cycles is by ranking factor performance each decade – the chart come from Pim van Vliet (of Low Vol fame) at Robeco:

The 2010s was the first [decade] in which value came dead last since the 1930s — which, oddly, was when value investing was first promulgated by Benjamin Graham.

Chris Watling of Longview Economics (who provided the first chart) reckons that value moves in line with technological waves:

Value does well when technologies have picked up and begun to proliferate through the

economy. Thus the dot-com boom gave way to a period when many companies improved profits by harnessing the internet. Value takes over at the end of a cycle.

Valuation signals come both from extreme highs in growth stocks and lows for value indices.

Since the last growth peak in 2000, only Microsoft of the large growth stocks has beaten the value index:

Amazon and Netflix are both as expensive as Polaroid was in 1972. They are also more expensive than many of the giants of 2000. That said, the likes of Alphabet and Apple look far more sensibly valued, and far more entrenched than the Niftys were.

John quotes work by Andrew Lapthorne at SG looking at the outperformance of the top 5 and top 10 stocks ion the S&P 500:

The index does indeed seem almost as top-heavy as it did in 2000. Value underperformance may have longer to run. But it does look as though the time for value to reassert itself is approaching.

Ruffer was also looking at value.

- Their chart shows that while growth keeps outperforming in price terms, it is starting to fall back in terms of underlying earnings.

Before 2017, growth’s outperformance was supported by stronger earnings growth.

- But now it’s just a PE re-ratings game.

Apple’s market capitalisation alone is now greater than the combined value of Germany’s entire DAX index. Microsoft took 42 years to become a $500bn business, then only two years to add the next $500bn.

And the five largest listed companies on the S&P 500 now account for a greater share of the index than at any time since the Dot Com bubble.

Market cap

Regular readers will know that I am not a fan of market cap indices. Writing in MoneyWeek, Cris Sholto Heaton explained why:

- They don’t reflect the global economy in the way that many of the investors who buy them think that they do.

- They underperform because they over-weight the most highly rated parts of their target index (such as the tech stocks currently driving the outperformance by growth that we just looked at).

Cris uses the MSCI World index as an example:

- It has 64% allocated to the US

- And no EMs at all – it’s entirely developed markets

In the real world, the US is 25% of global GDP, whilst EMs make up around 50%.

- Developed markets have bigger and more liquid markets (higher free floats)

- And particularly in the case of the US at present, they are more highly rated (valued)

A GDP-weighted index has outperformed the standard one 1.7% pa since 2000.

- Unfortunately, there are no ETFs available that track such indices.

Equal-weights and risk parity are relatively simple ways to solve this problem.

Plan B

I reported a couple of weeks ago that Portugal has introduced a 10% pa tax on ex-pat pensions.

- This week the Times reminded me that the ex-pat tax in the part of Italy I like is only 7%.

And the town I normally stay in is just below the 20K population cut-off.

- So that’s plan B for the time being.

Quick links

I have just two for you this week:

- UK Value Investor provided his FTSE-100 CAPE valuation and long-term forecast, and

- Musings on Markets had a data update on the price of risk.

Until next time.