Weekly Roundup, 10th January 2017

We begin today’s Weekly Roundup in the FT, with the Chart That Tells A Story. This week it was about UK household debt.

Contents

Household debt

Adam Palin looked at ONS data which showed that credit cards were the most common form of unsecured (non-mortgage) debt, with close to 25% of households having an outstanding balance. (( I believe that the ONS classifies car loans as secured debt – secured against a depreciating asset! ))

- Mail order, overdrafts, personal loans and student loans were the four next most popular categories.

48% of households and 35% of individuals had some unsecured debt.

- These numbers are slightly down from before the 2007/07 financial crisis.

The average per debtor household was £3.4K, much less than the average £85K for the 36% of households with mortgages.

Balances on the credit cards and mail order accounts – as well as overdrafts – were low (less that £2K, and less than £1K for overdrafts).

- The less common personal loans averaged close to £6K and student loans averaged £11K.

Unsecured debt is slightly less common at the bottom of the income scale, and debt to income ratios are similar (13% at the bottom, 12% at the top).

- Middle earners borrow the most (15% of income).

Switching from income to wealth changes the analysis: 58% of the poorest borrow, compare to 36% of the richest.

- Those with dependent children borrow the most, and the over-60s borrow the least.

Happiness

Jason Butler looked at whether money can make you happy.

- Research shows that while being poor makes you unhappy, an income above around $75K doesn’t make you any happier.

Jason contrasted people who like the external trappings of wealth – social status, keeping up with their peers etc – to those who look for inner satisfaction.

It’s important to avoid lifestyle inflation and becoming trapped in a job you don’t enjoy.

- The happiest people in the UK are florists and gardeners, and the least happy are bankers and tech workers.

Control over your work and being able to regularly see its consequences seem important.

- And spending your money on experiences rather than things also seems to be better.

- Ideally you should spend in a way that strengthens personal relationships.

Economists

Chris Giles, Gemma Tetlow and George Parker reported on the reaction from leading economists to the comments made by the Bank of England’s Andy Haldane to the effect that their profession was in crisis.

- Haldane accused economists of having a “Michael Fish moment.” (( For younger readers, Michael Fish was the TV weatherman unfortunate enough to deny that a hurricane was looming back in October 1987 ))

The focus of this was the lack of a UK recession in response to a Brexit vote.

There are three points to make here:

- there likely will be a UK recession during the next two to five years while we are sorting out Brexit

- it will be difficult to determine to what extent (if any) this is down to the Brexit vote

- Michael Fish – unlike the Remain economists before the Brexit vote – had no incentive to mislead the British public

My own take on macroeconomics is that it is worth looking at historical data – and in particular trends in that data – to work out what is going on.

Forecasts are useful in only two ways:

- as inputs to scenario planning, to make your portfolio “anti-fragile”, as Taleb would have it

- they reveal the thought processes and biases of the forecaster, as Buffet has said

John Lee

John Lee wrote ostensibly about the potential effects of Trump and Brexit on his portfolio in 2017, but in reality his article was also about the futility of predictions.

- His portfolio was up 16% in 2016.

He believes that “the key to portfolio success is in avoiding the losses”.

- His only major loss was on Braemar, which hit his 20% stop loss.

- Christie is down 35%, but John has hung on to that.

- Major winners included Treatt (up 52%), James Fisher, Lok’n’store and Quarto.

He predicts “many unexpected events” will occur during 2017, but he will stay fully invested.

Planning for Trumpflation

John Authers also looked at how people should position their portfolios during 2017.

- He says that although contrarian trades are often profitable, sometimes is makes sense to stock with the herd.

- The recent switch from deflationary to inflationary expectations is probably one such case.

Trumps deregulation agenda and tax cuts should supply immediate stimulus, with possible support from infrastructure spending in the medium term.

The December US employment figures suggest a risk of overshooting, however.

- Wages are now increasing faster than inflation.

- Despite the overhang of non-participants in the labour market, those workers in demand are beginning to see the benefits.

So growth could lead to inflation, interest rate rises,a shock to stocks, and even stagflation.

- Tariffs and a trade war could also harm stocks.

John thinks that “there is far too much uncertainty to be anything other than diversified”.

- He has a bias away from bonds and towards international (non-US) equities.

2016 as a turning point

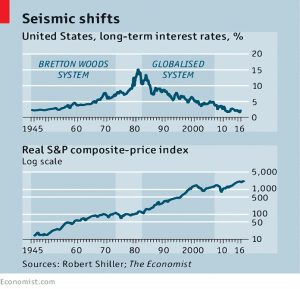

Over in the Economist, Buttonwood felt that 2016 would be seen as an economic turning point as well as a political one.

The first economic period after World War 2 was the Bretton Woods system of fixed exchange rates and capital controls (1945 to 1973).

- Growth was rapid, driven by rebuilding after the war.

- Technology from the first half of the 20th century (cars, TVs etc) became widespread.

- High taxes reduced inequality.

Then in 1973 the Arab oil embargo led to high unemployment and inflation.

In the 1980s, currencies floated and capital controls were abolished.

- Financial liberalisation, privatisation and lower taxes led to more inequality, as did globalisation.

- Growth was slower but inflation was tamed.

- Monetary controls replaced fiscal ones.

Then we had the 2008-08 financial crisis.

Through both of the earlier economic periods, equities did well for the most part, but faltered towards the end, before the collapse of the system.

What will the third period look like?

- Optimists are cherry picking from the previous two – tax cuts and deregulation, with fiscal rather than monetary policy.

But the “populist” / democratic revolt is against free movement of labour and capital.

- Trade wars and ageing demographics could make the 2020s closer to the 1930s than the 1980s.

I expect the truth lies somewhere between these two extremes.

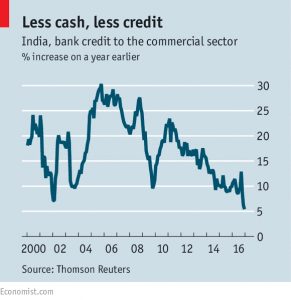

India’s demonetisation

The newspaper also provided an update on the progress of India’s project to withdraw and replace 86% of its paper currency.

The queues at the banks and ATMs have disappeared, largely because old notes can’t be exchanged since 30th December.

- There are also more new notes in the ATMs, to match the daily withdrawal limits that are still in place.

The damage to the economy has already been done.

- Sales of fast-moving consumer goods reduced by 1.5% in November, and big ticket items like motorcycles did even worse (bikes were down by a third).

GDP growth forecasts for the year to March are down by 0.5% to less than 7%, though this is partly due to oil price increases and the strength of the dollar.

Worse news still is that the clampdown on the black economy seems to have failed.

- Almost 15 trn rupees of the 15.4 trn rupees in circulation as old notes have now been accounted for.

- Either the rich weren’t hoarding cash or they were good at laundering it.

The possible good news is that the lending out of the increased deposits by banks should now in theory boost the economy.

- But some worry that lack of deposits was not the constraint, and this won’t happen.

Despite these poor results, I can see similar note withdrawals happening in the future.

- At least the next country to try it will have some practical experience to draw on.

Social care

Back in the FT, Jonathan Eley looked at how we should pay for social care for the elderly.

The stuff in the headlines is the lack of funding to support people in their own homes.

- There’s also an issue with a lack of space in care homes.

Things are only going to get worse as between 2010 and 2030, the number of people aged over 85 is expected to double.

- One in four people at present need care, and as the population skews ever older, this proportion can be expected to rise.

Care homes, and care in the home, is paid for by councils, and the government is planning to allow a surcharge on council tax to fund elderly social care.

- This would hit poorer areas (with a higher proportion of people to fund care for) harder than rich areas.

There’s another problem with this plan:

- Chronic care for eg. cancer is funded by the NHS, but other illnesses (eg. Alzheimer’s / dementia – now the UK’s biggest killer) are in theory funded by the council.

- In fact, since many affected people have more than £23K in assets, they end up contributing themselves as well.

The coalition government proposed a cap on personal contributions to care costs of £72K, but this shows no sign of being implemented (they are due by 2020).

- In any case, the cap would exclude “hotel” costs (accommodation and food) which make up the bulk of costs.

I think that social care should be rolled into the NHS.

- This would end the postcode lottery, since funds could be centrally allocated.

- It would also resolve the tug-of-war between hospitals trying to free up beds and councils unwilling or unable to pay for more space in care homes.

Or course, that would only exacerbate the NHS’ own looming funding crisis.

- But at least all of the nation’s health issues could be considered as one, rather by via a piecemeal approach.

Jonathan proposes extra national insurance (effectively a tax rise) or an expansion of the inheritance tax base (presumably by cutting the already meagre allowance).

- I don’t think that either of those options will fly.

Three interesting charts

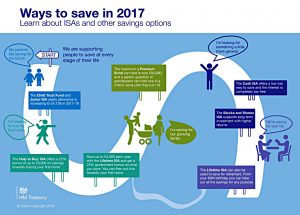

We end with three charts I came across last week.

First, the government’s recent infographic on “ISAs and other savings options” in fact includes only ISAs and Premium Bonds.

- Pensions are not mentioned.

- Industry commenters have claimed that this shows that government departments are not working closely together.

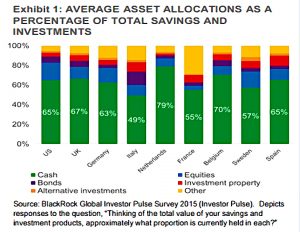

The second chart shows the results of a BlackRock survey (( From 2015, unfortunately )) on the compositions of investors’ portfolios. (( I got this one from Pragmatic Capitalism ))

- Here in the UK, 67% of money is allocated to cash – that’s four to seven times more than is required.

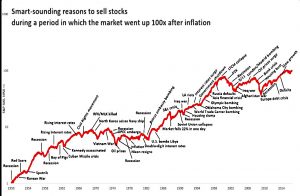

Finally, following on from yesterday’s article reassuring you not to worry about all-time highs, here’s a chart I came across on Twitter that illustrates my point that the coast is rarely clear for you to invest.

- It shows all the reasons you could have used not to invest over the past seven decades

- This was a period during which the S&P 500 went up 100 times after inflation.

It pays to be brave and invest anyway.

Until next time.