Weekly Roundup, 2nd July 2019

We begin today’s Weekly Roundup in the FT with Merryn Somerset Webb, who was writing about student debt forgiveness.

Contents

Student debt

We’ve talked about student debt before.

Here in the UK, the system operates more like a graduate tax, levied on earnings above a threshold level and with any outstanding balance forgiven after 30 years.

The reforms I would like to see are:

- A more reasonable interest rate on the outstanding balance (say 1% above bank base rate) and

- A sensible threshold (say the average wage in the UK).

Merryn was looking at the potential forgiveness of US student debt, as supported by Bernie Sanders and Alexandria Ocasio-Cortez.

- 45M people over there how a total of $1.6 trn.

Over here the two Jeremies (Hunt and Corbyn) have said they will do something about UK student debt.

I’m not a fan of debt forgiveness:

- it’s essentially an attack on property rights (as Merryn points out), which are the fundamental rights which underpin a civilised society

- it would do nothing to encourage the financial discipline that is so lacking today, and

- it could be inflationary (since those forgiven would presumably be able to borrow again immediately)

Forgiving only student debt would be doubly unfair, favouring a group of people who are likely to become wealthy in the end at the expense of their poorer peers.

- Bailing out people who made a mistake (in this case, overpaying for a non-too-useful degree) is a dangerous precedent to set.

Everybody makes mistakes like this during their lifetime, and we can’t provide the entire population with a get-out-of-jail-free card.

Merryn recommends as a solution a form of “People’s QE” – where every adult is given free money to the tune of the average student debt $30K in the states).

- In ordinary times this might be inflationary and also risky to the integrity of the currency, but under the current economic regime, we would probably get away with it.

My concern would be that if it worked for student debt, it would become a knee-jerk solution for any financial problem.

- Until in the end, we would have problems with inflation and with the exchange rate.

Long term asset funds

The Woodford saga rumbles on.

- Kate Beioley wrote about a proposal from the Investment Association (the trade body for open-ended funds) for a new structure for investing in illiquid assets.

Their surprising response to the public outcry at the lack of daily liquidity in a popular fund is to suggest that daily liquidity may not be necessary and/or appropriate for certain asset types.

- in other words, these long-term asset funds (LTAFs) would be gated from the get-go, with trading only allowed at certain intervals (each month or quarter).

It’s not clear what customers might be offered as an incentive to tolerate this built-in illiquidity, given that investment trusts would offer access to the same assets with up to the second pricing.

- It’s also likely that the gating wouldn’t solve the illiquidity problem since a lot of selling demand could build up over a quarter.

This may be academic since the IA thinks that such funds shouldn’t be offered to plebs.

- They have suggested a requirement for appropriateness tests (presumably the high net worth and sophisticated investor tests used for certain products already) or (paid-for) advice before the new funds can be accessed.

- In general, the LTAFs are targeted at pension funds.

In any case, I see no reason to slow down my steady migration from legacy OEICs over to ETFs and ITs.

Human Capital

In an FT piece “borrowed” from sister publication Investors Chronicle, Chris Dillow wrote about human capital – our ability to earn a living in the future.

- Young people aren’t really as poor as they seem since they have a lot of future earnings to look forward to.

By the same token, sensible older folk will have saved some money as they earned it, to guard against their inevitable loss of future potential.

Chris wants to go further, and classify a volatile and insecure income (from architecture, say)as equity, whilst a secure and stable income (from medicine) could be classed as a bond.

- On this basis, young doctors need more stocks than young architects.

But at the same time, since young people tend to have less secure incomes, perhaps the advice to own lots of stocks when young is not so good.

- The tendency of their earnings to move with age from stock-like to bond-like would suggest that they need more stocks as they get older.

Another thing to remember is to add your human capital to your home country allocation.

- This would mean that young people, in particular, need a higher international allocation.

I’ve never been a fan of the idea that old people should hold more bonds.

- There’s an argument to be made for lowering the equity allocation around retirement (so as to reduce sequencing risk.

- But in general, most people should be targeting 60% to 75% equities.

However, Chris is on to something with the capitalisation of non-listed assets.

- I capitalise my DB pensions (as bonds) in order to encourage a higher allocation to equities than I would otherwise dare to hold.

Redwood fund

John Redwood had his regular update on the ETF fund he runs for the FT – but this month there was no updated table of holdings.

- The fund is 50% in stocks and the rest is in bonds and cash.

He’s up 10% in 2019.

John is still avoiding the Eurozone, and Germany in particular.

- He’s worried about a row between Italy, which wants to spend more, and Germany, which doesn’t.

The rich

The Economist looked the richest people in the UK.

- Official stats collection processes find it hard to access data about the very richest.

A new study looked at individual tax returns up to the 2015/16 tax year, focusing on the top 0.01% – just 5,000 people.

- Unlike the 1% (who earned £129K pa or more), these guys earned at least £2.2M per year.

Most of them live in London and the vast majority in England.

- 90% are men, only 5% are millennials and one-third work in finance.

Some 15% don’t work at all and 40% of the total income of the 0.01% was “unearned”.

- I find this terminology a little confusing; presumably, the report includes capital gains here as 40% of all income coming from dividends would seem extraordinary.

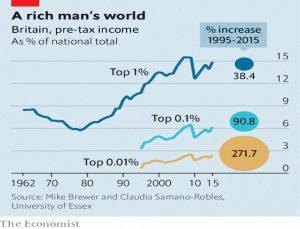

The article notes that the top 0.01% have almost tripled their share of national income since 1995.

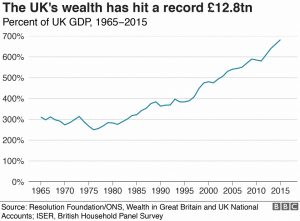

The BBC also had an article looking at wealth in Britain.

- Astonishingly this was work specifically commissioned by the BBC (using licence fee cash) from the left-wing lobby group The Resolution Foundation.

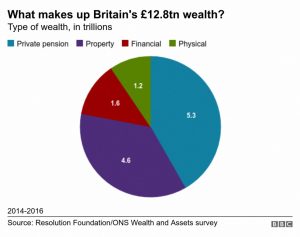

Most wealth comes from pensions and property.

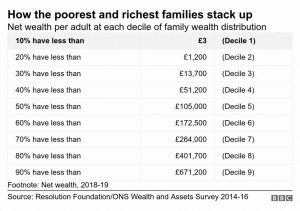

To get into the top 10% you need £671K.

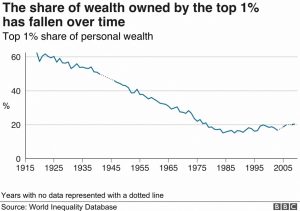

Wealth inequality has fallen over the last century.

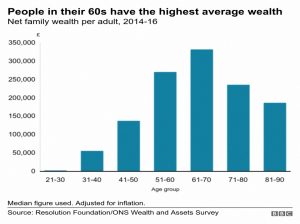

Not surprisingly, older people have more money.

- This chart doesn’t include human capital, which we discussed earlier.

Honesty

Let’s end with some good news, which is that people are more honest than we (they) think.

- The Economist reported on a study of whether people would return wallets that they found in the street.

Only 40% of empty wallets were returned.

- But wallets with $13 in them were returned 51% of the time.

- Wallets with $94 in them were returned more than 60% of the time.

Interestingly, people (and more than 250 economists) thought that the relationship would work in the opposite direction.

- Scandinavia was the most honest location, Asia and Africa the least honest.

LTA breaches

More good news comes from David Prosser in MoneyWeek, who reports that HMRC has withdrawn its appeal against the ruling allowing accidental breaches of LTA fixed protection rules.

Quick links

I have a bumper fifteen for you this week:

- Alpha Architect looked at Large-Cap Price-to-Book Investing.

- And at Trend Following – no pain, no gain.

- And asked whether active management is skilled.

- The Reformed Broker looked at the things that can’t be counted.

- The Economist wondered whether London’s reign as the capital of capital was at risk.

- And asked whether a robot will really take your job.

- And wrote about liquidity issues at a fund manager who isn’t called Woodford.

- As did Moneyweek.

- Who also claimed that gold is poised for a new bull market.

- The FT looked at Bitcoin’s second coming.

- And at the collapse of a UK student property scheme.

- UK Value Investor provided his mid-year forecasts for the FTSE-100 and FSTE-250.

- AltFi looked at Monzo’s annual report.

- Adventurous Investor revealed Corbyn’s route to power.

- And Money Observer explained ETF domiciles.

Until next time.

For more on the human capital topic described above, see

https://www.amazon.com/Are-You-Stock-Bond-Financial/dp/0133115291