Weekly Roundup, 15th August 2017

We begin today’s Weekly Roundup in the FT, where Ken Fisher was writing about QE.

Contents

Yield curves

It was another terrible week for the Saturday FT, as it continued its slide from respected investment publication to consumer tabloid.

- Ken’s is the only article from the FT that I’m covering this week.

He was arguing for a steeper yield curve – a bigger bap between short-term and long-term rates.

- Years of QE and the purchase of long-term bonds have driven their prices up and yields down, flattening the curve.

A steeper curve would lead to more bank lending and GDP growth.

- Banks borrow at the short end of the curve and lend at the long end, so the steeper the curve, the greater their profits.

- A steep curve encourages them to lend more, leading to more investment.

The UK is ahead of Europe here, with M4 (broad money) growing by 6% pa.

- So we can expect more inflation, more investment and more growth.

Inflation

The Economist wrote about how hard it is to measure inflation.

- The UK has just adopted a new measure called CPIH – the Consumer Prices Index including owner-occupiers’ Housing costs.

The longest running number is RPI, which includes mortgage interest.

- It’s now only produced because things like student loans and index-linked bonds depend on it.

CPI uses a better formula than RPI, but only includes rents, not mortgages and the fees on buying houses.

- Since these represent 15% of national household spending, CPIH has been introduced.

CPIH uses “rental equivalence”, which basically uses the cost of renting an equivalent home as the costs faced by homeowners.

- At the moment the Treasury and the BoE are sticking with CPI, though that might change in the future.

The real problem is that each individual has their own personal inflation rate, depending on where they love in the country and what they do with their money.

- So one number – no matter how sophisticated – will never suffice.

Political risk

Buttonwood looked at whether financial markets are any good at predicting politics.

- It turns out that they aren’t, as wishful thinking leads them astray.

Gambling markets got Brexit and Trump wrong, as well as the effect that Trump would have on the markets.

But although US markets are at record highs, the fall in the dollar against the euro means that euro equities have outperformed American ones in dollar terms.

- And in euro terms, Wall Street has fallen.

So the market is up for reasons that investors didn’t predict – inflated foreign earnings and tech stocks responding to global rather than domestic growth.

Reach for yield

The newspaper also looked at how investors chasing higher yields are now buying bonds from ever-riskier countries.

- Iraq, Greece and Argentina are the latest names on the list.

- Egypt, Ivory Coast, Nigeria and Senegal have also issued eurobonds this year.

The yield on 10-year Treasuries is 2.26%, whereas many of these high-risk bonds yield 6% to 7%.

Investing and inequality

In MoneyWeek, Matthew Lynn looked at why the rich keep getting richer.

- According to a new paper from Sweden, it’s because they are better investors.

Households in Sweden must report their wealth each year, so the data available is the best in the world.

- The top 5% to 10% of households outperformed median households by 2.7% pa

- The top 0.5% to 1% outperformed by 4.1% pa

- And the top 0.1% outperformed by 6.1% pa

It’s all down to asset allocation.

- The median household’s wealth was mostly in their home, just as you would expect to find in the UK.

- The rich had far more in risky assets such as stocks.

- The average household had 21% in these, but the richest 1% had 95%.

I remember reading something similar in the Economist a few years ago.

- Despite higher wages, Germans are on average less rich than people in the UK.

- It’s because they rent property rather than buy, and invest in bonds rather than stocks.

Matthew recommends that we stop chipping away at pensions and encourage more risky investments.

- He’d also like to introduce CGT on primary residences, but as we discussed last week, that would simply lock up the housing market.

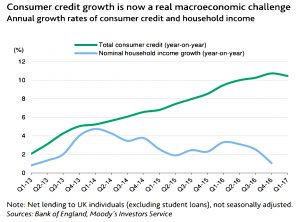

Credit bubble

Over at Business Insider, Jim Edwards look at the UK’s credit bubble.

- Jim is worried that the longer UK rates stay low (they’ve now been close to zero for a decade) the bigger the bubble will inflate.

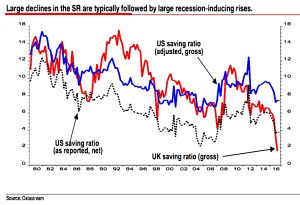

When it pops, we could have a problem, because we have too much debt and we’ve stopped saving.

Debt is at a peak.

Meanwhile, a low savings rate points towards a future recession.

- Fear of the future causes consumers to cut spending (increase saving) which triggers the recession that they are afraid of.

- Jim is particularly worried about car finance, but I’m not sure this sector is big enough to cause real trouble.

To deflate the bubble, interest rates need to rise.

- But that in turn requires wage inflation, which is absent.

Jim recommends further increases to the minimum wage.

- For me, this runs the risk of substitution low wage labour with more automation.

But it could plausibly also kill off zombie firms that can only survive because wages (and interest rates) are low.

- Jim uses the crowded food delivery market in London as an example:

- Deliveroo, Eat 24, Jinn, Uber Eats, Just Eat, Feast, Hungryhouse, and Etefy will all deliver to your door.

How many would survive if wages – and then interest rates – were increased.

Twitter pics

I only have three for you this week.

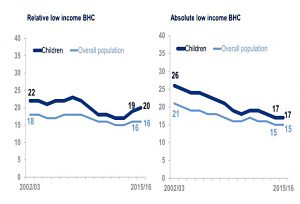

The first shows how the use of relative poverty figures can mislead.

- Comparing income to an arbitrary line of 60% of median earnings suggests that the number of children in poverty is increasing.

- Using absolute numbers instead shows that it isn’t.

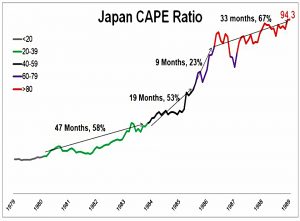

The next shows the Japanese stock market in the late 1980s and early 1990s, and illustrates just how far a bubble can inflate before it pops.

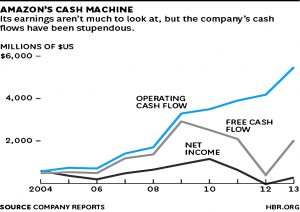

And the third one shows how Amazon’s rising share price has been underpinned by dramatic growth in operating cash flows.

Until next time.