Weekly Roundup, 19th May 2015

We begin today’s Weekly Roundup once again with the Chart That Tells A Story from the FT.

Contents

Property funds

This week Judith Evans looked at the rising premium to net asset value on global listed direct property funds over the past 10 years. This excludes funds that only buy shares in other property companies.

Back in 2005 the premium was 10%. It then fell to a 51% discount during the 2008 financial crisis, but has now climbed back to a record premium of 19%. The market capitalisation of these funds has grown from £2bn to £9bn, as more funds have been created.

This growth has been driven by yield chasing. These trusts can enhance rental returns through gearing. And returns have been good – UK funds total return in 2014 was 18%.

It may not be too late to invest. Andrew Summers at Investec suggests working out the projected yield if the premium reduces to zero over your planned period of investment. Some funds will still be competitive on a yield basis. You could also look at less cyclical property sectors such as student accommodation or doctors’ surgeries.

Fund management fees

Merryn’s FT column looked at fund management fees. She doesn’t like ad valorem fees since they incentivise asset managers to bring in more funds to manage, rather than to manage their existing funds well.

But existing performance fees are not much better, since they are asymmetric. When the fund goes up, the manager gets a bonus, but when it goes down, he doesn’t lose money. This is obviously an inducement to excessive risk-taking. Even the use of high water marks doesn’t change this.

The Orbis Access fund changes this model. It has refunds from the managers on the days they underperform. Equitile will use a model where an ad valorem fee of 0.4% is charged on the first £400M of funds, with a long-term performance fee on the rest of the money raised.

This is not perfect – a flat fee for the fund, regardless of its size, would be best – but it’s a step in the right direction.

Osborne’s summer budget

The first column in the Weekend FT from Claer Barrett ((Who has taken over from Jonathan Eley as editor of FT Money)) was a suggestion list for George Osborne’s July budget:

- scrap the lifetime pensions allowance on DC schemes

- I support this as the proposed limit of £1M will only generate £26K of annuity income, and it penalises investors who perform well; I would be fine with a lifetime limit on contributions of £1M

- force annuity sellers to obtain independent advice before selling

- no – this is more nannying when we need to be encouraging people to take responsibility for their own finances

- increase the free childcare allowance from the proposed £2K per child per year

- no – the state should not be encouraging people to have children, and encouraging young mothers into the workforce will not solve the UK’s skills shortage or low productivity issues, as Claer believes

- add three extra council tax bands at the top and penalise absentee foreign property investors

- I understand the thinking here, but my (London) council is already £2K per year, and I’m certainly not receiving that value back, so I’m against any increase; I’d prefer to see cuts in council services and efficient councils taking over from wasteful ones; I’m fine with a tax on empty houses in London Zone 1

- build more houses and extend the rent-a-room scheme

- I can’t argue against either of these suggestions

- stall the social housing sell-off

- I don’t believe in social housing, so I’m against this one; anyone who has the means to own their own home should be encouraged to do so; homeowners make better citizens

- abolish non-dom status

- I’m neutral on this; I don’t see the non-doms as a big problem, and the abolition might lose the country money; having said that, the loophole is something of an embarrassment

- slow down the sale of RBS until US regulator disputes are settled

- I’m fine with this, as it should enhance taxpayer returns

- fix the 60% tax trap between £100K and £120K

- I have no prospect of earning £100K in the future, so I have no dog in this fight, but I do support the principle that tax should be progressive, with no “traps”

- impose “pounds and pence” fee declarations on fund managers

- I’m right behind this one

So a grand total of six and a half out of ten from me. Not terrible, but definitely room for improvement.

The ideal pension system

Elsewhere in the paper, on the occasion of the appointment of Ros Altmann as the new pensions minister, Sophia Grene produced a wish list for the reshaping of UK pensions.

Sophia seems to approve of Ros, with her support for the new freedoms (no need to buy annuities, the ability to sell them if you already have one) and her criticism of the lifetime allowance, but she would like a bottom-up redesign:

- a state-provided safety net

- we already have this, with the new state pension of £8K

- encouragement to save as a default option

- this is auto-enrolment, probably set too low at the moment, but it’s a start

- separate schemes from employers as single-employer workers no longer exist

- Sophia suggests industry-based schemes as in Holland; I would prefer a government scheme, as in Sweden or Australia, but it’s step in the right direction; we both agree they schemes will have to be DC

- longevity pooling to discourage hoarding in retirement

- I support this but not Sophia’s specification that pools should be split by income bands; she doesn’t want poor people who die younger to subsidise the rich; she suggests using the industry schemes mentioned above

- but that’s the whole point of dead pools – no one would join a pool with higher life expectancies, so they have to be population wide

Infrastructure and “one stop” funds

After what feels like a break of a few weeks, David Stevenson was back with an FT column about infrastructure funds. David has previously recommended – and invested in – HICL, INPP and 3i Infrastructure.

The aim was a 5%+ dividend and small capital appreciation, but many of the funds have done very well and now stand at large premiums to book value. David has started to take profits and wonders whether they may begin to take on too much debt or get involved in more early stage projects.

He’s still bullish on infrastructure as 5% to 10% of a portfolio, and feels that lots more of it is needed in Europe and the UK. Diversification across sectors (energy, roads, rail, airports etc.) and countries is key. His chosen vehicle is LON:GIN, an ETF from State Street called the SPDR Morningstar Multi Asset Global Infrastructure ETF.

This tracks 18 globally diversified infrastructure sectors at an annual cost of 0.4%. The fund is 40% US, 8% UK, and a 50/50 mix of equity and bonds. David plans to split his infrastructure weighting 50/50 between this fund and the investment trusts mentioned earlier.

In a separate article for Money Week, David looked at “one-stop” funds – those with managers who can do both the big-picture, long-term thinking and also the short-term repositioning of the portfolio.

Funds that David has previously recommended which fall into this category include Personal Assets Trust (LON:PNL), Capital Gearing Trust (LON:CGT), BACIT (LON:BACT) and Witan (LON:WTAN).

And now he has another candidate for the list – Tellsons Endeavour. This is an open-ended fund, so it’s not of great interest to me personally, but for those who like these things:

- the fund invests in high-quality companies with defensible franchises and brands

- it invests in both equities and debt

- it currently has a 60/40 equity/bond split

- it can go 70/30 in either direction

- it can also go up to 40% cash

- it operates on either a 1.31% annual charge, or

- a 0.31% charge, plus 20% of outperformance

- the benchmark is average of the short-dated gilt return and the rolling 5-yr CPI

- the partners have all their wealth in the fund

The charges seem high to me, though the fund is small at the moment (below £25M) and that benchmark looks too easy to beat. But David likes the look of it, and most of the funds he’s picked out in the past have done well.

Tim Harford’s column was about tax. People don’t like paying tax, which is why politicians announce that they will be paid instead by bankers, multinationals and tax dodgers. Voters are bribed with allowances and exemptions.

Even worse than our dislike of paying taxes are the things people will do to avoid them. Some involve legal structures to re-describe existing behaviour (such as the multi-nationals’ exploitation of international tax laws) while others affect the behaviour itself.

Tim chooses the example of the mother who wants to work but will stay at home rather than pay for childcare, because the tax on her income makes it not worth her while working. That’s two FT columnists in the same week arguing the case for working mothers.

Tim quotes work by Gabriel Zucman which identifies the complexity and inconsistency of international tax systems as a big problem. US companies now book 18% of their profits in tax havens, as opposed to only 2% back in 1984.

Work by Henrik Jacobsen Kleven puts forward the Scandinavian tax system as the “best”: these countries raise 45% of GDP in tax, compared to 35% in the UK and Germany and “only” 25% in the US. This seems to me to depend on how you define the problem. I’d rather we shrank the state and the tax bill instead working out ways to extract more from citizens.

Klevens explanation for the higher tax take involves comprehensive reporting (which would likely produce privacy issues in Anglo-Saxon countries) and a wider tax base. Tim gives the example of UK VAT, which could be as low as 10% if levied on all purchases; instead we have a 20% rate levied on about 50% of spending. I think that here at least he has a point simpler is better.

Equity Crowdfunding

Judith Evans also reported on the successful equity crowdfunding campaign by Scottish independent brewer Brewdog, which has raised a record £5M in three weeks on its own platform – Equity for Punks.

Brewdog aims to raise £25M over the next year. Co-founder James Watt said “there is a thirst for alternative finance out there … people are sick and tired of the fat cats controlling everyone’s money.”

AllStreet, which analyses crowdfunding investments, said that is was “difficult to see how investors will make a financial return on this deal”. The fundraising values the firm at £305M on annual sales of £30M. This deal makes as much sense as the SNP budget.

Bond market tipping point

John Authers wondered if world bond markets had finally reached a tipping point.

Markets are down over the last month, but the long term trend remains. Bunds have lost five months of gains in a few days, but the gains of previous decades are intact.

There have been false tipping points before, notably the “taper tantrum” in May 2013.

And conditions are unusual – EuroZone QE has just begun, and US is struggling to return to “normal” policies after QE. And although liquidity is reducing, it still remains higher than 10 years ago.

German Bunds tracked US treasuries until late 2012, when deflation fears in the EU dragged Bund yields lower. The ECB then caved and announce QE, pushing up inflation expectations. The ECB bond purchases pushed Bund yields even lower for a time, but in the end investors decided the deflation scare was over and yields rose again.

If this explanation is true, the correction may already be over and this may not be a tipping point. Alternatively, if the sell-off continues, it may eventually become self-perpetuating as leveraged buyers exit the market.

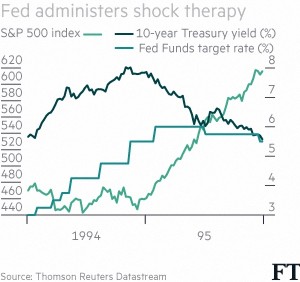

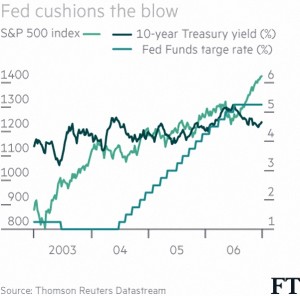

John thinks that how the Fed raises rates will be crucial. In 1994 rates rose quickly, and long term yields rose while the stock market was flat. Ten years later, rates rose predictably in 0.25% steps. Long term yields fell and a stock bubble was created.

Ending the debt subsidy

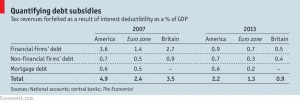

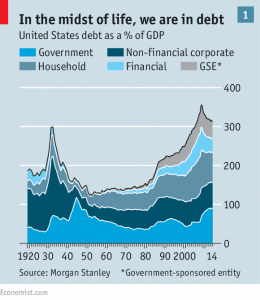

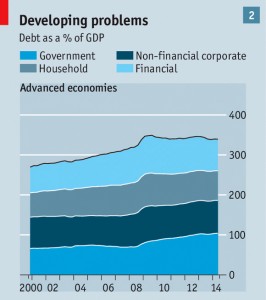

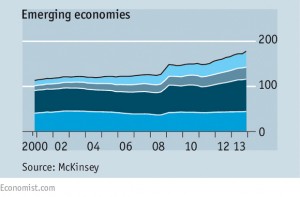

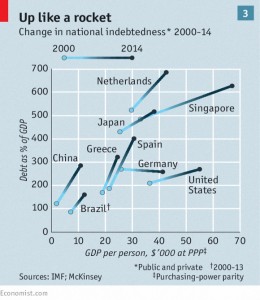

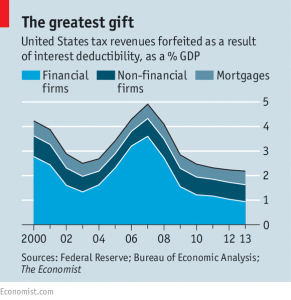

The Economist made a convincing argument for the abolition of debt subsidies. Almost all countries, including the UK allow firms to offset debt interest against profits. Many go further and allow citizens to deduct mortgage interest payments from their tax returns.

Before the financial crisis, this subsidy amounted to 3% of GDP in Europe ($510bn) and 5% in the US ($725bn). Even now with record low interest rates, the US still gives up 2% of GDP.

This encourages people to borrow too much, pushing up the price of property and reducing investment in wealth-creating assets. Sixty percent of bank lending in rich countries is for mortgages.

More companies end up with financing structures that are too risky to survive downturns. The dotcom crash produced equity losses of $4 trillion, but only a mild recession. The 2008 crisis produced losses in leveraged banks of “only” $2 trillion, but the world economy was crushed.

Politically, making the change will be difficult for countries with mortgage interest relief – few politicians or voters like policies that make house prices lower. But the UK managed this in the 1990s.

For corporate interest relief, the big problem is coordination – countries will be unwilling to remove subsidies that might persuade multi-nationals to relocate. One approach would be to make the change revenue-neutral, by lowering the rate of corporation tax at the same time.

Now is the time to act. With interest rates at historic lows, the debt subsidy is small. When rates rise the benefit will grow, and become harder to remove.

Until next time.

2 Responses

[…] list is a little shorter than the one from Claer Barrett that we looked at last […]

[…] to get into housing. We reported a couple of weeks ago on the arguments for getting rid of the debt subsidy, but that’s not specific to housing. It would need to apply to all […]