Weekly Roundup, 25th October 2021

We begin today’s Weekly Roundup with a Russell Napier interview.

Secular Inflation

Russell is a financial historian and a friend of MoneyWeek.

- His latest book is on the Asian Financial crisis of the 1990s.

Russell was interviewed on the Macro Voices podcast which is hosted by Erik Townsend.

- This is one of the small number of podcasts that I listen to every week, and I recommend it to you all.

The subject of the interview was the inflation/deflation debate.

- For many years Russell has been arguing in favour of deflation, but he recently changed his tune, which made me sit up and take notice.

They start with the Chinese property crisis, which Russell expects to lead to lower Chinese interest rates and money printing (and a lower exchange rate – and a Cold War).

- Which in turn leans to cheap Chinese exports and eventually tariffs in the west, which is inflationary.

It [also] kickstarts a huge capital investment boom into the rest of the world as we try to replace all the stuff we’re not buying from China.

Russell is certain that the west won’t raise interest rates in response to inflation, because we have too much government debt.

- He sees savings institutions being forced to buy government bonds.

That’s what I call phase two financial repression. It’s bad for equities because these institutions are not like a central bank, they have a finite amount of money.

He also expects control of monetary policy to move away from central banks and into governments.

- And high on the government agenda are green investment and the redistribution of wealth.

It’s a great interview, but Russell doesn’t have a lot of good news:

- Real returns for bonds will be shocking

- Equities do well until inflation hits 4% and they are hit by liquidation pressure from institutions as well as high inflation

- The dollar goes up since the US is at the end of this chain (China or Europe should go first)

- Governments will crackdown on crypto as a currency ( “governments can live with it as a

speculative asset class the way they live with baseball cards”) - The negative real interest rates must be good for gold, and the green agenda will end gold-mining

Redwood

John Redwood said that the “financial cleansing” in China will deter international investment.

Markets are having to get used to intensified rivalry between the great powers, broken supply chains and disruptions to global trade. China is becoming more assertive and nationalistic.

The new policy of “common prosperity for all” is intolerant of inequalities, hostile to successful entrepreneurs, entertainers and stars of social media and aims to nationalise more businesses or keep them heavily regulated by the state.

The current focus is property and secondary banking (see Evergrande).

- It remains to be seen whether this results in headwinds to growth or a series of bankruptcies.

In the US, Buden is keen to signal that the failure in Afghanistan doesn’t mean that China can take Taiwan, whilst in Europe, the German election has left a leadership vacuum.

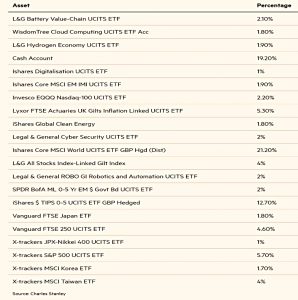

The Redwood portfolio assumes more inflation to come, and some interest rate rises.

- Most of the stock market gains have no probably been had, and John is staying away from China for now.

India

If not China, perhaps it was time for investors to look at India? Merryn Somerset Webb thought so.

With most markets looking expensive and inflation building, good homes [for pension contributions] are hard to find.

Merryn’s answer is to think long-term and to focus on current valuations and long-term growth prospects.

- This brings us to India, where Covid cases are falling as vaccination proceeds.

The Sensex index of top Indian shares has more than doubled since last year’s March lows, is up 22 per cent year to date and hit 60,000 for the first time last week.

It has a fast- growing and increasingly affluent middle class, a very young and educated population and wages there are low relative to those in much of the rest of the emerging world — one-third of China’s.

There’s also an ongoing tech revolution and a transfer of multi-national manufacturing away from China.

- The downside is that the index now has a PE of 30.

Not surprisingly, Merryn tips a Baillie Gifford investment trust for exposure – Pacific Horizon, which has 29% in India (and 27% in China).

- She also mentions India Capital Growth Fund and Ashoka Indian Equity Trust.

Trading Startups

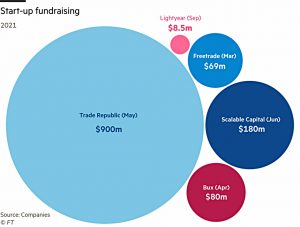

In the FT, Joshua Oliver looked at the battle to be Europe’s Robinhood.

- Robinhood decided in 2020 to abandon its planned UK launch, but this has only encouraged rivals to try to take its place.

Freetrade was the first mover in the UK, but CEO Adam Dodds admits:

It’s a land grab right now. The battle hasn’t even started.

Joshua’s article looks at the European landscape, but as usual, my focus is the UK.

- Trade Republic (from Germany) is launching in Spain but not the UK, and Scalable Capital (also from Germany) is targeting France, Spain and Italy, but has already pulled out of the UK.

Bux (from the Netherlands) has now launched in Ireland and is reportedly planning a move into the UK.

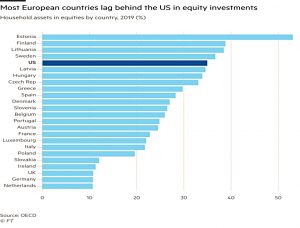

- The issue they all face is that lots of European countries aren’t big on trading stocks.

Robinhood has taken a lot of stick for its gamification of stock trading and use of leverage (including options) so most of the new European firms are avoiding going down the same route.

European authorities do want to see more people investing their money in the market, to help boost the savings of ageing populations whose retirement prospects are threatened by low interest rates, regulators are concerned that super-slick trading apps could cause more harm than good — with people risking addiction and money they cannot afford to lose.

Payment for order flow (which Robinhood relies on for fees) may be banned in the EU (as it already is in the UK).

Martin Sokk, a co-founder of Lightyear, said:

One of the main reasons there is no good solution for the European market at the moment is because nobody understands how to operate across these different markets in a way that makes both financial and logical sense for retail investors.

Crypto is another elephant in the room – the target audience is keen but the regulators are not.

- A third is what will happen to these dining-room traders when (if) the bull market ends?

The two platforms I use the most – Trading 212 (run from London, but originally from Bulgaria) and Stake (from Australia) – aren’t even featured in Joshua’s article.

- I’ve also just signed up for LightYear, which is mentioned.

I have an account with Freetrade, but I’m moving away from it because the free account is so limited.

- For me, T212 has the best UK account (and a free ISA), whilst Stake and LightYear are good for US stocks.

VCTs

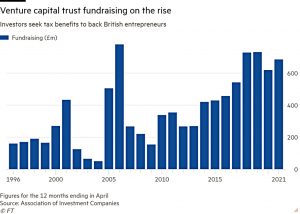

Joshua’s second article reported that a surge of investment into venture capital trusts has been driven by the announced rise in tax on dividends.

- VCTs are certainly filling up quickly this year.

VCTs have raised £128m since the start of the tax year in April, according to data collected by broker Wealth Club, the fastest pace since 2006, and five times ahead of the tally at this point last year.

They are also being announced earlier than usual – I’ve already invested in eight of the nine that I need for this tax year.

- But I think the main driver is the shrinking and now frozen LTA, which makes investing in a pension much less attractive.

And for higher earners, the taper of the annual allowance also restricts pension contributions.

Will Fraser-Allen of VCT manager Albion Capital agrees:

A big driver of money into VCTs has been progressive rule changes to limit. the

amount that can be put into pensions by additional rate taxpayers.

VCTs do have a nice tax break on dividends, but it’s the income-tax relief which counts.

- Getting some of your cashback upfront lowers the risk profile of what might otherwise be a pretty niche product.

As always, diversification is key – invest a little in each tax year, and spread your cash across the dozens of available trusts. (( Note that not all VCTs raise funds in every tax year ))

Bitcoin

On the FT podcast, Claer Barrett interviewed Bitcoin maximalist, Peter McCormack.

- I used to listen to Pete’s podcast – What Bitcoin Did – for a while, and it’s a good intro to the world of bitcoin.

I can only handle so much maximalism, however.

Pete got into bitcoin to buy weed on Silk Road.

- He made $1.5M trading BTC in 2017, but then lost most of it.

Now he just buys and holds.

I believe in bitcoin being the best form of money that exists, so I decided I’d put as much of my personal and business profits into bitcoin [as possible] and just hold it.

He also warns against fraud:

Consider that everyone’s a scammer and protect yourself. You might get a fake email [supposedly] from Ledger [a hardware wallet manufacturer] saying that you need to update your hardware wallet, plug it in — and then you have your bitcoin stolen from you. The threat model is wide.

His advice to newbies is surprisingly conservative:

Before you invest in this kind of thing, make sure you’ve got a job and a good secure income and then make a decision about what percentage of that you want to invest. Understand what bitcoin is, and the role that the people who support bitcoin think it can play in society.

He warns against trading and leverage:

Ninety-five per cent of people who try to [trade] will lose. Bitcoin is volatile. [Leveraged trades] will play with your emotions. I’ve spoken to many people who’ve completely screwed up financially with crypto and lost everything.

Seems reasonable – I would take a small position myself if I could find a platform that was easy and cheap to trade on.

Quick Links

I have six for you this week, all from The Economist:

- The newspaper looked at the race to redefine cross-border finance

- And at the hydrogen rush

- And at what Facebook’s rumoured name-change means.

- The Economist also looked at Samsung’s ambition to dominate chipmaking

- And at the geopolitics of money

- And at the European gas crisis.

Until next time.